Qantas Airways (ASX:QAN)

SELL Qantas (ASX:QAN), 5 September 2022

Our subscribers have made 20.3% on our original call on Qantas Airways (ASX:QAN). It is time to take profits.

While QAN is up 20.3% from 14 July (when it was $4.39) we now think it is worthwhile to take some profits on this one.

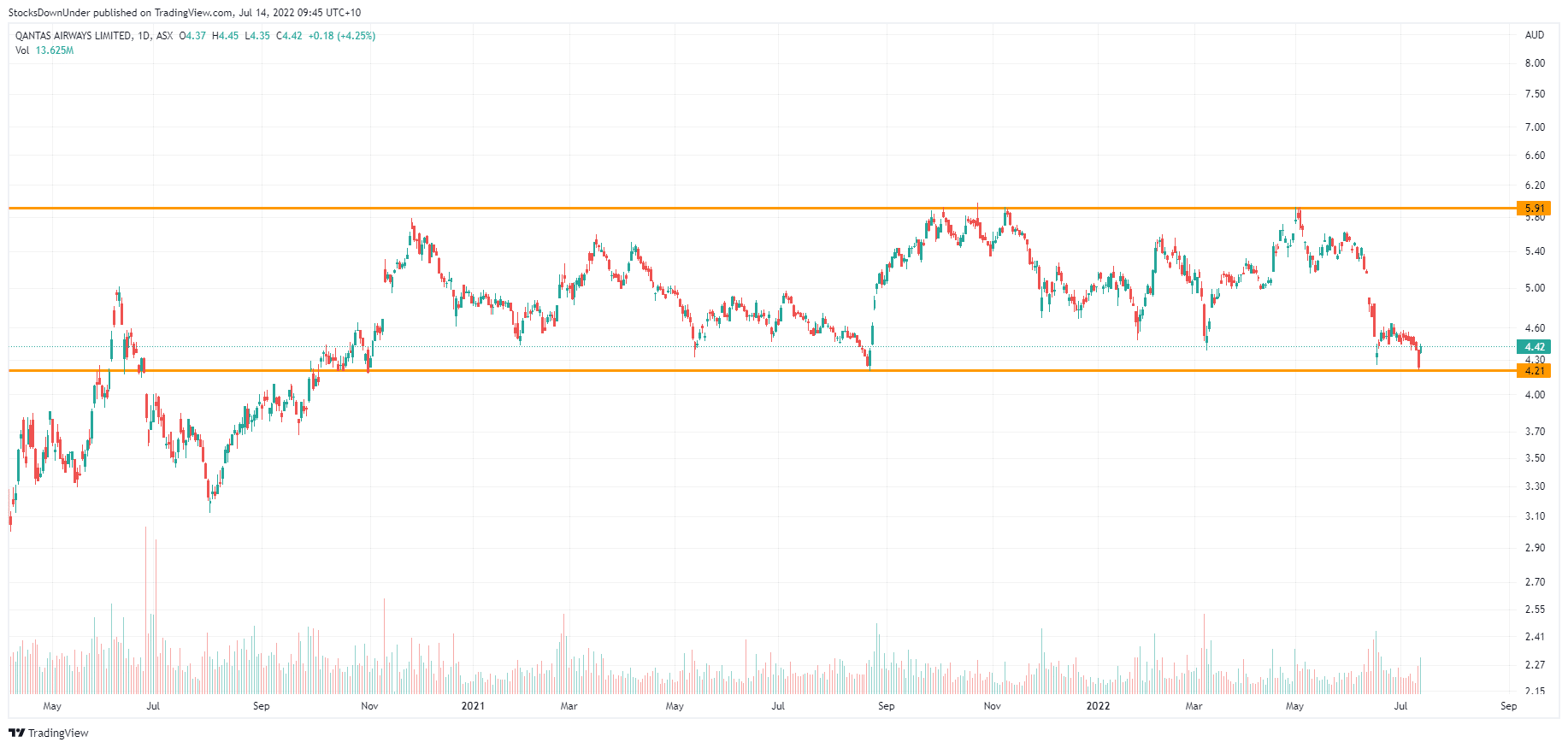

Qantas (ASX:QAN) share price chart (Graph: TradingView)

The market liked the FY21 results for Qantas, which were released on 25 August 2022, and that prompted a re-rate in the stock. However, the stock is now reaching a resistance level at around the current price, and we think it will stall there over the next few months, in line with many other stocks in the travel sector.

There are near-term sentiment issues on QAN

We are broadly optimistic about the medium-term prospects for Qantas. Coming out of FY22 Qantas is expected to return to ‘normal’ earnings in FY23, with EBITDA of over $3bn, and grow that EBITDA number substantially in FY24. There is, however, risk to the downside in terms of earnings estimates.

The issue with Qantas in the short term is sentiment to do with cost management and service delivery. Qantas has been in the news a lot lately due to these concerns. We believe the risk of industrial action at the airline has increased in recent weeks.

We note that Qantas passengers flying internationally face disruption on Monday 12 September after ground handlers at Dnata, the air services providers, voted to strike for 24 hours. We also think tonight’s Four Corners report on the ABC will draw further attention to these industrial issues.

We believe that, ultimately, Qantas will be able to deliver solid earnings growth in FY23 and beyond we noted above. However, there will be some turbulence in the next few months in the stock that suggests better value elsewhere, which is why we are changing our recommendation.

——————————————————————————————————————————————————–

FYI, Our original investment strategy for Qantas (ASX:QAN) dated 14 July 2022

- There is strong demand for international and domestic travel from Australians after two years of lockdowns and travel restrictions. In this environment, we believe Qantas is exceptionally well placed for several years of strong growth.

- Buy QAN up to $4.60

- Use a stop loss at $4.15.

- Our target price for QAN is $5.70.

Investment thesis:

- Qantas has underperformed the general market since the end of 2020 due to restrictions on travel and, more recently, with concerns regarding Qantas’ service delivery. We think this provides a good buying opportunity, particularly with the stock at the low end of the trading range right now.

- Passenger demand is the main reason to buy now. Qantas benefits from strong, pent-up demand for travel in the aftermath of Covid. The company has a long history of solid service delivery and while this has been tarnished by operational issues recently, we attribute these to the airline being ‘rusty’.

- Qantas is expected to register several years of strong earnings numbers. Coming out of FY22 Qantas is expected to return to ‘normal’ earnings in FY23, with EBITDA of over $3bn, and grow that EBITDA number by over 30% in FY24. The market, however, prices Qantas on a low EV/EBITDA multiple of only 3.5x FY24 consensus.

- Qantas’ net debt is expected to have been a very manageable $4bn by June 2022, which is close to the target range of $4.2bn and $5.2bn.

- Qantas believes it can manage the impact of oil prices by reducing domestic capacity to 106% (in the December 2022 quarter) and 110% (in the March 2023 quarter) of pre-Covid levels

- At the half yearly result in February 2022 the company indicated that its 1HY23 hedge book was ‘effective at market prices’, which at the time was US$87 a barrel (Brent) and AUDUSD of 0.79.

- International growth is still to come. Qantas only intends to be at 90% of pre-Covid international capacity by the end of FY23. This means that FY24 can be an even better year for the airline.

- There is potential for a strike, but it is manageable. In August about 1,000 engineers across the airlines vote on industrial action over their demand for a 12% pay rise. This comes after a two-year wage freeze for all Qantas Group personnel. While this strike action, if it eventuates, could be slightly disruptive, we don’t believe it can gravely impact the airline’s recovery.

Qantas Airways (ASX:QAN) share price, log scale (Source: Tradingview)

Who is Qantas?

- Qantas is the world’s second oldest airline, widely regarded as the world’s leading long-distance airline and one of the strongest brands in Australia. In 2004, Qantas launched Jetstar in Australia as a low cost carrier.

- Qantas Domestic carried 22 million passengers in FY19 on approximately 4,300 flights per week in Australia. In FY19 nearly nine million international passengers were carried on over 720 flights per week.

- Qantas is known globally for excellence in safety, operational reliability, engineering and maintenance as well as customer service.

- Qantas Frequent Flyer and the adjacent Qantas Loyalty businesses have historically proven strong drivers of demand.

- Qantas has one of the highest returns on equity in the airline industry globally.

Australians are very keen to travel

- In 2019, approximately 9.4 million tourists visited Australia from overseas, up 2.4% on 2018.

- In 2019, Australian residents undertook 11.3 million outbound international trips.

- Tourism is Australia’s largest services export industry.

- Travel by Australians is virtually recession-proof, given the underlying demand.

- Qantas is a prime beneficiary of all this.

Share price catalysts

- The FY22 result in August.

- The September quarterly trading update.

The risks

- Rapid increases in the price of jet fuel.

- A return to Covid-related restrictions.

- A recession reducing international travel in favour of domestic travel, slightly reducing Qantas’s revenues.

- Prolonged industrial action.

- Sentiment impacted by service problems, should they continue.

Qantas update 25 August 2022

Qantas (ASX: QAN) released its FY22 results this morning and it showed the airline is recovering from COVID very nicely, but the journey isn’t complete yet.

As expected, Australia’s flag carrier recorded a heavy post-tax loss, but now has nearly all of its planes back in the sky, a strongly performing Qantas Loyalty Division and is repairing its balance sheet. It also announced a peculiar new route.

Qantas returning to positive territory

With FY22 including the Delta and Omicron waves of COVID-19, Qantas recorded its third straight statutory loss before tax of $1.19bn, or $1.86bn on an underlying basis. Its underlying EBITDA was positive by $281m, slightly ahead of consensus and mostly achieved in the second half of the year. Its statutory operating cash flow was $2.67bn and its revenue jumped by 54% to $9.1bn, nearly 5% ahead of consensus.

Net debt declined to $3.9bn, below the $4.2-$5.2bn target range and it anticipates $1bn in savings thanks to the recovery plan implemented at the height of the pandemic.

And not just passenger flights

Strongly performing were its freight division, thanks to the eCommerce boom, and its loyalty division that hosts its Frequent Flyer program. It hosts 14.1m members and recorded $1.33bn in revenue, up 36%.

Although this was not included in its results, we observe that over 1bn points were spent by Qantas’ loyalty members on Monday when Qantas released a significant number of award seats, depicting that although members have some gripes, they are engaging with the program.

A positive FY23 awaits

FY23 consensus estimates predict $16.94bn in revenue, up 86%, and $2.97bn in EBITDA, representing a roughly 10-fold gain. The company did not provide any group revenue, EBITDA or NPAT guidance, but expects its Loyalty EBIT to increase to $425-$450m.

And it expects international capacity to reach 84% of pre-COVID levels and domestic capacity 106% of pre-COVID levels. Investors are evidently optimistic judging by Qantas’ 9% share price rise this morning.

A new, peculiar route

The company, as it typically does at reporting season, announced a number of lounge upgrades, including Auckland and Adelaide. But the most intriguing announcement was a new Sydney-Auckland-New York flight from June next year, going head-to-head with Air New Zealand on that route.

Given Air New Zealand will have launched the route already and seeing a lack of 787s, we cannot understand why the Red Roo doesn’t just wait until the A350s arrive and it could operate non-stop flights from Sydney. It will be interesting to see if this flight lasts beyond Project Sunrise.

Overall good outlook

Overall, we think the FY22 results release reads pretty well. QAN is on the way back and 2HY and Q4 data shows the recovery trajectory is actually pretty steep. On top of that, the operational issues should be over by the end of September so travellers will be able to enjoy a much better service going forward.