The Baltic Dry Index: What does it track and why has it dropped >30% in 12 months?

The Baltic Dry Index (BDI) is an index you may not have heard of, but you should have. In this article, we recap what it is, why you should watch it and where it is right now.

Do you need solid trading & investment ideas on the ASX? Stocks Down Under Concierge can help!

Concierge is a service that gives you timely BUY and SELL alerts on ASX-listed stocks – with price targets, buy ranges, stop loss levels and Sell alerts too. We only send out alerts on very high conviction stocks following substantial due diligence and our stop loss recommendations limit downside risks to individual stocks and maximise total returns.

Concierge is outperforming the market by a significant margin!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

What is the Baltic Dry Index?

The Baltic Dry Index is a composite index created by the London-based Baltic Exchange that assesses the cost of transacting dry bulk cargo around the world. It offers insight into global economic activity and trade flow dynamics as it provides an indication of demand for ships to transport goods across oceans and therefore, demand for these goods themselves.

The goods it tracks include items such as coal, grain, iron ore and cement. The Baltic Dry Index is also used to monitor shifts in supply and demand for commodities.

When there are higher levels of global demand for cargo, freight rates go up and the index increases. Conversely, when there is lower overall demand, freight rates drop and so does the index. This makes the The Baltic Dry Index a useful tool for tracking economic growth on a global scale.

The movements of the The Baltic Dry Index can have important implications for financial markets worldwide, because they reveal information about global supply and demand levels, which then affects commodity prices. Thus, monitoring changes in the BDI can help traders anticipate shifts in price fluctuations in various commodities.

Additionally, many investors use this index as an indicator of future market conditions as well as potential investment opportunities.

The sub indexes

The Baltic Dry Index has three sub indices. The Baltic Capesize Index tracks the cost of transporting various raw materials, such as coal and iron ore on vessels measuring over 100,000 deadweight tonnage in size. This index focuses on long-distance voyages between major Industrialized countries such as China, Japan, and South Korea.

The Baltic Panamax Index follows similar routes with slightly smaller vessels (around 70-90,000 deadweight tonnage) and cargo types that are transported over medium distances, such as cotton or grain imports to Europe from India or Brazil.

Finally, the Baltic Supramax Index relates to shorter haul transportations by vessels of about 50,000 deadweight tonnage for lighter cargo, such as grains or cement from countries like Turkey to Mediterranean ports.

Where is the Baltic Dry Index right now?

The BDI was established in 1985 and its all-time high was 11,793 in May 2008. In 2020 it hit an all-time low of 299 due to the impacts of COVID-19 on global trade.

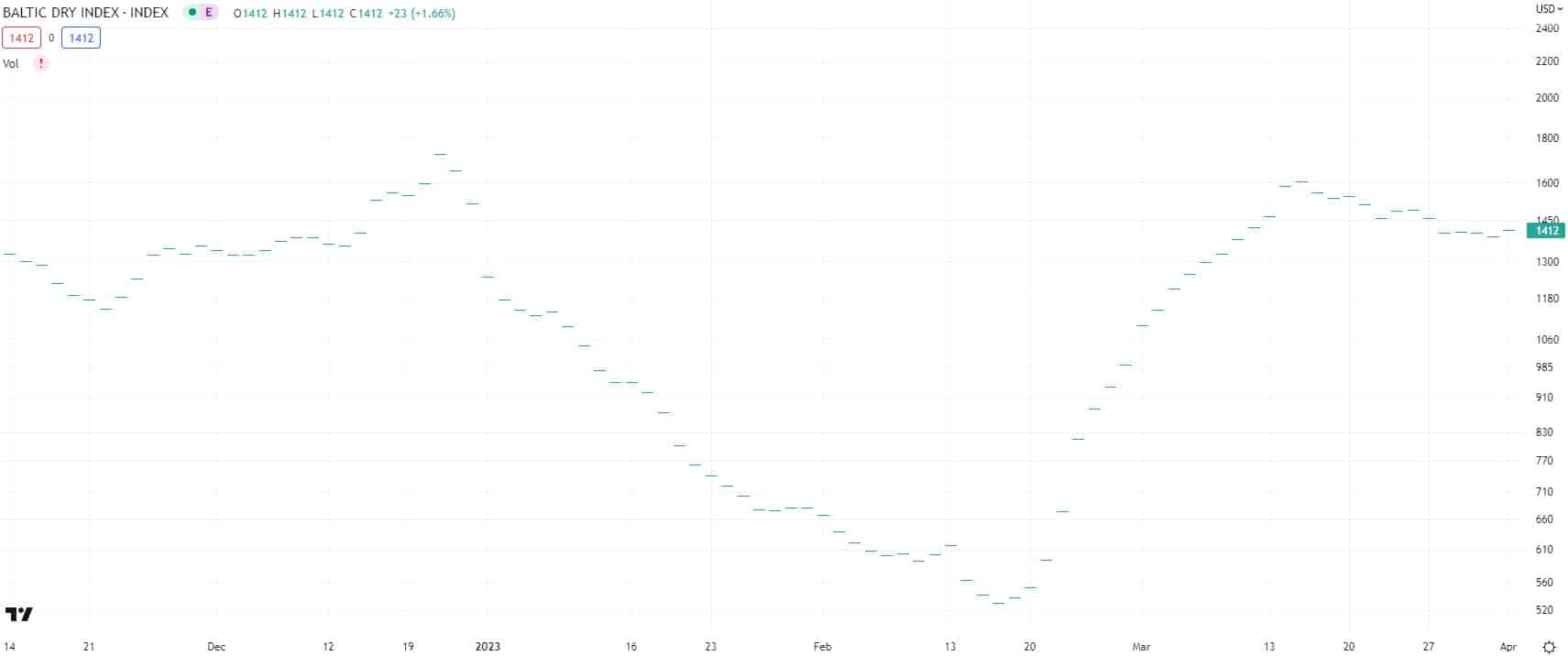

The Baltic Dry Index has been more than 30% down in 2023, largely due to the impacts of COVID-19 on global trade and the resulting disruption to supply chains.

The Baltic Dry Index price chart, log scale (Source: TradingView)

The effects have been long-lasting, with many industries continuing to struggle to recover from the disruptions caused by pandemic. In addition, the effects of climate change and natural disasters, such as hurricanes, have also contributed to a decline in global trade. This has resulted in a decrease in demand for commodities shipped via sea and is reflected in decreased charter rates for vessels used for shipping.

Furthermore, with many countries still grappling with economic uncertainty, there are fewer resources available for shipping companies to upgrade their fleets or expand their operations which further compounds the problem.

All of these factors have collectively contributed to the Baltic Dry Index’s position right now.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…