Not all REITs are created equal. Here’s the best REITs for 2024!

Nick Sundich, March 26, 2024

What are the best REITs (Real Estate Investment Trusts)? And what even are REITs? They are a type of security that invests in real estate. REITs can provide investors with an attractive source of income, diversification and the potential for long term capital appreciation. Furthermore, they offer all these advantages with far more liquidity than private real estate investments and without the obligation of having to purchase or manage property directly. But why should you consider them and how can you value them? And is it finally time to get back into them with interest rate cuts on the horizon?

What do REITs do?

REITs typically own income-producing real estate. REITs listed on the ASX typically own five types of properties: offices, industrial, retail, social infrastructure and residential properties. REITs typically hold their investments for the long term while collecting rent, but they can sell them if necessary to generate cash for operations or meet shareholder demand.

REITs investors benefit from the ability to diversify their portfolio across different types of real estate with a single investment. Moreover, since REITs trade on major exchanges, just like stocks do, they offer investors access to liquid markets where they can buy and sell their shares whenever they wish.

Advantages of investing in REITs

There are two main advantages of investing in REITs.

Firstly, unlike traditional stocks and bonds, which usually pay dividends at regular intervals throughout the year, most REITs pay out dividends quarterly or semi-annually. The amount distributed as a percentage of earnings is often much higher than what could be realised through traditional investments. This is due to tax advantages offered to this type of security.

And secondly, there’s potential for significant share price appreciation over time because REITs’ underlying holdings often increase in value as rental rates rise and properties appreciate in value over time. This provides investors with an additional opportunity for growth beyond what would be available from other types of investments such as stocks or bonds.

How to value REITs

Investors value REITs based on a variety of factors, including their income potential, diversification benefits and potential for capital appreciation. There are 2 popular ways:

-

Net Tangible Assets

First, there is the discount or premium to the REIT’s NTA (Net Tangible Assets) per share. The NTA is essentially a reference point for what an investor could obtain for each and every share in the business in the event all of the REIT’s properties were sold.

A REIT trading at a discount to its NTA might be considered undervalued whilst one trading at a premium might be considered overvalued. Nevertheless, there might be good reasons why the stock is trading at a premium or a discount in the first place.

-

Price / Funds From Operations

The second valuation method uses the P/FFO (Price to Funds From Operations) multiple. It is similar to the P/E multiple except that it is more relevant to the REIT business model. FFO is essentially net income with depreciation added and gains from the sale of properties deducted.

Some REITs might also use Adjusted Funds From Operations (AFFO). AFFO is not a formal accounting metric, but it takes into account certain costs incurred by the REIT and additional income sources, such a rent increases.

-

P/E

For REITs that do not use FFO, investors may use P/E (Price to Earnings per Share) instead. Investors may also consider the yield from a REIT’s dividends or distributions to investors when making the decision about whether or not to invest.

The state of the market

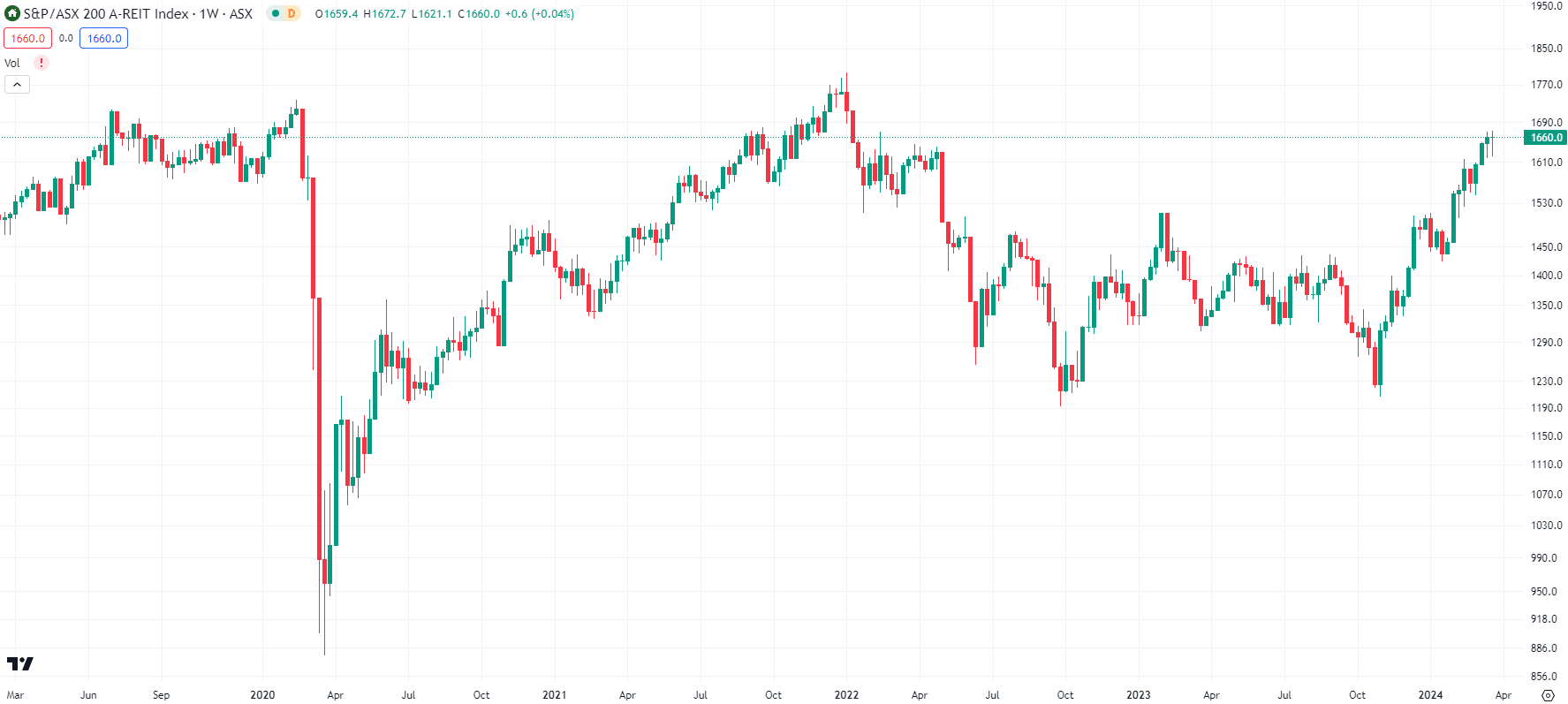

REITs have been in a sorry state since the pandemic. During the Corona Crash, many individual REITs plunged out of fear that distributions would dry up and the property market would crash. The poor state of the property market recently, as a result of rising interest rates, hasn’t helped the recovery either. Indeed, the ASX 200 REIT Index only briefly surpassed its pre-pandemic high before retreating as interest rates hiked. But now, the index is about to surpass pre-COVID levels once more. So is it time to get into this sector again?

ASX 200 REIT Index, log scale (Source: TradingView)

It is unlikely that there’ll be a sector-wide recovery because there are so many different fates different stocks are experiencing. Nevertheless, this does not mean that there won’t be opportunities out there for investors, nor that all sectors will rise if and when there is more clarity on the direction of interest rates.

There remains significant uncertainty surrounding office REITs because of the rise of flexible working. Similarly, because of the long term rise of eCommerce there are many question marks around discretionary retail REITs as well.

But what are the best REITs?

Industrial REITs, however, offer the most promise of any sector, in our view, given the demand for industrial property that is driving rents and property values up. So called ‘social infrastructure’ properties, such as childcare centres, offer promise too given government subsidies and consequential income stability. We would point to 2 in particular.

Goodman Group (ASX:GMG)

Goodman Group is one of the biggest property stocks on the ASX owning various logistics facilities around the world. As of early January 2024, it has $82.9bn in total Assets Under Management with a further $12.7bn in projects as a Work In Progress. It owns industrial properties across the globe that have an average of 4.9% rental growth, 99% occupancy and a 5.4 year WALE (Weighted Average Lease Expiry). Goodman top tenants include Amazon, Coles, Australia Post, FedEx, JD, DHL and Global Express.

Demand for logistics facilities was growing pre-COVID and could arguably have got to this point eventually if not for COVID, although a lot slower. Demand took off exponentially when COVID-19 restrictions hit, leaving to substantial growth in eCommerce.

It made a $1.8bn operating profit in FY23, a figure that has grown by a CAGR of 17% in 5 years, and boasts $3.1bn in Group Liquidity – not accounting for a further $17.6bn across its Partnerships. ESG investors will like this company because it has already achieved carbon neutrality across all its operations. In 1HY24, it made $29.6m in operating earnings.

Charter Hall Social Infrastructure (ASX:CQE)

What are social infrastructure properties you might ask? Properties delivering community services such as childcare, education, health, government services and transport. CQE has $2.2bn in assets across Australia.

Compared to other property classes, social infrastructure properties provide long leases, high tenant retention and low correlation to other property classes. CQE has a 12.8-year WALE, 100% occupancy and it has 77% of properties with annual fixed reviews.

REITs represent a good investment opportunity

Overall, the key factors that investors consider when valuing REITS are their income potential and diversification benefits along with the potential for capital appreciation over time. However, in the current market, it is important that investors think critically about their investing decisions, because there is uncertainty over the sector recovery, i.e. if and when it may come. Additionally, there’s likely to be significant divergence in performance among different property sectors. So pick wisely!

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Recent Posts

Tigers Realm Coal (ASX:TIG): Its making an awkward exit from Siberian coking coal, but what’s next?

Tigers Realm Coal (ASX:TIG) has been one of the few ASX stocks (if not the only ASX stock) with direct…

Is a soft landing still likely in Australia in 2024?

Is Australia still set for a soft landing? For some months now, it was thought the answer was a firm…

Johns Lyng Group (ASX:JLG): One of a few ways to profit from climate change

Johns Lyng Group (ASX:JLG) is a restoration services company, repairing properties after damage by insured events, including weather and other…