Centrex (ASX:CXM)

Our investment strategy for Centrex (ASX: CXM)

- Centrex (ASX:CXM) owns the globally significant Ardmore Phosphate Rock Project in Queensland. The project is now shipping phosphate rock to end-users and we believe the market is currently undervaluing this initial business.

- Buy Centrex up to 16 cents.

- Our minimum target price for CXM is 21 cents.

- Use a stop loss at 12 cents.

Watch our recent interview with Centrex’s CEO HERE.

Investment thesis:

- China is the world’s largest producer of phosphate rock, but has imposed exports bans in mid-2021.

- Russian is the world’s fourth largest producer of phosphate rock, but has seen its exports sanctioned following its invasion of Ukraine.

- As a result of those two developments, the price of phosphate rock has risen from US$110 per tonne just before China imposed its export bans to US$287.50 today.

- As of mid-2021 Centrex’s Ardmore Phosphate Rock Project had a pre-tax NPV of $166m on a 10% discount rate, but that was calculated using a phosphate rock price of US$135 a tonne. In the June 2022 quarter the average price was US$287.50 a tonne (as per World Bank commodities market data).

- Currently Australia imports all the phosphate rock used to make fertilisers, such as superphosphate. Ardmore can potentially replace all of these imports, which farmers would welcome due to lower supply chain risk.

- Centrex is currently operating a pilot plant at Ardmore with a capacity of around 400,000 tonnes annually (Ardmore Stage 1) and expects to be able to sell all the product from this plant domestically at US$250 per tonne.

- The Definitive Feasibility Study (DFS) envisages a larger operation producing 800,000 wet tonnes per annum (Ardmore Stage 2). Centrex is currently doing Front End Engineering and Design in this plant ahead of a Final Investment Decision (FID). In the meantime, it is also contemplating an expansion of the original pilot plant (Ardmore Stage 1.5).

- Phosphate rock prices have risen markedly in recent days, thanks to Chinese export bans from September 2021 and the War in Ukraine, which took Russian exports off the world market.

- At less than current prices production from the Ardmore pilot plant can generate in excess of A$85m in sales annually (i.e. 250,000 tonnes multiplied by US$150 per tonne times at a 0.70 AUDUSD)

- The potential for the expanded 800,000 t.p.a. plant envisaged in the DFS to be funded is high because of the high level of offtakes already negotiated, with offtake partners including Samsung C&T, a commodities trading arm of Korea’s Samsung business group.

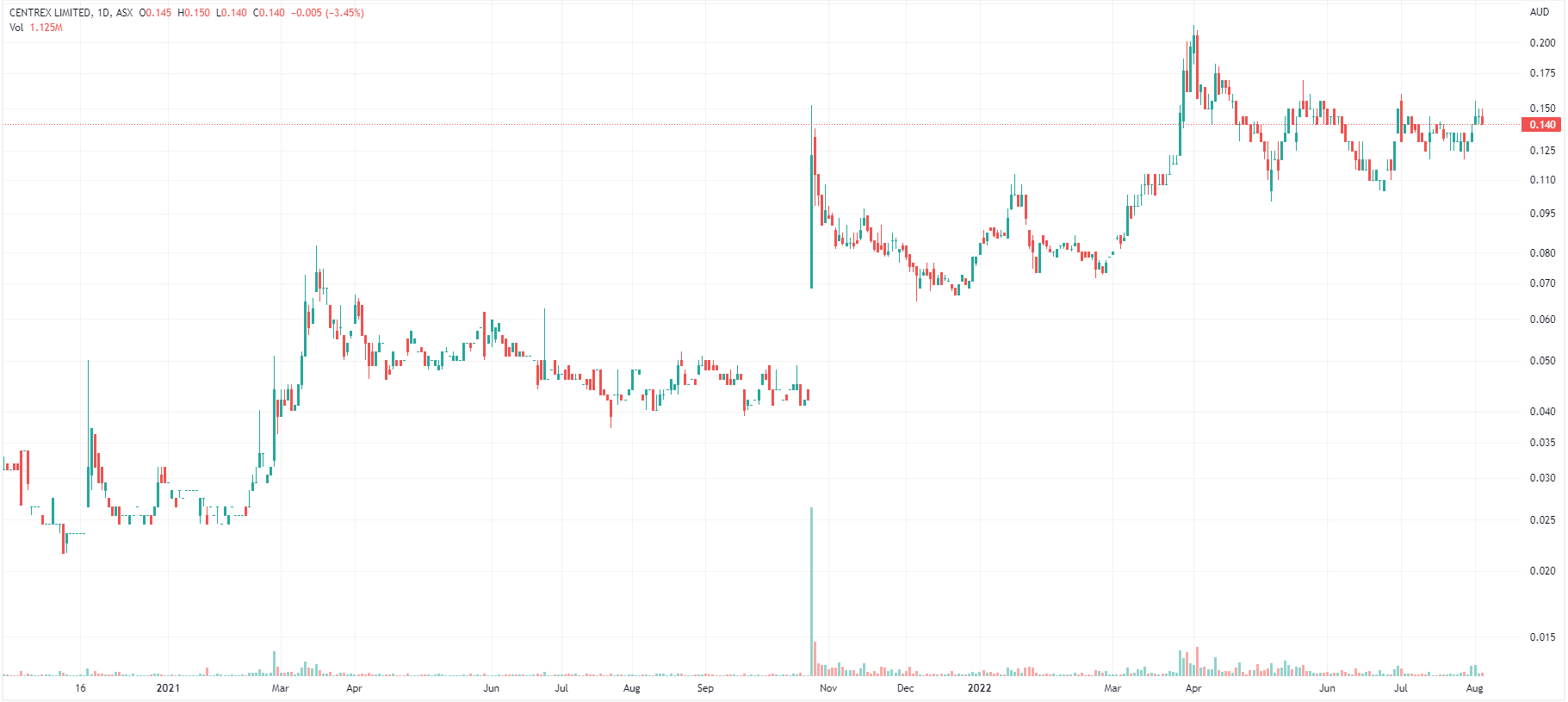

Centrex price chart, log scale (Source: Tradingview)

Who is Centrex?

- Centrex is the developer of the Ardmore Phosphate Rock project, which is located around 120 km south of Mt Isa in northwest Queensland.

- Centrex acquired Ardmore in mid-2014 from the major fertiliser supplier Incitec Pivot (ASX: IPL). At that time, for a mere A$5m down, Centrex got one of the few remaining undeveloped high-grade phosphate rock deposits in the world. Incitec has a right of first refusal over up to 30% of production and gets a 3% royalty.

- Currently, as per the updated August 2021 DFS update, pre-production capex of $78m will deliver a ten-year operation producing 800,000 wet tonnes of phosphate rock concentrate annually, which would ship via pre-existing rail lines and export from the Port of Townsville. On the August numbers the Ardmore payback period is less than two years and the IRR is a very high 52%.

- The ten-year mine life is based on the current JORC 2012 reserve of 10.1 million tonnes at 30.2% P2O5. That sits within a 16.2 million tonne resource of not dissimilar grade.

- In 2021 Centrex started making small amounts of DAPR (‘Direct Application of Phosphate Rock’, which is crushed rock for direct application to crops) and marketed it under the ‘Agriflex’ brand. This has potential to be a ~250,000 t.p.a. business from the current plant in FY23.

- In the June 2022 quarter the company successfully commissioned its initial pilot plant with a 70 tonnes per hour capacity and producing a superior 34.5% P2O5 final product. Product from this plant was initially transported at a 10,000 tonnes per month rate and is expected to reach 20,000 tonnes per month by early 2023 and 30,000 tonnes per month by mid-2023. The first export shipments from Townsville are expected in early September 2022.

Phosphate rock is important for food production

- Most fertilisers are combinations of nitrogen, phosphorus or potassium.

- The global phosphate rock market is estimated to be in excess of US$20bn and growing 3% per annum.

- Demand is growing because of the increasing world population and changing diets as more of the world enters the middle class.

- A significant player in phosphate rock is Morocco, which holds more than 70% of the world’s reserves. Many phosphate consumers outside of Europe would prefer sources closer to home.

Our minimum target price is 21 cents

- The pre-tax value of $166m from the DFS, reduced by 30% to conservatively account for tax, plus the cash on hand at 30 June 2022 ($13.4m), is 21 cents per share (607.9 million shares).

- Obviously, using higher phosphate prices and valuing the business from the current pilot plant (250,000 tonnes per annum), can make for a considerably higher valuation. For conservatism we haven’t valued Ardmore Stage 1, because it is technically a pilot plant that are typically not included in project valuations. However, with Ardmore Stage 1 showing that it can be a business in its own right, we see potential for a considerably higher target price than 21 cents.

Share price catalysts

- First exports of Ardmore phosphate rock from Townsville in September 2022.

- The September quarterly report that should show material revenues coming through.

- Potential announcements related to Ardmore Stage 1.5 at any time.

- The FY22 results release in August that may mention initial revenues from the project in the June quarter.

The risks

- Declines in phosphate rock price from the current levels, e.g. in case hostilities between Ukraine and Russia end or if China decides to lift its phosphate rock export bans.

- Issues in terms of negotiating Townsville port capacity to export more phosphate rock.

- Technical issues in implementing Ardmore Stage 1.5.

Update 9 August 2022

Centrex (ASX: CXM), developer of the Ardmore Phosphate Rock Project in northwestern Queensland, has released a project update.

The company is now shipping rock from Ardmore to Townsville at a rate of 10,000 tonnes per month and it intends to get this to 30,000 tonnes a month during the course of calendar 2023. It also expects that its first phosphate rock exports will be made next month.

Encouragingly, the price of phosphate rock as per the benchmark price, which is rock FOB North Africa as measured by the World Bank, has now reached US$320 a tonne, as against the mere US$125 a tonne at which Centrex did its Definitive Feasibility Study for what it is now calling ‘Ardmore 2.0’ where 800,000 tonnes per annum will be produced . That study placed a pre-tax NPV of $166m on Ardmore on a 10% discount rate.

Centrex is currently doing Front End Engineering and Design on Ardmore 2.0 ahead of a Final Investment Decision (FID). In the meantime, Centrex is also contemplating an expansion of the original pilot plant, which it calls Ardmore Stage 1.5, and expects to be able to give an update on this in the near future.

Our minimum target price for CXM remains 21 cents.

Update 13 October 2022

Centrex has shipped the first phosphate rock from its Ardmore Project in Queensland from the Port of Townsville. The initial parcel consisted of 7,200 tonnes grading 34.5% P2O5. This follows the successful commissioning in the June 2022 quarter of the initial pilot plant at Ardmore with a 70 tonnes per hour capacity.

Product from this plant was initially transported at a 10,000 tonnes per month rate and is expected to reach 20,000 tonnes per month by early 2023 and 30,000 tonnes per month by mid-2023.

Minimum target price of 21 cents

Our minimum target price for Centrex remains 21 cents. This figure represents the pre-tax value of $166m from the original Ardmore DFS, reduced by 30% to conservatively account for tax, plus the cash on hand at 30 June 2022 ($13.4m).

Obviously, using higher phosphate prices and valuing the business from the current pilot plant (250,000 tonnes per annum), can make for a considerably higher valuation. For conservatism we haven’t valued Ardmore Stage 1, because it is technically a pilot plant that is typically not included in project valuations.

However, with Ardmore Stage 1 showing that it can be a business in its own right, we see potential for a considerably higher target price than 21 cents.

Update 23 November 2022

Centrex (ASX: CXM) has unveiled details of its ‘Ardmore 1.5’ strategy, where it transitions the current pilot plant at the Ardmore Phosphate Rock project in Queensland over to a commercial-scale production facility without having to go to ‘Ardmore 2.0’, which was the subject of a previous Definitive Feasibility Study. Centrex will now target 625,000 tonnes per annum of beneficiated phosphate rock output from Ardmore, but the capex bill for this is very light, coming in at only $31m including contingencies.

The company still intends to go for the 800,000 tpa Ardmore Stage 2 but has now quantified a relatively inexpensive way of getting there. In the meantime it can get 80% of the DFS output at only 40% of the DFS capital spend.

Centrex expects to spend the remainder of calendar 2022 and all of 2023 ordering, installing and commissioning the relevant capital items that make up Ardmore 1.5. It will need to secure project finance for Centrex but with phosphate rock prices remaining above US$315 per tonne we believe it will not be difficult to secure this.

It’s also worth noting that there are already substantial offtake partners for Ardmore including Samsung C&T and Incitec Pivot, providing additional comfort for the financiers.

Update 27 July 2023

Centrex (ASX:CXM) provides a quarterly update

Concierge Pick Centrex (ASX:CXM) has provided a Company Update to its shareholders.

During the June quarter of FY23 (4Q23), the company shipped 30kt of phosphate and has shipped 74kt across FY23. These may appear paltry figures, but it is the first company in Australian history to export phosphate rock to an international market, having made a 15kt shipment to Korea and two unquantified exports to New Zealand during the quarter.

The average selling price is US$271/t (A$402/t) of beneficiated phosphate rock (excluding trial shipments). This depicts that phosphate prices are still elevated and that CXM is making good money.

Although it has not provided specific revenue figures, it has $7.3m in liquidity ($6.7m of that being cash). It also has 16,132t of processed beneficiated rock ready to be exported.

Big ambitions

CXM updated shareholders on its long term ambitions. It is aiming to produce 440kt of phosphate rock in CY24 to be made available to the Company’s offtake partners.

For this purpose, it plans to upgrade capacity at Ardmore to 625kt. Although environmental and mining approvals are in place, it needs to secure finance for this and has told investors it is pursuing this.

Beyond the risk of an inability to secure finance, there is the risk of adverse weather in Queensland – something that has impacted the company’s operations in the past, although it has not in the current quarter.