SiteMinder (ASX:SDR)

Our investment strategy for SiteMinder (ASX:SDR)

- Buy SiteMinder up to $3.65.

- Our minimum target price for SDR is $4.50.

- A secondary price target range would be $5.00 to $5.40 per share.

- Use a stop loss at $3.20.

Who is SiteMinder?

- SiteMinder allows hotels to easily connect with potential guests

- The technology has considerable competitive advantage

- The company is expected to get to breakeven by 4Q24 (June quarter).

- Revenue is growing very fast with ample growth opportunities, specifically in Europe and Asia.

The Sydney-based SiteMinder owns the world’s largest open hotel commerce platform. The platform allows hotel and other accommodation properties to easily connect to all the major booking platforms globally. The platform is currently used by ~35,000 hotels, across 150 countries to connect with potential customers via more than 400 websites and distribution channels.

SiteMinder’s suite of software products covers many tools a hotel manager would need to manage his or her properties. For example, Channel Manager sends room, rate and availability information out to hundreds of distribution channels; Booking Engine allows guests to book directly rather than via third party websites; Multi-Property allows centralised rate, promotion and distribution management for hotel chains; Hotel Payments allows hotels to receive both direct and indirect payments depending on where the booking came from; and so on.

The company outperformed peers during the pandemic

SiteMinder, co-founded in 2006 by ‘the two Mikes’ – Mike Ford and Mike Rogers – achieved a total annual revenue of $101m in FY21 even though the world was in the middle of the Covid-19 pandemic. In FY22 it earned 15% more revenue at $116m. We believe that SiteMinder’s growth can be accelerated now that we are through Covid.

SiteMinder’s CEO since 2019 is Sankar Narayan, formerly Chief Operating Officer of Xero. Co-founder Mike Ford remains on the board as a co-Managing Director alongside Narayan.

A very weak IPO

SiteMinder went public on ASX in November 2021 in a heavily oversubscribed IPO priced at $5.06 per share. The IPO was mostly conducted to allow investors from earlier rounds, mostly Private Equity/Venture Capital) to sell down, with only $90m in new capital being raised. This factor, as well as the 2021-22 bear market for Tech stocks that was underway by the time the IPO was completed, impacted the stock heavily in 2022. We see potential for it to turn around in 2023.

Our investment thesis for SiteMinder:

SiteMinder has a unique platform. SiteMinder represents a single interface for hotels to the plethora of third-party booking websites, such as Booking.com, Expedia and AirBnB, markedly reducing the hotel’s operational overhead. No competitor has come close to replicating what SiteMinder has created with its Property Management System in terms of intelligence, automation and customer experience. Indeed, from about 2022 SiteMinder wasn’t a Property Management System as much as it was an e-commerce platform. The platform regularly wins industry awards as the best in its class and SiteMinder has the scale to fend off would-be copycats, with eight offices around the globe that enable 24/7 support for the platform in 11 languages.

Mind you, SiteMinder has competition, including D-Edge, Staah, RateGain and RateTiger, but none are as comprehensive as SiteMinder and none can compete with SiteMinder in the market for smaller properties. SiteMinder is, by and large, staying away from Property Management System for larger (>40 rooms) hotels, so as not to interfere with its partners in this space. While the largest market for SiteMinder today is Europe, the company serves hotels all over the world.

The market opportunity for SiteMinder is enormous. Today, there are over one million hotels globally and the vast majority (i.e. 85%) are independent small and medium-sized businesses (SMBs). There is more than half a billion US dollars up for grabs in global gross hotel bookings and over half of that comes from online bookings. SiteMinder’s target SMB hoteliers stand to benefit from the improved online connectivity with SiteMinder can allow them. SiteMinder believes that its main competition in this space is manual solutions such as pen and paper or Excel spreadsheets.

SiteMinder represents a travel re-opening play. With the Covid-19 pandemic now more or less over in terms of travel restrictions, hotels globally are gearing up to welcome back visitors. SiteMinder will likely benefit in a business development sense.

SiteMinder continues to innovate around its product offering. A good example is the Multi-Property product, specially designed for the world’s hotel groups and chains and launched in May 2021. We see this innovation as helping to build a moat around the SiteMinder offering.

SiteMinder is rapidly growing its user base. As at November 2021 the company’s products were being used by around 35,000 properties of all sizes in over 150 countries. By June 2022 the user base had grown to 34,700. In FY22 42% of revenue came from the EMEA region (Europe, the Middle East and Africa), 32% from the Asia-Pacific region and 26% from the Americas.

SiteMinder had a great FY22, with $116m in revenue, up 15%. Importantly, monthly ARPU rose by 13% year-on-year, a reflection of the company’s ability to upsell to customers. FY22 saw the company growing strongly in the Americas (up 27%) and the EMEA region (up 21%), but only steady in the APAC region, which reflects the fact that Chinese people weren’t travelling in FY22.

The September 2022 quarter shows the power of SiteMinder’s platform. In that three-month period Annualised Recurring Revenue (ARR) grew 31.8% (in constant currency terms) to $145m. Actual revenue for the quarter was 30.5% better at $35.7m.

The company is on track to be breakeven by 4Q24 (June quarter), with the company likely to reduce its EBITDA loss in FY23. SiteMinder had $117m cash as at June 2022 and $108.9m as at September 2022, and is therefore well placed to make it into the black without requiring new capital. The company has guided to being to free cash flow neutral by the last quarter of FY24.

SiteMinder earns money both by subscription and usage-based fees. In FY21 SiteMinder generated 83.3% of revenue from recurring subscription fees and the remainder through transaction fees from subscriber properties. In FY22 subscription was only 75% of total revenue as the company had introduced new transaction-based products to encourage product usage.

Transaction products include Demand Plus (which makes properties visible on the high-performing travel sites) and SiteMinder Pay (which allows the property to easily accept payments online). As the company grows transaction revenues its gross margins will likely decline, since gross margins on subscriptions for SiteMinder are more than 80% whereas transaction products typically have lower gross margins, in the order of 30%. However, since transaction products need lower levels of support, margins at the EBITDA line are likely to be much less impacted and EBITDA itself will more than make up for any margin decline.

SiteMinder has great economics, with the ratio of Long Term Value to Customer Acquisition Costs (LTV/CAC) having reached 3.9x by the fourth quarter of FY22. In FY21 LTV/CAC was just 2x. The expansion shows the stickiness of SiteMinder’s customers.

SiteMinder has a great earnings profile, with the company ‘pre-Covid revenue growth rates’ going forward. Between FY17 and FY19 revenue rose 31%.

What went wrong for SiteMinder post-IPO?

• We noted above that the IPO was mostly about allowing existing investors to sell rather than raising new capital.

• There was a bear market in Tech through 2022.

• Throughout 2022, the market particularly didn’t like Tech companies, however promising, that were yet to get to cash flow breakeven.

What can now go right

• The top line is growing nicely.

• Global travel is increasing post-Covid.

• The recent quarterly numbers have been good.

• China is opening up, which is good news for the company’s Asian business that may likely see an uptick after the initial increase in Chinese travellers, i.e. late in 2023.

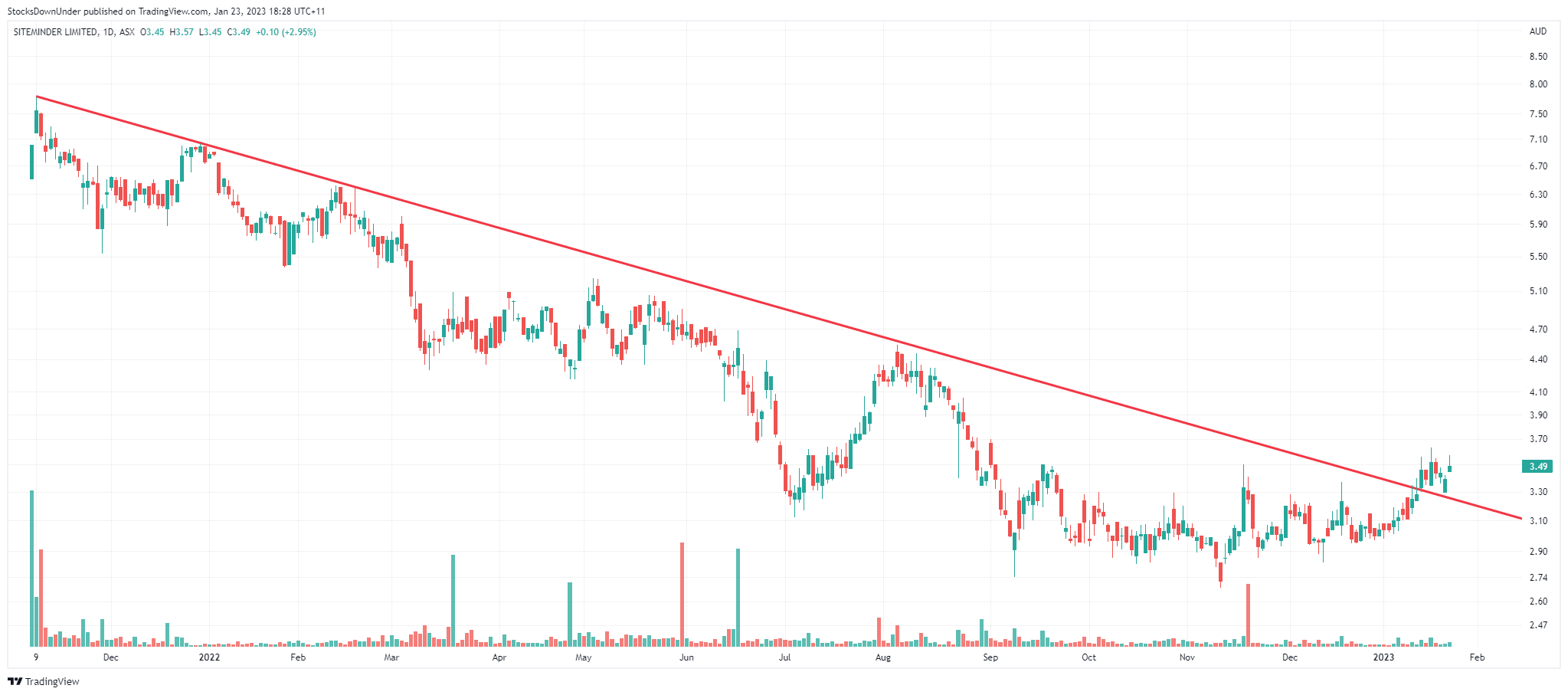

SiteMinder share price chart, Log scale (Source: Tradingview).

Initial price target of $4.50 (+28.5%)

• The stock was last trading around $4.50 in August 2022. $4.50 now forms a strong resistance level. And it recently broke out of the downtrend and tested that breakout successfully.

• $4.50 would represent an EV/Revenue multiple of just 6.2x consensus for FY24, which we believe is very reasonable given the expected revenue growth of ~27% in FY23, FY24 and FY25.

• A secondary price target range would be $5.00 to $5.40 per share.

• We set a tight stop loss at $3.20.

Catalysts for the re-rate of SiteMinder

We see three main catalysts to prompt a re-rating of the stock from here:

1. The December 2022 quarterly result, due out in late January 2023.

2. The 1HY23 result, which has the potential to highlight continued growth in the story.

3. Further director buying of stock after the result. There were a few director transactions after the FY22 result.

Risks

1. Continued interest rate increases impacting sentiment towards Tech stocks.

2. A more modest, i.e. disappointing, growth rate than expected at the half-yearly result.

3. Renewed flare ups of Covid that may impact travel.

Check the Concierge page to stay update on our other Concierge stocks!

Update 27 April 2023

The Q3 quarterly is out … steady as she goes!

- Our Concierge pick SiteMinder (ASX:SDR) just published its third quarter cash flow report and business update.

- Revenue grew strongly again at 27.1% (autonomously and at constant currencies). Last year’s Q3 was very strong, so even though 27% is lower than the roughly 30% SDR aims for, we believe it is a very solid number.

- Annual Recurring Revenue (ARR) now stands at $150m.

- Cash outflow (at $8.5m) continues to improve as well, five quarters in a row now. SDR reaffirmed it’s on target to raech cashflow break even in 4Q24 (June quarter next year). And it has ample funds ($86.7m) to get there.

- In terms of outlook, SDR indicates that advanced bookings for the Northern summer are very strong. This bodes well for SDR’s customers and hence for SDR. We are particularly keen to see how Asia will be developing for SDR this year as Chinese tourists are starting to come back to Asian destinations now.

- Lastly, Ellerstone Capital just became a substantial shareholder in SDR with 5.02% of the voting rights. We think this is positive news as it illustrates that SDR is an institutional-grade stock and is getting increased insto backing.

- The stock is trading higher in morning trade.

Update 28 July 2023

SiteMinder (ASX:SDR) provides a quarterly update

Our Concierge Pick SiteMinder (ASX:SDR) is finally doing what we want it to do, i.e. going up!

The company provided an update this morning on the June quarter and provided its unaudited FY23 results. And SDR has reiterated its guidance for positive EBITDA and free cash flow in 2HY24.

Revenues were up more than 30%, i.e. the minimum level we were looking for. Specifically, it recorded $151.4m in revenue, up 30.5%. $103m of this was subscription revenue (up 18%) with the balance being transaction revenue which was up 65%.

Overall, we think this was a good result and the market agrees. SDR is up more than 21% this morning.

Our target for SDR is unchanged

So far, SiteMinder has delivered almost 23% for our subscribers since we put it on Concierge in January 2023. We’d hoped this performance would have come through a little earlier, but the troubles with US Silicon Valley Bank back in March have delayed this by at least 3 to 4 months, we reckon.

But better late than never! We see further upside towards our price target for SDR, which is $4.50 per share.

UPDATE 8 September 2023: We are taking profits on SiteMinder (ASX:SDR)

We put SiteMinder on Concierge on 21 January 2023.

After initial setbacks due to the collapse of Silicon Valley Bank in March and the market thinking SDR’s funding was in jeopardy, the stock has rebounded nicely as our travel rebound thesis played out.

Our initial target price for SDR was $4.50, with a secondary target of $5.00. At $4.50, the technical chart still looked very good and we decided to let it run for a little longer.

But now, as we approach $5.00, we believe it is time to lock in our profits of 40%+ in approximately 8 months.