Can Telix Pharmaceuticals rise to become the next CSL by 2025?

Nick Sundich, July 25, 2022

Biotech company Telix Pharmaceuticals (ASX: TLX) has gone from strength to strength ever since its Illuccix prostate cancer imaging agent got FDA approval back in December 2021.

Investors have gotten excited about the company and arguably have every right to be, although they shouldn’t get complacent.

Who is Telix Pharmaceuticals?

Telix Pharmaceuticals is a biotech company that listed on the ASX in 2017 at 65 per share, valuing it at $150m. At the time, it was the biggest biotech IPO in over 20 years (since CSL’s privatisation). But, Telix has grown more than 10x larger in share price and market capitalisation – now $6.72 and $2.1bn respectively.

Telix’s flagship product is Illuccix, which is used for the imaging of prostate cancer and is FDA approved. It is working on a second product for imaging renal cancers, but for now, Illuccix is the primary source of its revenue.

Substantial growth post-IPO

Biotechs list on the ASX with investor hopes that they will be able to commercialise their products and fight the disease they are targeting. Unfortunately, companies have to clear several hurdles, including clinical trials and regulatory approval, steps that many companies fail at.

Telix Pharmaceuticals taking more than four years post-listing to obtain approval for Illuccix depicts the difficulty of these steps. But its share price rise illustrates that if a company can overcome all the obstacles, the gains can be large.

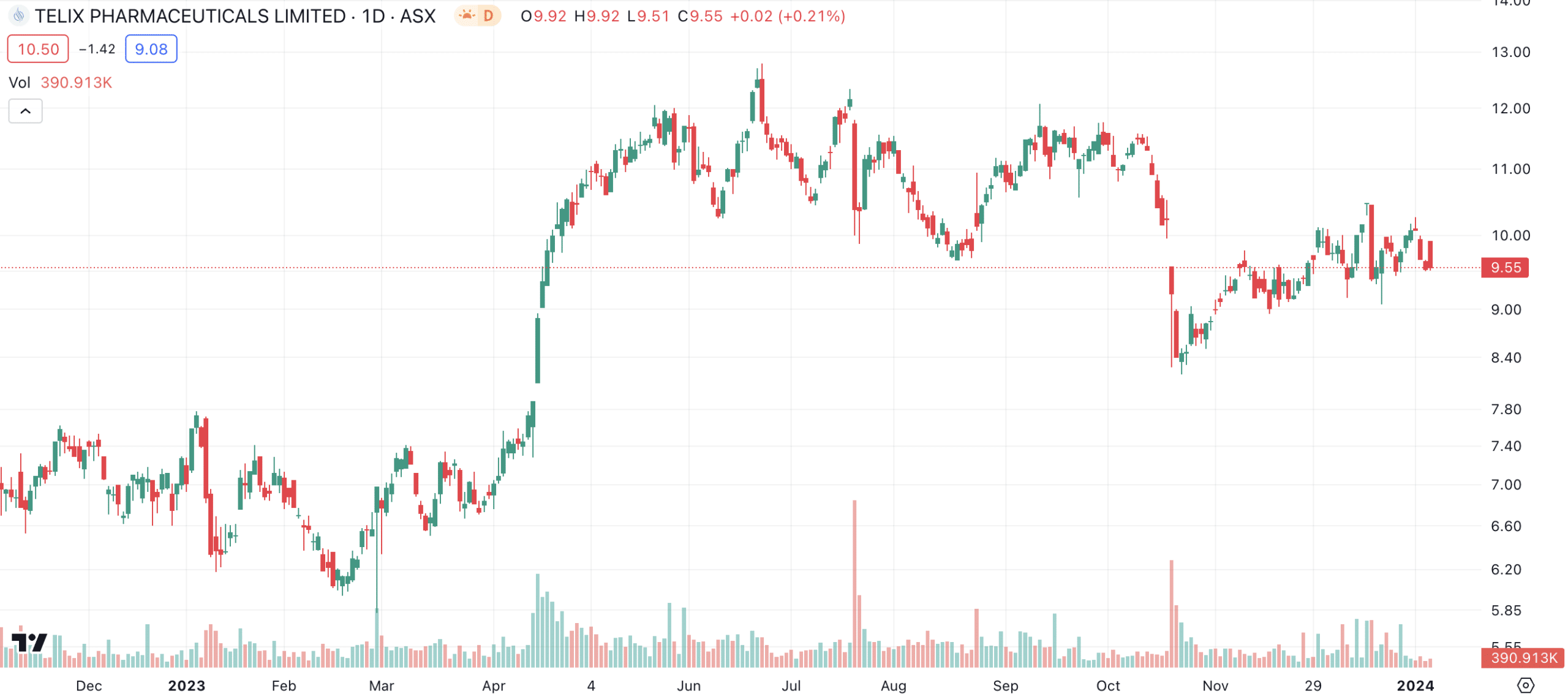

Recently, rising interest rates and spiralling inflation led to investors abandoning emerging and unprofitable companies like a dumpster fire. Telix was not immune, more than halving from over $8.60 to just over $4 in 1HYCY22. But shares have never looked back since mid-2022.

Telix (ASX:TLX) share price chart (Graph: TradingView)

Telix Pharmaceuticals gaining from Illuccix (and hope of more to come)

Telix’s revenues have kept growing exponentially ever since Illuccix was commercialised. In the June quarter of CY22, it made A$22.5m in revenue, up 10x from the quarter before. The cash just kept coming in:

- A$55.3m in the September quarter of CY22

- A$78.2m in the December quarter of CY22

- A$100.1m in the March quarter of CY23

- A$120.7m in the June quarter of CY23

- A$133.6m in the September quarter of CY23

- A$148.1m in the December quarter of CY23

Investors also expect the company can commercialise more products in the future and Illuccix in other jurisdictions. It is pursuing marketing authorisation applications for TLX591-CDx (Illuccix) in over a dozen countries as well as seeking further FDA approval to expand its indication for patient selection for radioligand therapy.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Investors can be confident, but not complacent

Telix Pharmaceuticals shareholders are clearly excited, but we think they should keep two things in mind:

First, the company is not yet profitable notwithstanding the progress it has made. Its CY23 results, due in February 2024 will make for interesting reading. It still saw US$14.3m in outflows during the first half of CY23 (1HY23), although this was way down from the US$70.9m it list in 1HY22. Its EBITDAR was $82.4m in positive territory, from $28m in negative territory 12 months ago, and it made a 64% gross margin.

Second, its revenues won’t keep growing at the same pace forever. Consensus estimates for CY23 expect $505.5m, up 215% from the year before. For CY24, analysts expect $660m, up 31% from CY23. This is not backwards by any means, but it is slower growth. For CY25, $833.7m in revenue is expected, up 26% from the year before, followed by $949.7m which is only 13% higher.

The mean target price amongst the analysts that cover the stock is $13.53, up 42% from the current share price. There are 7 analysts and the estimates range between $11.45 and $16 – some diversity, but all higher than the current share price.

We think it may be a step too far to say Telix Pharmaceuticals will become “the next CSL”.

But it is one of the few biotechs on the ASX with a commercialised product. It can inevitably gain more revenue as it continues commercialising Illuccix in the USA and elsewhere. And if it can commercialise TLX250-CDx, that could be further good news.

So long as investors recognise the risks above, we think Telix Pharmaceuticals is one of the best positioned biotech stocks on the ASX.

Frequently Asked Questions about Telix Pharmaceuticals (ASX: TLX)

- Is Telix an Australian company?

Yes, Telix is headquartered in Australia. But it has international operations in Belgium, Japan, Switzerland and the USA.

- Does Telix pay a dividend?

No, Telix does not pay a dividend.

- Is Telix a BUY right now?

We think Telix looks strong right now after its first commercial quarter of Illuccix in the USA.

- What does Telix do?

Telix is a biotech that has commercialised Illuccix – a product used for the imaging of prostate cancer and is FDA approved. It is working on a second product for imaging renal cancers but for now, Illucix is the primary source of its revenue.

- Is Telix ethical?

Ultimately this question is up to individual investors. But we observe that biotechs tend to have more ethical traits than negatives considering their efforts to fight disease.

Blog Categories

Recent Posts

Tigers Realm Coal (ASX:TIG): Its making an awkward exit from Siberian coking coal, but what’s next?

Tigers Realm Coal (ASX:TIG) has been one of the few ASX stocks (if not the only ASX stock) with direct…

Is a soft landing still likely in Australia in 2024?

Is Australia still set for a soft landing? For some months now, it was thought the answer was a firm…

Johns Lyng Group (ASX:JLG): One of a few ways to profit from climate change

Johns Lyng Group (ASX:JLG) is a restoration services company, repairing properties after damage by insured events, including weather and other…