Megaport

BUY

Date of inclusion: 10 February 2022

Share price on inclusion in Marc & Stuart’s Top Picks: $14.74

52-week range: A$10.67 / A$22.00

Risk Level: Medium

Megaport connects Enterprises in the Cloud

Megaport is the middleman that helps enterprises connect with partners between various data centres as well as within the same data center. Simply put, its software makes it easier and more secure for businesses to connect to critical Cloud-based systems, such as daily collaboration tools, payments systems and data back-ups. The Megaport labyrinth connects to more than 400 data centres throughout Australia, Asia, Europe and North America. Once a customer is on the Megaport platform, new connections can be made in minutes, rather than weeks and months it used to take.

Let’s say Macquarie Bank needs a direct, secure connection to CBA’s network to handle payments (banks need many of these types of connections). Instead of installing a data cable directly from Macquarie’s IT hub to CBA’s, the two banks can simply connect their networks in a data centre where they are both present, e.g. in NEXTDC’s Sydney S1 data centre. Megaport will help connect the two banks inside this datacentre.

Depending on the country and the required network speed, Megaport will charge between $500 and $16,000 per month per connection. Furthermore, once a customer is connected through Megaport, it can connect to any party that is present in a datacentre where Megaport is also present. So, even if Macquarie and CBA are not present in the same data center, they can still connect through Megaport given MP1’s presence in a large number of these centers. That is a big money saver for Megaport’s customers!

Read our our recent article on MP1 here

The business model is extremely scalable

In FY24 and FY25, EBITDA growth is projected to soar by 170% and 87% respectively, while revenue is “only” expected to grow by 36% and 22% in those years. In other words, most of the additional revenue Megaport realises from FY23 and beyond will fall straight to the EBITDA line, and then to the bottom line, because the bulk of investments have already been done in the years up to FY22. This scalability is why we like Megaport so much.

In the 1HY22 earnings call on 9 February, the company actually indicated it would be EBITDA break even in 2HY22, so sooner than the market was expecting. Additionally, growth is expected to accelerate from the 42% in 1HY22. Longer term, because of the scalable business model, we see EBITDA margins approach 50%.

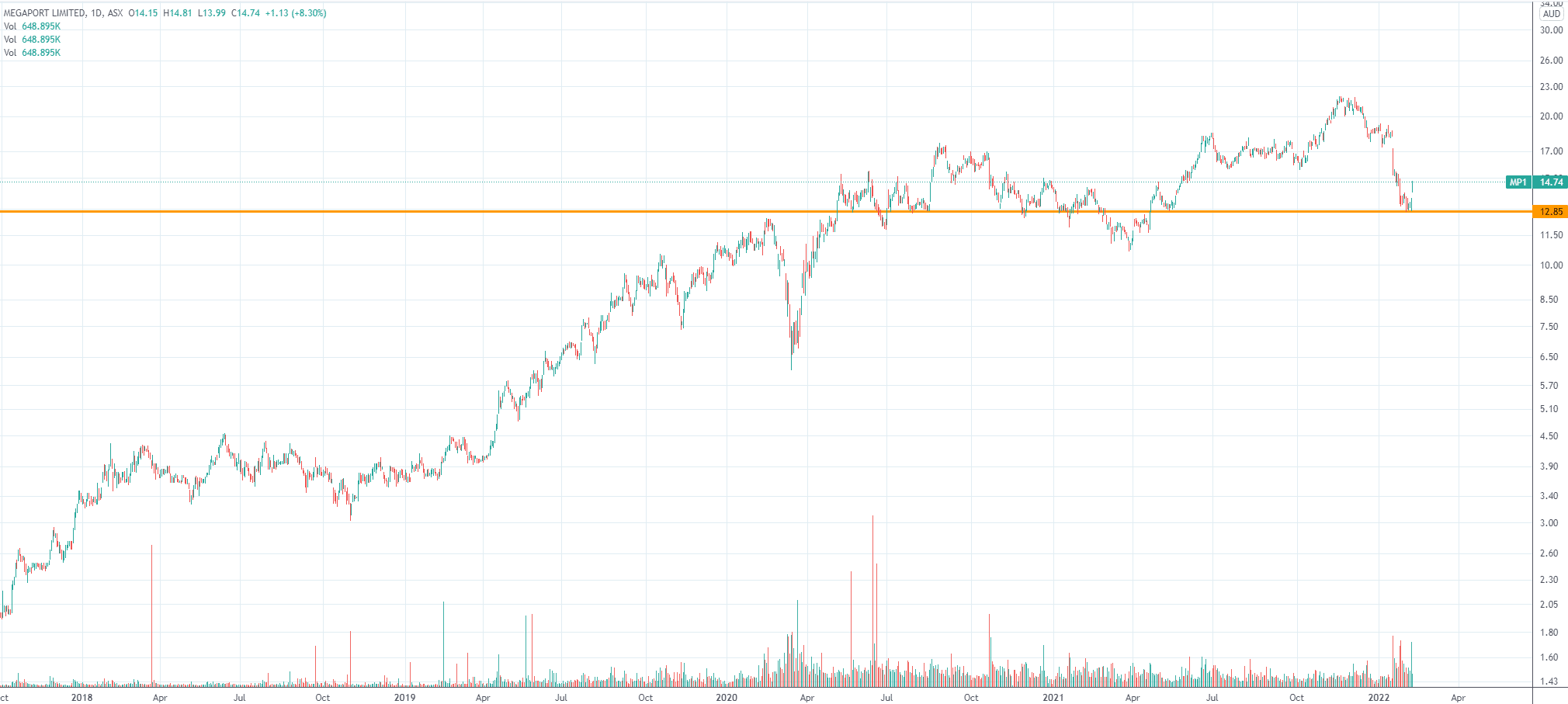

Megaport (ASX:MP1) chart, log scale (Source: Tradingview)

Valuation is looking better than AfterPay back in 2019

When we look at valuation, we see the shares are currently valued at EV/EBITDA multiples of 32.6x for FY24 and 17.4x for FY25. So, on our beloved EV/EBITDA-to-EBITDA-growth metric, Megaport is trading at a ridiculously low 0.19x and 0.20x for both years. That is lower than AfterPay back in 2019.

The stock bounced nicely off a long term support level recently and we believe MP1 can double in the next 9 to 12 months.

Key company specific risks

- A key risk is that a large IT player could decide to move into this space. However, we think this market is niche enough to be left alone by the big companies.

Disclosure: Pitt Street Research / Stocks Down Under directors own Megaport shares.