Whispir (ASX:WSP)

Our investment strategy for Whispir (ASX:WSP)

- Buy Whispir up to $0.85.

- Our initial target price for WSP is $1.25.

- Use a stop loss at $0.66

Read the Emerging Stocks Down Under article on Whispir from 4 October 2022 here.

Who is Whispir?

Whispir is a Melbourne-based operator of a ‘communications-as-a-service’ platform mostly for Australian and New Zealand corporates, but with the business now growing internationally.

The Whispir platform is ‘omni-channel’ in that it allows personalised, seamless communication across email, SMS, social media and the web. It is currently used in around sixty countries around the globe. Enterprise customers use Whispir to engage with their customers or stakeholders and the company generates revenues by charging users a monthly fee, plus a small fee per message and per recipient. The platform is increasingly allowing AI, algorithms and data to inform how and when customers communicate.

After a Series A Funding round in 2016 (in which Telstra Ventures was an investor), WSP did its ASX IPO in 2019 at $1.60 a share, having raised $47m. The peak share price was $4.72 in July 2020. Jeromy Wells, who co-founded Whispir in 2001, remains CEO and currently holds around 11% of the company.

Our investment thesis for Whispir:

- Whispir’s product offering is compelling, with strong benefits to customers in terms of the messaging capability.

- WSP has been growing strongly in recent years, with revenue consistently growing at 20 to 30% per annum. As we noted above, FY22’s revenue growth was 48%. All of Whispir’s growth has been organic for many years. Total revenues in FY18 were only A$27.8m. They reached $70.6m in FY22. The vast majority of revenue is recurring in nature.

- The company enjoys very high net revenue retention figures. 120%-plus for net retention (Net revenue from existing customers, plus upgrades, minus downgrades, and customer churn, which indicates business growth potential from the current customer base) is best-in-class for communications software. In FY22 Whispir enjoyed 125.5%, which exceeded expectations.

- The company has some powerful enterprise customers, such as BHP, Rio Tinto, Foxtel and Australia Post. The Walt Disney Company uses Whispir to streamline the recruiting and onboarding of new employees. AGL Energy uses the platform to automate workflows for e-billing and digital customer experience. And so on.

- Most customers, large or small, stick with Whispir, with the churn rate only 2% or 3% a year. There were over 1,000 customers at the end of FY22, with customer numbers having risen 25% through the year.

- Whispir enjoys strong gross margins at 58.5% in FY22, reflecting the scalable nature of the platform and the fact that most of the revenue (i.e. 77% in FY22) is transaction revenue.

- Telstra is a significant Whispir channel partner in Australia enabling Telstra’s business customers to add on its services as part of their package. This has helped Whispir attract a lot of new business, albeit at a lower gross margin than non-Telstra business because Whispir has to pass on a portion of its SMS-related revenue to the telco.

- SingTel provides an important bridgehead into Asia. In December 2021 Whispir signed a three-year contract with SingTel to replace that telco’s core SMS notification systems while also enhancing ‘app push’ capability (the messages that come from a specific app installed on a mobile device) for internal users alongside email, voice, WhatsApp and Rich Message capability.

- Covid showed the power of the Whispir platform, with major healthcare providers using it to deliver personalised communications related to pandemic response.

- Governments are finding new uses for Whispir, with recent programmes including a three-year contract with South Australia’s Department of Education (for 900 schools in that state) and the Victoria Police development of ‘STOPIT’, which enables commuters to instantly report cases of unwanted behaviour on public transport.

- The company had a great FY22. Whispir enjoyed record revenue of $70.6m in FY22, up 48%, and reduced its EBITDA loss to $10.6m, which was better than expected. The fourth quarter in particular saw operating expenses decline as efficiencies were realised.

- WSP is near breakeven. The company expects to reach positive EBITDA in the second half of FY23 and to be cash flow positive in FY24. Revenue of $81m would have seen Whispir breakeven in FY22.

- WSP is funded for the rest of the journey to breakeven. As at June 2022 the company had $26.1m cash and no debt, and did not believe that it required further capital to get to breakeven.

- WSP has been growing internationally with key partnerships being reached in Asia and the US in recent days. The company now has a US office in Boulder, Colorado to target that key market. There are also offices in Singapore, The Philippines and Indonesia.

- WSP is working on next generation services that will allow low-code/no-code composition and dispatch of messages with the highest engagement, allowing, for example, customers to better score the engagement to content. Whispir’s R&D budget in FY22 was $16.2m, which was 23% of revenue, but that expenditure helps build a stronger competitive position.

- Whispir’s valuation has dropped to a fraction of ‘normal’. Before the bear market of 2022 unprofitable software or platform businesses tended to trade on revenue multiples of 8x to 12x. Now 4x is more normal, but Whispir is now under 1x.

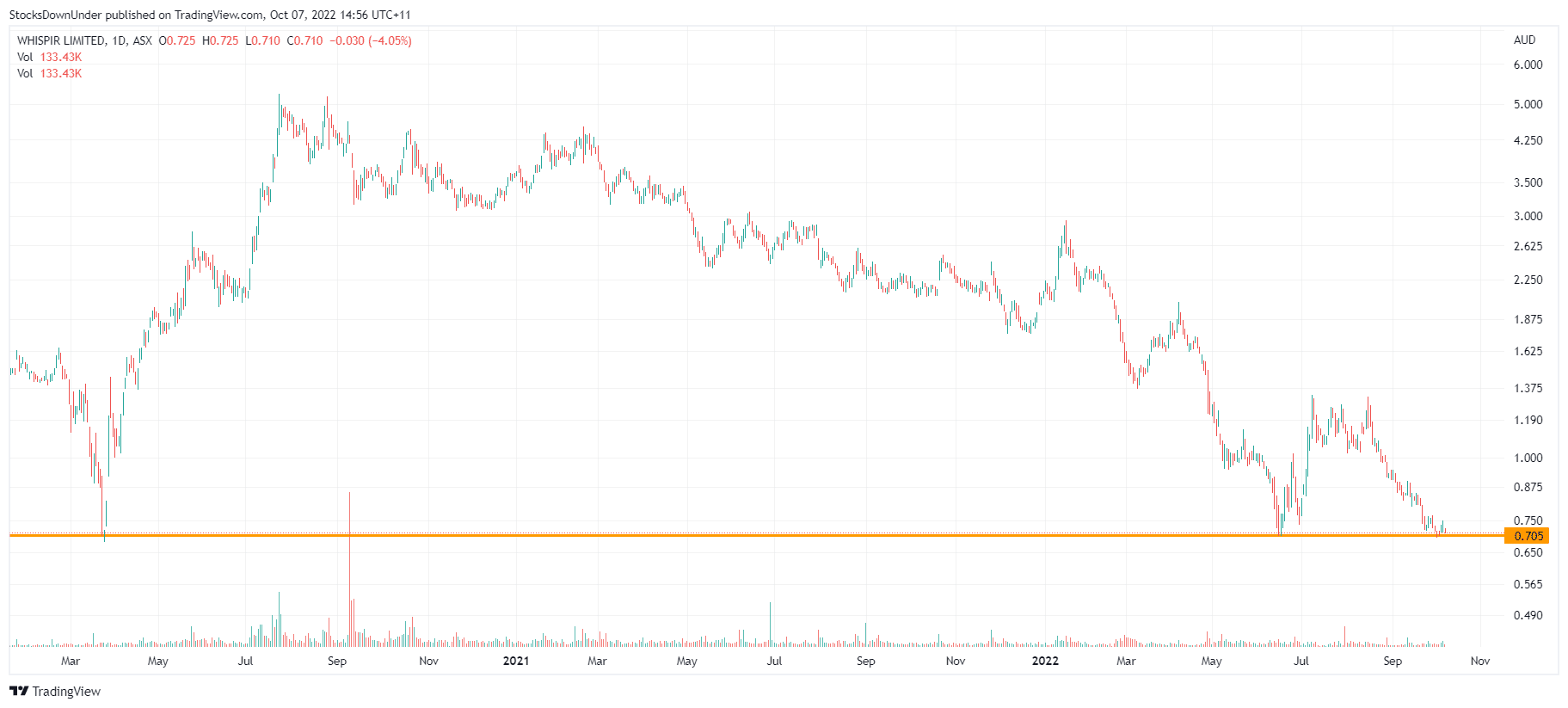

Whispir (ASX:WSP) share price chart, log scale (Source: Tradingview)

Why has Whispir stock declined since mid-2020?

- Technology stocks generally have been hard hit in the bear market of 2022, as evidenced by the Nasdaq Composite Index in America falling from over 16,000 points in November 2021, to close to 10,500 in early October 2022.

- Technology companies yet to reach profitability have been marked down as the market has become more risk averse.

- WSP has also been impacted by concerns that it was overly reliant on Covid-related messaging, with 2022 seeing less need for this kind of capability than was the case in 2021 and 2020. We think the 2022 de-rate creates a strong buying opportunity.

- We believe the technology bear market is coming to an end, with the Nasdaq Composite having come down around 30%.

- Whispir’s current share price is back to the Corona Crash low, which was 70 cents.

Target price of $1.25

- The stock was trading at that level through July and August 2022.

- $1.25 would represent an EV/Revenue multiple for FY23 consensus of only 1.5x

- Longer term we believe $2.70 per share is not unreasonable for Whispir as this would represent an EV/Revenue multiple for FY23 consensus of 4.5x.

- We believe the current share price around $0.70 is a great entry level considering the stock has bounced up from this support level three times now.

Catalysts for the re-rate of Whispir

We see four main catalysts to prompt a re-rating of the stock:

- The next quarterly result due out around Wednesday 19 October;

- The Annual General Meeting, probably in late November, with the potential for a favourable business update;

- The 1HY23 results announcement in February 2023.

- Confirmation that the company is becoming EBITDA positive in 2HY23.

- Technology stocks gradually coming back in favour as the market revaluation, driven by interest rate hikes globally, may soon come to an end. We believe inflation expectations for 2023 may have peaked recently, which should result in slower than previously expected interest rate hikes going forward.

Risks

- A resumption of the 2022 bear market in technology stocks;

- An increase in customer churn above 3%;

- An increase in marketing and R&D expenditure, which could push out the arrival of cash flow positive status until FY25, implying a capital raise may be necessary.

UPDATE 26 OCTOBER 2022

Whispir releases its Q1 FY23 report

Whispir unveiled its cash flow and activity report for the quarter ending 30 September 2022 (Q1 FY23). The company’s cash receipts were $14.4m, down 15% and 11.5% from the previous quarter and from Q1 FY22 last year. This was nonetheless 38% higher from Q1 FY21.

The company’s Annual Recurring Revenue (ARR) was $62m (down from $65.4m three months ago) and its cash on hand was $17.1m.

Long term growth very much intact

The key reason for the lower cashflow and ARR is that COVID-related revenue from last year is not recurring. State governments simply send out fewer COVID-related messages as the pandemic is now largely in our rear-view mirror. But compared to 1Q21, i.e. the last pre-COVID quarter when it comes to large scale messaging, cash receipts were up 38%. In other words, the long term growth trajectory is very much intact.

EBITDA positive in 2HY23

Whispir recorded a $9.2m cash outflow for the quarter. However, it expects to be EBITDA positive (excluding share-based payments) during the second half of FY23 as it wins new contracts.

Not all investors may like this result as some metrics appear to be going backwards when the company is telling investors that the opposite is happening. But you need to look through the COVID period and you’ll see that this company is growing very fast.

We think Whispir is significantly undervalued at the moment considering its product offering, powerful enterprise customers, client retentions and gross margins. We also believe that the technology bear market is coming to an end and that this stock can rebound with its peers.

Our target price for WSP remains unchanged at $1.25.

UPDATE 27 OCTOBER 2022: Sell Whispir

We are selling Whispir after the stock broke our stop loss following yesterday’s result. The WSP share price is not indicating any imminent recovery in today’s trading either.

Following yesterday’s results, we spoke to both the CEO and CFO this morning. Q1 of any financial year is always a weak quarter for Whispir. It’s the quarter when the company pays its annual fees, software licenses etc for the whole year. In addition, it is the slowest revenue quarter of the year as well, given that many people are away in July and August.

So, the bottom line is that cashflow is always weak in Q1. And in this case the Annual Recurring Revenue number was off by just $250k for September. But that set a sour mood in the market.

Still EBITDA positive in 2HY23 and no cap raise

Management reaffirmed this morning that it still expects to be EBITDA positive in 2HY23, which starts in 2 months. On top of that, it said it does not foresee an equity capital raise. In other words, nothing has changed in that respect.

Stop losses don’t lie

However, our stop loss was triggered and we are not seeing an improvement in sentiment today. We need to stay disciplined. Therefore, we have to close out WSP and we are taking it off Stocks Down Under Concierge unfortunately.