Paradigm Biopharmaceuticals (ASX:PAR): An osteoarthritis solution that could hit the market within 3 years

If you thought the were plenty of treatments for osteoarthritis already, Paradigm Biopharmaceuticals (ASX:PAR) is a company that has something to say about that.

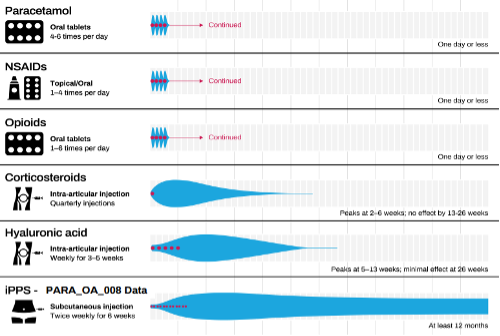

You see, any ‘treatments’ that exist are only about addressing the pain or other symptoms rather than being a cure or remission. These treatments tend to need frequent administration or lose effectiveness over time. This is particularly true with opioid medications, an increasingly popular resort for patients. But in Zilosul, Paradigm just might have an answer to these problems.

Paradigm Biopharmaceuticals and Zilosul

Zilosul is Paradigm’s formulation of PPS (pentosan polysulfate sodium). PPS is a heterogeneous semi-synthetic drug manufactured from European beech-wood hemicelluloses (in other words, from the bark of beech trees) by sulphate esterification. Zilosul has conventionally been used for blood clots, but Paradigm is repurposing the drug. PPS works against osteoarthritis by blocking or inhibiting cartilage-degrading enzymes.

Paradigm completed a Phase II trial in 2023, and this was a success. Not only was there a reduction in pain, but it was sustained over time (ie. for 12 months instead of 3-6 months). Moreover, Zilosul didn’t only reduce pain, but it resulted in an improvement in the cartilage thickness and volume. Zilosul is not just another form of short-term pain relief, or even longer-term pain relief (although of course it does relieve pain), but it regenerates joint tissues in a way that existing treatments do not.

Source: Company

Now in Phase 3

Paradigm has now entered a Phase 3 trial – PARA_OA_002. The company was given regulatory approvals to conduct the study in the USA, Australia, the UK and Canada in the first half of 2022.

PARA_OA_002 was planned with two stages, first a dose selection for the next step of PARA_OA_002. This stage is now complete and the company opted for 2mg/kg twice weekly. In the second stage, dosage will be administered, as determined in the first stage.

Judging by the share price performance of the company, some investors were concerned about the drug’s efficacy and that the clinical and regulatory processes may take more time because the protocol would need to be amended. However, the company will not need to perform additional toxicity or efficacy study because there is existing data on this dosage. And most importantly, the objective of determining the lowest efficacious dose was reached.

The Second Stage of PARA_OA_002 will see administration of that dosage with 235 patients receiving the chosen regimen and 235 receiving placebo. The primary endpoint in the trial is the change from baseline at Day 56 in the standardised WOMAC pain questionnaire. Secondary outcomes will include change from baseline at multiple time points out to day 168 in WOMAC, as well as Patient Global Impression of Change (PGIC) and Quality of Life (QoL) assessments. It is likely that the number of patients enrolled will be around 600, including patients in the first Stage.

So, what’s next?

PARA_OA_012 expects first results toward the end of CY25 (subject to the recruitment rate), given it will be initially testing at the 56-day mark. The company plans to submit to the FDA following the conclusion of the pivotal and confirmatory trial completion in CY26. Thereafter, the FDA could take up to 9 months to give an answer, and so we could see approval in CY27.

In our view, it is plausible that regulatory approval in Australia could be achieved ahead of the US. PAR has made a TGA provisional approval determination application, including outcomes from the PARA_OA_008 trial and a manuscript providing a comparison of PPS clinical data with other available treatments for osteoarthritis.

We also see potential for a licensing deal prior to commercialisation. Recent transactions show that such a licensing deal could be in the hundreds of millions of dollars, even if it was just for one or two jurisdictions. Merck sold the rights of its drug M6495 to Novartis for €50m upfront, with a further €400m based on development and commercial milestones as well as royalties on future net sales of the drug – even though the drug was only at Phase 1. Grunenthal licensed its osteoarthritis stem cell medicine Resiniferatoxin (RTX) to Shionogi. The deal was for a total consideration of up to US$525m despite only including one country – Japan. Crucially, however, this drug was in Phase III at the time.

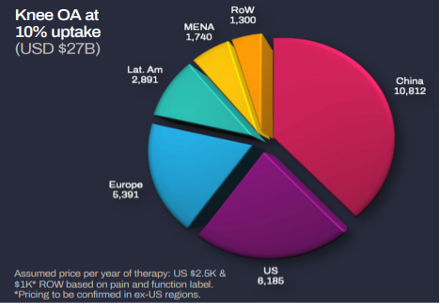

A US$27bn global opportunity

The two key markets are the USA and Australia. These jurisdictions are by no means the only opportunities but are all but certain to be the first two given these are where the company has applied for regulatory approval. There are varying estimates for how to value the total market and Paradigm has derived its own. It has estimated its opportunity as US$27bn, of which US$6.2bn is in the US and US$10.8bn is in China. You can see that even if the company only captures a small share of each market, it could be highly lucrative.

Source: Company

Beyond being a major market opportunity, Zilosul could represent a solution to a public health crisis – with opioid medications, a common resort of osteoarthritis sufferers, running rampant in the USA. Opioid drugs are used because they can provide quick relief, but need to be taken frequently to maintain the impact, which is why people get addicted to them.

Pitt Street Research just released a report on Paradigm

Our friends at Pitt Street Research has just published a report on Paradigm Biopharmaceuticals. Pitt Street valued Paradigm at $227.9m in a base case and $318.2m in a bull case. These equate to A$0.76 per share in the base case and A$1.06 per share in the bull case, based on 299.8m shares outstanding. We encourage our readers to check out the report for more information on the company.

Conclusion

Paradigm is a lucrative opportunity simply by being one of the few ASX biotech stocks in Phase 3. But it has an opportunity in the osteoarthritis market, which is a big in its size and in hunger for legitimate solutions that are not just short-term relief but longer-term reduction in pain and damage.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…