3 reasons why Xero (ASX:XRO) has significant upside right now

Nick Sundich, March 4, 2024

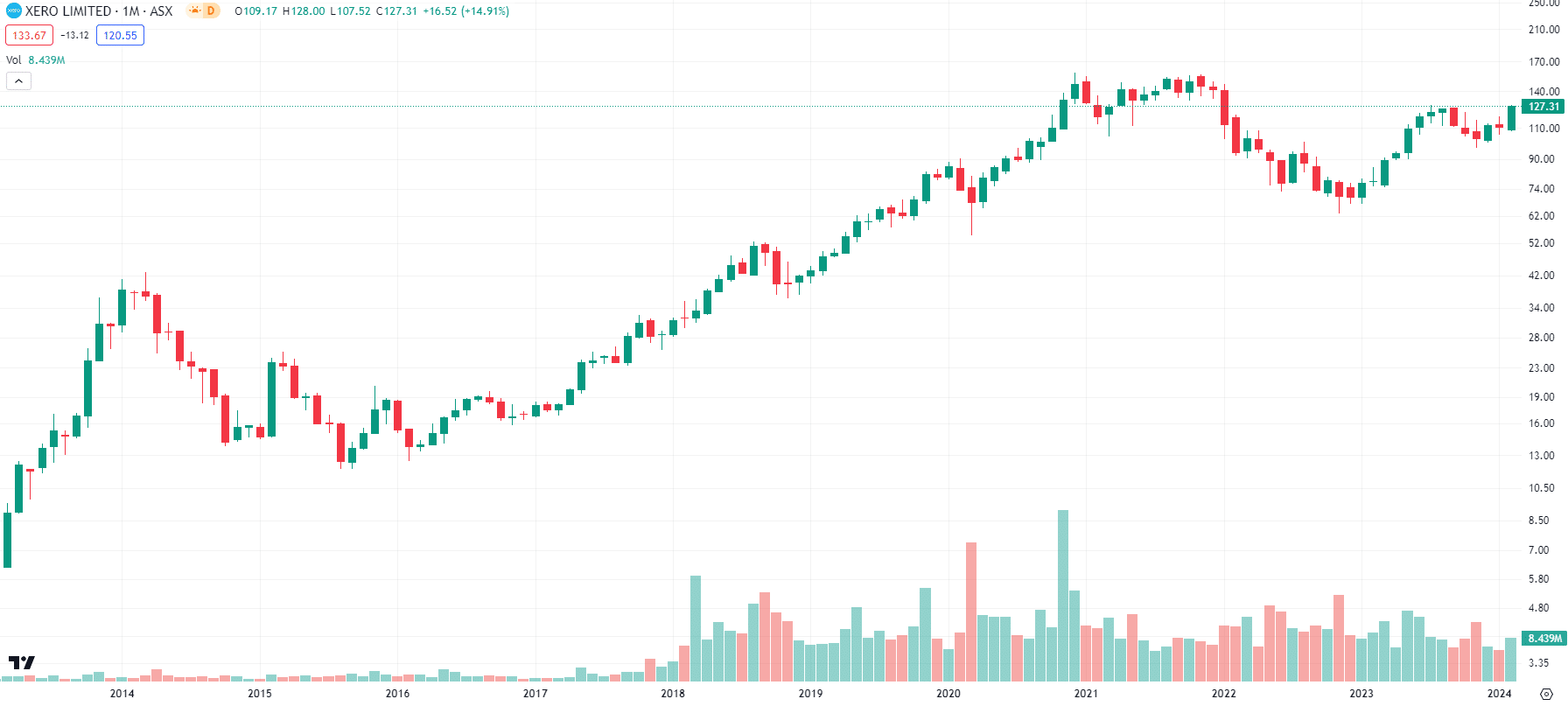

Xero (ASX:XRO) is one of the ASX’s best-performing tech stocks over the last decade, offering accounting software helping SMEs do business. Although the company was caught up in the Tech Wreck of 2022, shedding half of its value across that calendar year, it bounced back with a vengeance in 2023.

Xero (ASX:XRO) share price chart, log scale (Source: TradingView)

And we think it has significant potential to grow further, and there are good reasons why.

1. Xero is useful and loved by its customers

Xero is all about helping small & medium sized businesses do business. The company, which has over 3 million subscribers, primarily sells accounting software that helps businesses keep books, pay bills and send invoices. But it has gradually developed features useful beyond book-keeping, such as storing files, converting currencies, keeping track of inventories and creating professional quotes.

Clearly, Xero is an essential service to its customers….it’s very hard to switch it off just to save a few bucks. And what incentive is there to switch to another solution like an MYOB? Very little. Whatever few bucks would be saved, would be lost in the long-run. Xero’s tools are estimated to save its customers on average 5.5 hours of manual work per week. We guess that is why its churn was only 0.9% in FY23, even amidst inflation.

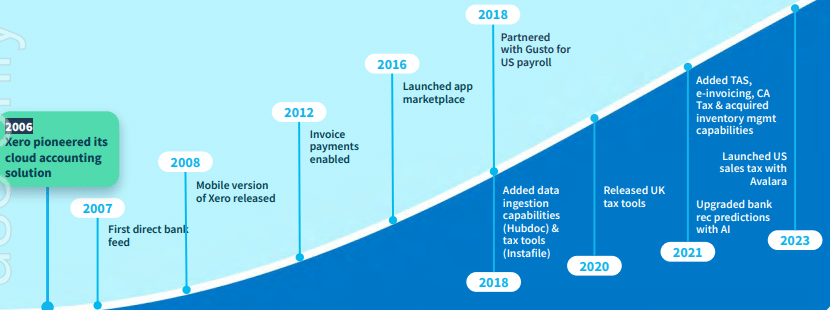

2. Xero keeps innovating and expanding

We touched on this above, but the innovation of the company ensures it remains ahead of its competitors. This is a testament to the company’s leadership.

Source: Company

The company went through a pivotal period with Rod Drury retiring after over 15 years leading the company and the CEO’s seat being taken by Sukhinder Singh Cassidy, who started in February 2023. Clearly investors have had little issue with her so far. One telling sign that the company is moving forward is that Ms Cassidy is based in San Francisco rather than Wellington or Sydney, a sign that it is becoming a truly global player.

Consider that in FY23, its non-ANZ revenues grew stronger than its ANZ revenues and the average revenue per user was higher.

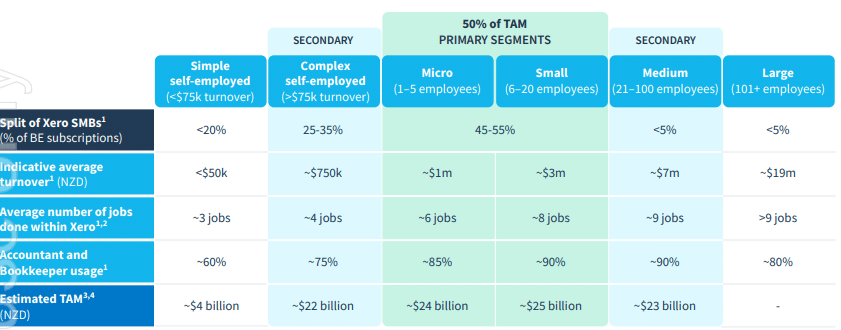

3. Still more potential for growth

Xero uses the New Zealand financial year, which runs April to March and will be releasing its FY24 results in mid-May. In advance of that, it held an Investor Day and revealed some more medium term goals. It told investors it believed it had the opportunity to double the size of ‘our business’, alluding to the company’s revenue which was $1.4bn in FY23. It told investors it is still underpenetrated in many markets, even its core segments.

Source: Company

The company believes the TAM (Total Addressable Market) is NZ$100bn and that is just the top 3 jobs its software is used for – Accounting, Payroll and Payments. Adjacent Tasks, including other tasks such as inventory, CRM and project management, could be another $39bn.

OK, so how much will it grow?

So far as specific guidance is concerned, it only gave these 3 points:

- Reiterrating its existing FY24 guidance it told investors it is targeting an operating expense to operating revenue ratio of around 75%, which would be an improved margin compared to FY23.

- Rule of 40. This states that if an SaaS company’s revenue growth rate is added to its profit margin, the combined value should exceed 40%.

- The above goal of doubling revenues – it wasn’t clear what time frame, although presumably by the end of FY27, given the presentation’s focus was FY25-FY27.

Let’s turn to consensus estimates, drawn from 16 analysts. In FY24, the company is expected to record NZ$1.7bn in revenue (up 20%), $469.4m in EBITDA (up 55%) and NZ$0.99 in EPS, which would translate to ~$150M profit, a sharp turnaround from the $100m+ loss in FY23.

Looking at FY25, $1.99bn in revenue (up 17%), $607.9m in EBITDA (up 30%) and $1.61 in EPS, or a $244m profit. In FY26, $2.3bn in revenue (up 16%), $775.3m in EBITDA (up 27%) and a $334m profit. Finally in FY27, $2.6bn in revenue, $988.3m EBITDA and a $435m profit.

Still lots of upside

The mean share price is A$122.84 per share, a 4% discount to the $127.31 share price it closed February at. Granted, the estimates range from $78.85 on one extreme and $158.83 on the other. The company’s P/E for FY25 is 82.5x and 58.5x for FY26. Pretty big, isn’t it? However, the company’s PEG multiples are just 0.66x and 0.47x respectively, so perhaps it is not so highly valued after all.

And let’s look at one of Xero’s biggest bulls, Goldman Sachs. Its target of A$152 per share is drawn from 40x EV/EBITDA for FY25, relative to the 33.8x it is trading at right now. The 40x figure was drawn from a confidential list of peers, although we would observe that fellow WAAAX stock WiseTech (ASX:WTC) is trading at 48x EV/EBITDA right now.

Looking at Xero’s raw valuation, it is $20bn on an equity value basis. This makes it very big for an ASX stock, particularly a tech one, although it is not irrelevant to note that Intuit in America is US$185bn.

Potential risks for Xero investors

We think the biggest potential risks are worsening economic conditions and investor sentiment towards companies that are only just profitable. We do not think competition is a significant risk given the superiority of the platform.

So far as investor sentiment is concerned, we think this problem will disappear as the company is expected to become profitable right about now. And even though a downturn in economic activity is a risk, we think the company will continue to prove itself resilient.

Some investors have been disappointed specifically with the company’s performance in the UK market and fear the poor state of the UK’s economy could mean that Xero continues to disappoint there. Although the UK is easily the company’s second-largest market, only behind Australia, it is responsible for only 26% of subscriber numbers and 27% of revenue. We don’t think this market alone should impact the entire company, barring some doomsday scenario.

Conclusion

Xero is one of the best companies on the ASX and has good growth potential in the months ahead. We think the next couple of months might present a good entry point, because if the recent reporting season is any guide, stocks that report good results can significantly re-rate – yes, even large caps.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Recent Posts

Tigers Realm Coal (ASX:TIG): Its making an awkward exit from Siberian coking coal, but what’s next?

Tigers Realm Coal (ASX:TIG) has been one of the few ASX stocks (if not the only ASX stock) with direct…

Is a soft landing still likely in Australia in 2024?

Is Australia still set for a soft landing? For some months now, it was thought the answer was a firm…

Johns Lyng Group (ASX:JLG): One of a few ways to profit from climate change

Johns Lyng Group (ASX:JLG) is a restoration services company, repairing properties after damage by insured events, including weather and other…