Recent Articles

Whitehaven Coal (ASX:WHC) Surges After Triple Credit Rating Win- Buy, Hold, or Wait for a Better Entry?

Whitehaven Coal (ASX: WHC) climbed…

Collins Foods (ASX:CKF) Surges 11% on Germany Expansion: Time to Buy

Collins Foods is growing in…

Liontown (ASX: LTR) Falls on H1 Loss Despite Production Breakthrough- Is Now the Time to Buy?

Liontown’s production is improving, but…

Atlassian Cuts 1,600 Jobs for AI – What It Means for ASX Tech Stocks in 2026

ASX tech stocks face fresh…

Locksley Resources (ASX:LKY) From Ore to 99.5% Antimony, Proof Beats Promises

Locksley 99.5% Purity, The Antimony…

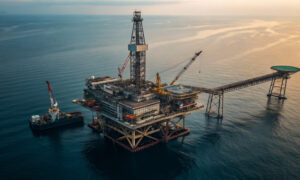

Oil Jumps Again as Tankers Burn Near Hormuz

14 Ships Hit, Oil Spikes,…

IperionX (ASX:IPX) Losses Hit US$34m, The Onshoring Bet Gets Pricier

Admin Costs Up 5x, Now…

ASX Gambling Shares Set to Benefit from New Zealand Casino Reform

While the broader gambling conversation…

Oil Crashes From US$119 to US$91 in 48 Hours: Should You Sell Woodside and Santos Now?

Oil just delivered one of…

Ora Banda Mining (ASX: OBM) Surges 21% After Round Dam Grows 964% to 1.33Moz – Is OBM a Buy?

Ora Banda Surges as Round…

Macquarie Technology (ASX:MAQ) Secures A$200M Government Backing – Is This the Buy Signal?

Macquarie Technology Wins A$200M Government…

GQG Partners (ASX: GQG) Drops 5.5% Despite FUM Hitting US$172.9bn – Is This a Buying Opportunity?

GQG Partners Share Price Falls…

Oil Shock Puts Two RBA Hikes Back on the Table

Why Rate Hike Bets Just…

Lynas (ASX:LYC) Japan Just Put a US $550m Floor Under the Story

A 12 Year Price Floor…

Crude’s Biggest Drop in Four Years, One Tweet, One Signal, One Chokepoint

Crude Crashes as the War…

Oracle (NYSE:ORCL) $553B Backlog, $48B Capex, Now We Find Out

The Biggest AI Infrastructure Bet…

Analysts Encourage Investment In British Gambling Stocks Despite Tax Rises

Investment analysts are urging investors…

How Regulated ASX Utilities Keep Dividends Flowing Amid Rate Rises

Regulated utilities on the ASX…

Find Us in

Stocks Down Under Analysts delve into a large variety of ASX-listed stocks and sectors.

Sector Analysis

The Best Mining Stocks

Mining and resources stocks have substantial potential given demand for all types of resources and metals from gold and iron ore to battery metals like lithium and graphite! There are over 700 stocks in this sector from big miners to small cap explorers.

The Best Tech Stocks

Tech stocks are appetising in the context of an increasingly digital world ranging from data centre builders, cloud services providers and cybersecurity companies. Many of the ASX's best performing stocks in the last decade have been tech stocks.

The Best Uranium Stocks

Uranium stocks are in a good spot right now with rising demand for clean energy, nuclear energy making a comeback and yellowcake pricing reaching levels not seen since the GFC. This has enabled many companies with mothballed projects to bring them out of hibernation.

The Best Healthcare Stocks

There are dozens of Healthcare stocks on the ASX ranging from big names like CSL and Cochlear with established products and markets, to small cap biotechs and medtechs hoping to follow in their footsteps and commercialise the next big innovation.

The Best Mining Stocks

The Best Tech Stocks

The Best Uranium Stocks

Share Type Analysis

The Best ASX Stocks Right Now

The quest for the best stocks to buy now is a never-ending one, but armed with a solid investment strategy, you can create a diversified portfolio that stands the test of time. We provide our Top 10 ASX stocks we think investors should consider right now.

The Best ASX Stocks Right Now

The Top Penny Stocks

Navigating ASX Penny stocks, can be complex, given the diversity of companies operating in various sectors and the high risk associated with them. But there is potential for impressive returns if investors can find the right company.

The Top Penny Stocks

The Top Dividend Stocks

Investing in Dividend stocks can provide an additional source of income, and so are popular with a wide variety of investors. But only some companies pay dividends, and even consistent payers can fluctuate payouts year to year. We outline the Top Dividend Stocks for investors to consider.

The Top Dividend Stocks

Top ASX Index Funds

Explore our comprehensive analysis of the top ASX index funds, carefully curated by industry experts. Discover which funds are currently outperforming and why, based on detailed market trends and performance metrics. Ideal for both new and seasoned investors seeking strategic investment opportunities on the ASX. Dive into our report today to make informed investment decisions.

Top ASX Index Funds

The Top Blue Chip Stocks

Discover the best ASX blue chip stocks for investment. Our industry experts provide in-depth analysis on these well-established companies with strong credit ratings and a long history of performance and stability. Explore market leaders like Commonwealth Bank of Australia, BHP Group Ltd, and National Australia Bank Limited.

The Top Blue Chip Stocks

Top ASX Growth Stocks for Investing

Explore our comprehensive analysis of the top ASX growth stocks for investing. Our industry experts have curated a detailed report on the most promising opportunities available in the market. Whether you're a seasoned investor or just starting out, our insights provide valuable information to help you make informed decisions.

Top ASX Growth Stocks for Investing

Webinars and Interviews

Upside Gold (CSE:UG) has a sizable 3.3m oz gold resource to get excited about

Upside Gold (CSE:UG) We talked with Sophie Cesar, CEO of Upside Gold (CSE:UG), about the large…

Australis Oil and Gas (ASX:ATS) to develop the Tuscaloosa Marine Shale

Australis Oil and Gas (ASX: ATS) We spoke with Ian Lusted, Managing Director of Australis Oil…

BCAL Diagnostics (ASX: BDX): Interview with Executive Chair Jayne Shaw

BCAL Diagnostics (ASX: BDX) We spoke to Jayne Shaw, Executive Chair of BCAL Diagnostics (ASX: BDX)…

Dimerix (ASX:DXB) is waiting for FDA feedback on its pivotal ACTION-3 study!

Dimerix (ASX:DXB) We spoke to Dr Nina Webster, CEO of Dimerix (ASX:DXB), about the next steps…

Investment Glossary

What Is a Small Cap Company? A Complete Guide for Investors

Overview of Small Cap Companies…

What is the All Ordinaries Index and How Does It Work?

The All Ordinaries Index, also…

What is Commodity? Understanding Commodity Trading

Introduction to Commodities Commodities are…

Overview of Securities in the Australian Financial Market

What is a security? Security refers…

What Is an IPO? Understanding Initial Public Offerings

What is IPO? An Initial Public…

The Team Behind Stocks Down Under

Stuart Roberts

Co-Founder

Stuart Roberts is the co-founder of Stocks Down Under. Previously, Stuart covered the healthcare and biotechnology sectors at NDF Research and at stockbroking firms Southern Cross Equities, Bell Potter and Baillieu Holst from 2002 to 2015, where he developed a reputation for detailed analysis on previously uncovered Life Science companies. In 2018, he co-founded Pitt Street Research

Marc Kennis

Co-Founder

Marc is the co-founder of Stocks Down Under and has 25+ years experience analyzing companies in a range of sectors, including Food & Beverage, Industrials, Technology, Medical Equipment, Telecom and Media. Prior to moving to Australia in 2014, he worked for a number of brokers and banks in The Netherlands, including ING and Rabobank. In 2018, Marc co-founded Pitt Street Research,

The Team Behind Stocks Down Under

STUART ROBERTS

STUART ROBERTSStuart Roberts is the co-founder of Stocks Down Under. Previously, Stuart covered the healthcare and biotechnology sectors at NDF Research and at stockbroking firms Southern Cross Equities, Bell Potter and Baillieu Holst from 2002 to 2015, where he developed a reputation for detailed analysis on previously uncovered Life Science companies. In 2018, he co-founded Pitt Street Research together with Marc.

MARC KENNIS

MARC KENNISMarc is the co-founder of Stocks Down Under and has 20+ years experience analyzing companies in a range of sectors, including Food & Beverage, Industrials, Technology, Medical Equipment, Telecom and Media. Prior to moving to Australia in 2014, he worked for a number of brokers and banks in The Netherlands, including ING and Rabobank. In 2018, Marc co-founded Pitt Street Research, Australia's preeminent issuer-sponsored equities research firm.

PETER KILBY

PETER KILBYPete is Stocks Down Under's head of customer service. He is an avid investor with a knack for deep-dive company research. Pete likes the more established companies on ASX, but doesn't shy away from the occasional risky play. At Stocks Down Under he gets to do the two things he loves most, investing and talking to like-minded people.

Get in touch

contact@stocksdownunder.com

Follow us on