Here are 2 great ASX Electric Vehicle Stocks to Buy Now!

![]() Nick Sundich, April 17, 2024

Nick Sundich, April 17, 2024

The question of which ASX Electric Vehicle Stocks to Buy Now may not appear to be one worth asking at first glance. This is because there are no pureplay Electric Vehicle makers listed on the ASX. Investors wanting exposure to them will have to invest in overseas stock exchanges. There are also dozens of lithium stocks that provide indirect exposure, although the lithium sector is probably worth avoiding until prices recover.

But investors may not know that there are a couple of companies that provide even better indirect exposure, just without the volatility that comes with both battery metal explorers and miners, and even EV manufacturers. We are talking about energy infrastructure providers, including (but not limited to) infrastructure that will power electric vehicles.

2 ASX Electric Vehicle Stocks to Buy Now!

1. GenusPlus Group (ASX:GNP)

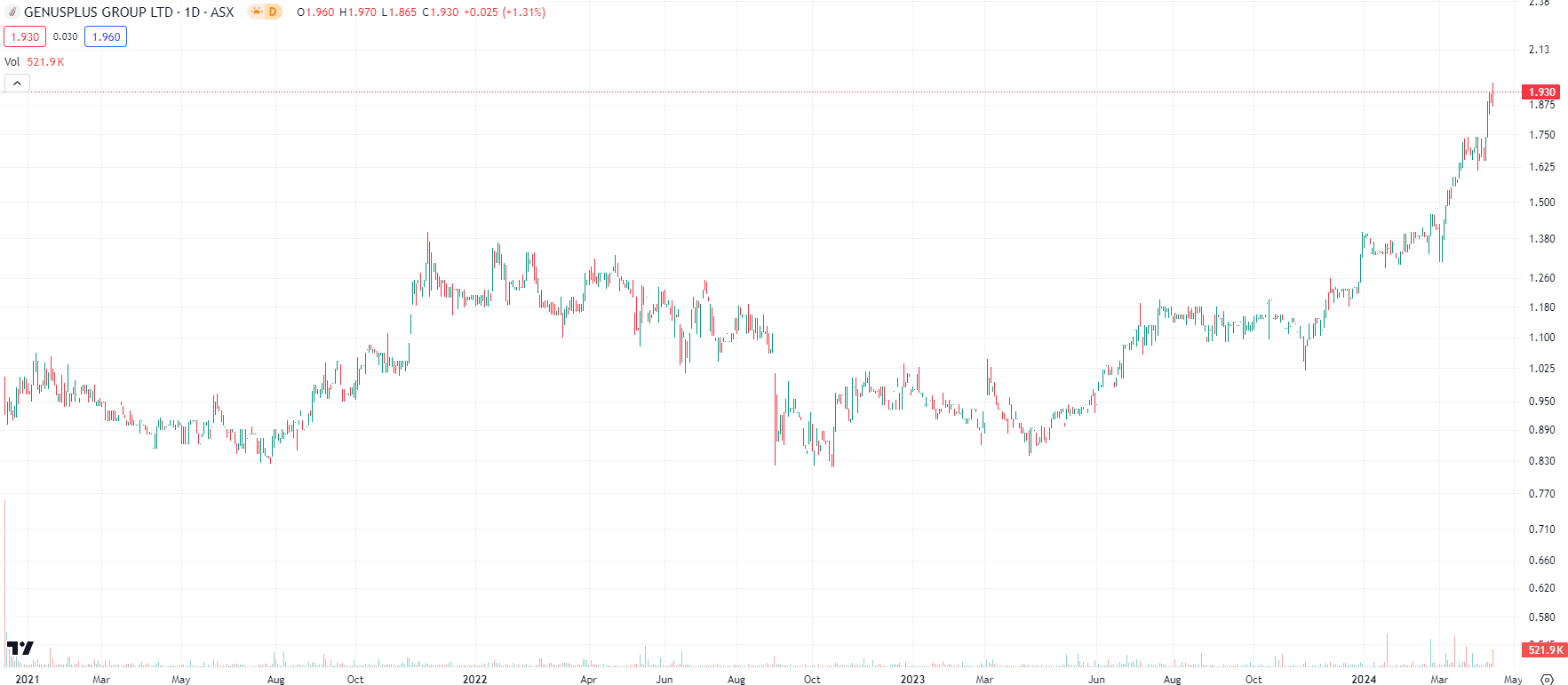

Genusplus Group is a company that builds and maintains powerline infrastructure, sub-stations and transmission towers. It listed in November 2020 at a $150m valuation, a figure that has more than doubled in the last three and a half years.

GenusPlus (ASX:GNP) share price chart, log scale (Source: TradingView)

One of just a few

At the time, it boasted being one of three companies that could build transmission powerlines and sub-stations – Downer and UGL are the two others. It is majority owned by founder David Riches and made ~$450m in revenue and a ~$13.5m profit in each of the last two financial years.

Australia’s transmission infrastructure needs substantial upgrading, not just for EVs, but decarbonisation technologies more generally. The Albanese government has unveiled a $20bn Rewiring the Nation Plan which plans to upgrade transmission capacity to handle the additional energy required. It has been estimated that 47GW of replacement dispatchable capacity from battery and hydro storage will be needed to ensure coal can be phased out by 2050. This is more than double the coal-fired generation capacity today – at 23GW.

GenusPlus will benefit directly

There are other initiatives at the state level too. Queensland has unveiled the SuperGrid Infrastructure Blueprint that will provide for $62bn of industry wide capital investment in the energy system over the next 15 years, involving both the State Government and the private sector.

But will GenusPlus directly benefit from it? Yes, and the company already is. Recent contract wins include Transgrid’s Humelink East Project, near Wagga Wagga in NSW, Melbourne’s Renewable Energy Hub (MREH) and the Kwinana Battery Hub in WA.

2. IPD Group (ASX:IPG)

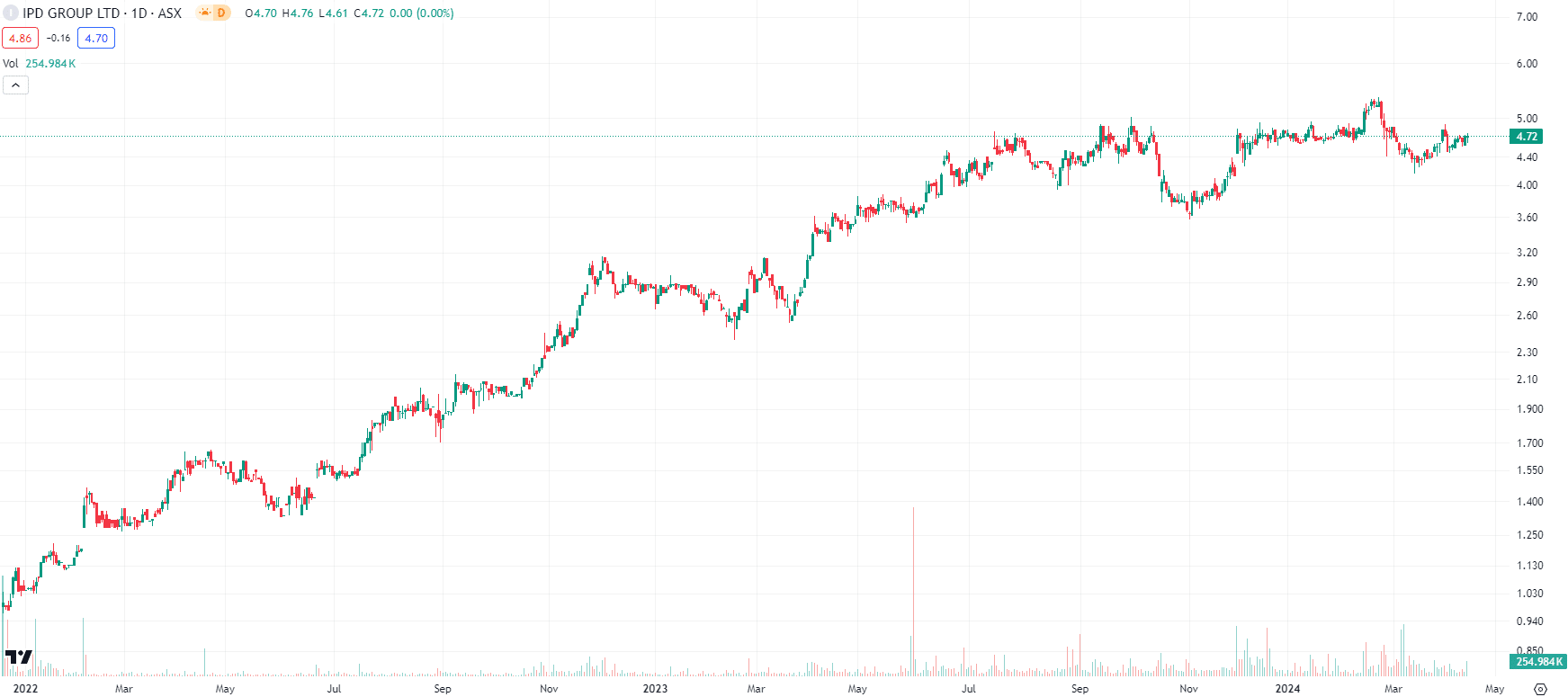

IPD Group (ASX:IPG) is another company that listed during the pandemic, but has never looked back. In other words, while so many companies that listed in 2020-21 turned out to be duds, this company has turned out to be a gem.

IPD Group (ASX:IPD) share price chart, log scale (Source: TradingView)

It too provides power infrastructure solutions and services. Unlike GenusPlus, its product suite specifically includes solutions for EVs like electric vehicle chargers. Others include metering services, power supplies, load management and distribution boards. The company generated $227m in revenue and a $16m profit in FY23, up 28% and 45% from the year before. It followed this up in 1HY24 with $121m in revenue (up 9%) and a $10m NPAT (up 23%).

Direct exposure to EV growth

Aiding the company in its cause isn’t just the need to upgrade power infrastructure generally, but to have necessary chargers for EVs on highways and even to have new strata apartments to be ready for EV charging – a new requirement of the National Construction Code.

A crucial move for the company was acquiring Gemtek and Addelec, which were separate businesses but are being merged. This new subsidiary will be a uniquely positioned full-service EV infrastructure provider. The company recently told investors that 20x more chargers would be needed by 2030 and this would be a $1bn opportunity for IPD, out of a forecasted total investment of $18-20bn.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…