EBITDA can be a powerful metric if you use it wisely. Here’s 2 key things you need to know about it

Nick Sundich, February 14, 2023

ASX investors will frequently hear companies talk about EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation) as well as its profit or loss. What is the difference between the two and why does it matter?

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

What is EBITDA?

It is a financial measure that is used to measure the profitability of a business before taking into account certain expenses that are not considered part of a business’ day to day operations – and, of course, taxes. Naturally, EBITDA will be higher than a company’s profit or loss because it excludes these items.

Is EBITDA reliable?

How you answer that question depends on whether or not you think the items EBITDA excludes distort true profitability.

The Yes Case

On one hand, the items EBITDA excludes are not related to the daily operating performance of a company. By looking at EBITDA, investors can get a better sense of how well a company is able to generate profits without considering financing costs (or balance sheet structure) and non-cash expenses, like depreciation and amortisation. Even though a company may not be NPAT profitable, EBITDA profitability may indicate that a company’s core operations are profitable.

You can also compare one company’s EBITDA to another, particularly companies in the same industry. Investors can make decisions about which company deserves their investment. Also, some companies release EBITDA for certain divisions and investors can use these figures to see which divisions are performing and which ones are not.

The No Case

The world’s most famous investor, Warren Buffett, despises companies that use EBITDA in their reporting – going to the point of pledging not to invest in companies that use it. He is critical because believes that some companies may attempt to manipulate their EBITDA numbers.

On one hand they could include one-time gains or other non-operating activities that artificially increase their earnings when times are good, but do the opposite when times are tough.

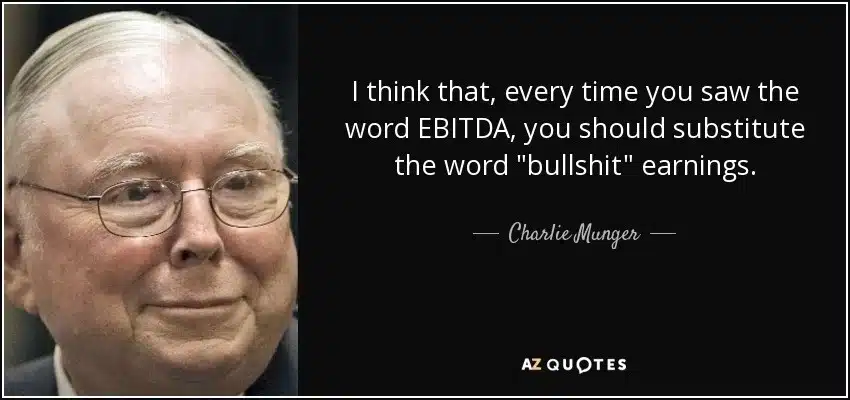

Buffett’s business partner, Charlie Munger, is even more scathing.

Look at EBITDA in conjunction with other metrics

EBITDA is not a formal accounting metric, giving flexibility to the company to include or exclude what it wants and investors in favour of EBITDA will point out that depreciation and amortisation are not actual cash flows out of the company. Even so, they can still affect its long-term financial health as companies will have to replace the depreciating assets some day and this will be definitely be a cash outflow at that time.

High levels of depreciation or amortisation can not only indicate potentially high cash outflows down the track, but also poor management of assets. Warren Buffett is known for his long-term focus. He therefore prefers to use metrics that factor in taxes and non-cash expenses when assessing a company’s worthiness for investment.

What about EBIT?

Some investors may opt to use EBIT (Earnings Before Interest and Tax). EBIT would account for depreciation and amortisation, but not for the cost of debt financing (interest) and taxes. For companies without any borrowings, there may be little to no difference between EBIT and the Profit Before Tax (PBT) that is an accounting metric. But if a company does have borrowings, there may be a substantial difference. This is why it is important for investors to also look the balance sheet in conjunction with these numbers.

2 occasions when EBITDA is useful

So, is EBITDA a good or bad metric? In our view, the short answer is that it can be both and therefore should not be used in isolation, as is the case with any other metric. In our view, it is most useful for two purposes. First, for comparing companies in the same sector. Second, for calculating takeover values of an M&A target, given the EV/EBITDA multiple is a commonly used approach to valuing M&A targets.

But sometimes it is not

But we would urge caution in using EBITDA for two specific purposes. First, to compare companies in the different sectors. Second, as a sole excuse to justify investing in a non-profitable company. This is not to say that non-profitable companies cannot be good investments, but investors shouldn’t say a non-profitable company is a good investment simply because it has positive EBITDA.

In the end, we think it can be both a good and bad metric and it should therefore not be used in isolation.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Recent Posts

Cochlear (ASX:COH) is a long term growth story you should listen too

Cochlear is one of few stocks that has created immense shareholder value and has also greatly improved the lives of…

Here’s why the RBA is worried about the ASX. Should you be too?

The RBA is worried about the ASX. It all but confirmed that in its latest bulletin, released last week. The…

Buying Netflix shares from Australia? A golden growth opportunity

Buying Netflix shares from Australia may seem like a no brainer. It has recorded exponential growth since its famous pivot…