Air New Zealand (ASX:AIZ)

SELL Air New Zealand (ASX:AIZ), 23 February 2023

Our subscribers have made 19.5% on our original call on Air New Zealand (ASX:AIZ). Notwithstanding today’s encouraging results, we think it is time to take profits.

While AIZ is up 19.5% since we recommended it as a Buy in late September (when it was $0.615), we think it is worthwhile to take some profits on this one.

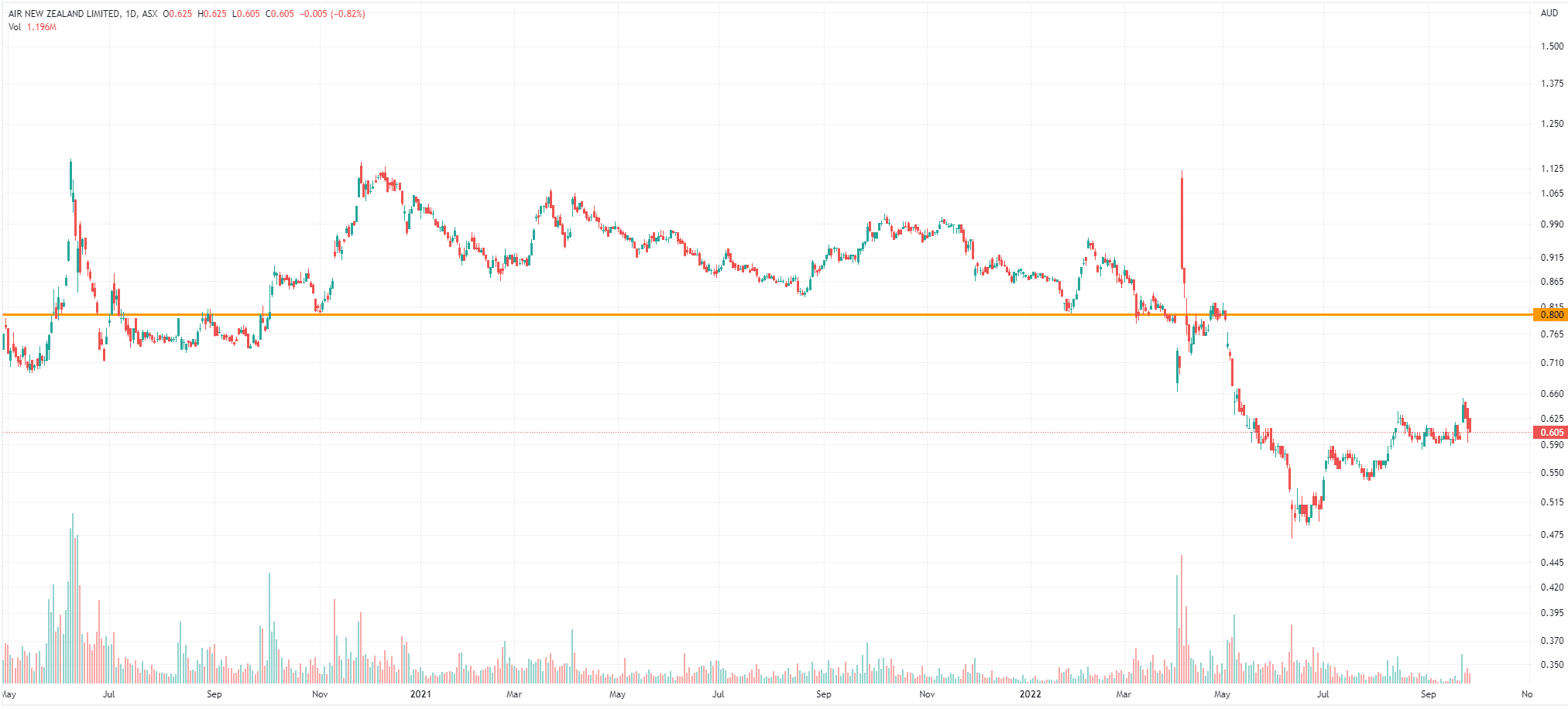

Air New Zealand share price chart, log scale (Source: TradingView)

Good 1HY23 results

Investors are likely to be pleased with AIZ’s 1HY23 results which were released this morning.

The company’s statutory earnings before tax were NZ$299m, up from a NZ$376m loss in 1HY22. Operating revenue was $3.1bn, nearly triple the NZ$1.1bn recorded in the prior corresponding period.

AIZ expects full-year FY23 earnings to be NZ$450-$530m and after previously telling shareholders not to expect to pay dividends until FY26, it would consider doing so this August at its FY23 results. This was based on the assumptions of an average jet fuel price of US$105 per barrel and that a preliminary estimate of the impact of the Auckland floods and Cyclone Gabrielle was accurate.

But now is the time to take profits

We think our subscribers should take profits on AIZ. Notwithstanding the company’s guidance, we think the travel thematic has run its course with investors.

Although many companies are optimistic about the impact of China, we think the impact on AIZ will be modest at best. This is for two reasons.

First, AIZ has continued flying to China for much of the pandemic – albeit with cargo only flights. Second, we think although so-called VFR (Visiting Friends and Relatives) travellers will return quickly, it will take several months for tourist numbers to return to pre-COVID levels. Indeed, given the sluggish Chinese economy, data from Chinese travel agent CTrip have indicated that there is far greater interest in South East nations (like Indonesia, Singapore, Thailand and Malaysia) that will be less expensive to visit.

——————————————————————————————————————————————————–

FYI, Our original investment strategy for Air New Zealand (ASX:AIZ) dated 28 September 2022

Our investment strategy for Air New Zealand (ASX:AIZ)

- Buy Air New Zealand up to 66 cents.

- Our minimum target price for AIZ is 80 cents.

- Use a stop loss at 69 cents, increased on 7 February from 56 cents.

Who is Air New Zealand?

Air New Zealand is the flagship airline for New Zealand. Based in Auckland, the airline operates a domestic and regional network within New Zealand and the Pacific and international services to Australia, the Pacific, Asia and North America.

The New Zealand government currently owns 52% of the airline with the remainder of the stock publicly traded on both NZX and ASX.

Air New Zealand has been a member of the Star Alliance since 1999. The airline currently has around 98 aircraft in operation including one Boeing 777-300ER and 14 Boeing 787-9 jets. Operating revenue in FY22 was NZ$2.7bn. Air New Zealand is renowned for the quality of its customer service and is routinely rated one of the best airlines in the world. Check out our recent Insights article on Air New Zeland HERE.

Air New Zealand (ASX:AIZ) price chart, log scale (Source: Tradingview)

Our investment thesis for Air New Zealand:

- Air New Zealand benefits from the re-opening of New Zealand to the world. New Zealand has been slightly later than other countries in terms of making it easy for people to flow into and out of the country. However, full re-opening has now taken place. New Zealand’s border restrictions began relaxing in March 2022, and full opening was completed on 31 July 2022. As a consequence Air New Zealand is now set to operate profitably once again.

- Air New Zealand will be profitable in FY23. On consensus numbers FY23 will see the airline record NZ$1.02bn at the EBITDA line, from breakeven in FY22. While the airline is not at this stage giving guidance for FY23 as a whole, it has guided to NZ$220-275m in pre-tax earnings (before significant items) for 1HY23.

- Air New Zealand recently gave a strong update. On 21 September it advised that it is continuing to see strong sales numbers for the first three months of FY23. In particular, January 2023 is expected to be especially strong, given the school holiday period.

- Air New Zealand has been ramping up capacity. New Zealand’s border restrictions began relaxing in March 2022. Since then, the airline has quickly ramped up its capacity to meet the growing demand for domestic and international travel. Bookings on the domestic network are now at around 105% of pre-pandemic levels with the international network around 75% currently. Corporate bookings continue to improve towards pre-pandemic levels and Air New Zealand expects an overall FY23 capacity utilisation of around 75-80% of pre-pandemic levels.

- Air New Zealand has a new ultra-long-haul route. In September 2022 the airline started flying from Auckland Airport (AKL) to New York JFK (JFK) direct, the first new route the airline has launched since 2018. This route is likely to attract business because it allows Australian passengers to easily fly to America’s East Coast while avoiding a lengthy transfer in Los Angeles. The US is the third biggest market for international travel to New Zealand, so this new initiative has much potential. AKL to JFK now makes Air New Zealand a player in the relatively new market for ultra-long-haul flights, allowing it to capture a whole new demographic of travellers who may have previously opted to take the cheapest option.

- Other routes are coming on stream for Air New Zealand. The nonstop Auckland to Chicago O’Hare International (ORD) route, which recommences on October 30, represents the last US link severed by Covid.

- Air New Zealand is adding to its fleet of 787s. The airline currently has 14 B787-9s in its fleet, another six B787-10s and two B787-9s on order. These jets will allow Air New Zealand to lower its cost base because they are lighter and are more fuel efficient.

- Air New Zealand has been recapitalised. The airline raised a lot of equity capital in March 2022 as part of a comprehensive NZ$2.2bn recapitalisation package to maintain its investment grade credit rating and prepare itself for a post-pandemic recovery. There is the risk, as we note below, that Air New Zealand will issue the $1bn in redeemable shares to the NZ government should business conditions not be favourable. However, we see strong demand for air travel mitigating that.

- Air New Zealand is revamping its loyalty scheme to better reward high-value customers. This work has potential to unlock significant value in terms of potential new revenue.

- Air New Zealand is developing subscription services for its domestic business, which could be game-changing. This will likely replicate similar offerings by other airlines elsewhere in the world (such as United Airlines in the US) where, for a fixed monthly rate and a time commitment, subscribers can take a number of trips on designated flights at required intervals.

- Oil prices are coming down. Air New Zealand based its recent earnings guidance on the average price of jet fuel price remaining at approximately US$130 per barrel. Obviously, if oil prices climb, this will weigh on Air New Zealand’s earnings. However, since June 2022 the trend has been down.

- Air New Zealand believes it can be an efficient airline, regularly delivering pre-tax Return on Invested Capital of more than 10% once it is operating normally. We believe achievement of this goal will contribute to a significant medium-term re-rate.

A$0.80 is a reasonable price target

- Air New Zealand broke through the A$0.80-cent support level in March 2022. We think the main reason for the decline since then is the general bear market and concerns that New Zealand will be slower to open up than other countries.

- In our view, A$0.80 is a realistic price target in the short to medium term given that this represents a previous support level. That A$0.80 level currently serves as a resistance level.

- AIZ is currently trading at an EV/EBITDA multiple of 3.9x for FY23. A share price of A$0.80 would represent an EV/EBITDA multiple of 5.9x on FY24 consensus estimates, which is still very low, in our view, given the expected EBITDA growth of the next few years of 8.2% and 10.7% in FY24 and FY25 respectively.

Catalysts for the re-rate of Air New Zealand

We see four main catalysts to prompt a re-rating of the stock:

- Steadily increasing passenger numbers as per the monthly operating statistics.

- Business updates allowing investors to gauge the path to FY23 profitability.

- Further on-market trades by various directors. CEO Greg Foran was an on-market buyer of shares in July 2022

- Increases in tourism numbers coming into and out of New Zealand.

Risks

- Another downtown in global travel;

- Volatile oil prices potentially squeezing margins;

- Potential for industrial action in New Zealand and elsewhere given cost pressures;

- Increased competition on some routes.

- The potential issue of NZ$1bn in redeemable shares by Air New Zealand to the New Zealand government in case the company needs additional capital to survive. This would initially dilute existing shareholders until the shares are redeemed.