Axel REE (ASX: AXL) gets ready for the big time

The equity market hasn’t been kind to Axel REE (ASX: AXL), which has three high quality rare earths projects in Brazil. The company did its IPO on ASX in late July after raising $13.3m at 20 cents per share. It ended its first day of trading on 23 July at a mere 12.5 cents, such was the bearish market conditions at the time. And things remain bleak. Right now, this company has cash backing of 8 cents per share and the share price has dropped to below 9c late September 2024!

Axel REE has plenty of upside from here

We see potential for better days ahead. For one thing, the market for small caps of every stripe has been terrible lately. More importantly, rare earths come in and out of favour depending on the price of the product coming out of China. Lately they’ve been down but a recent rally is likely to spark up some interest.

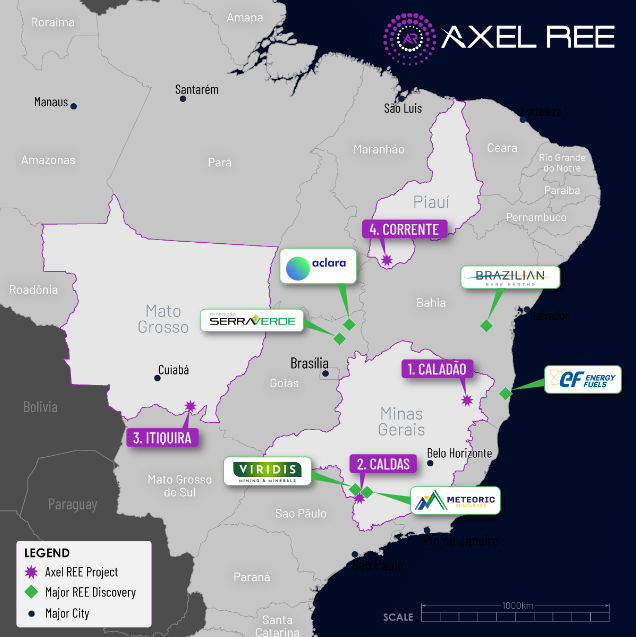

Axel REE went public in part to benefit from the interest in Brazilian rare earths that followed the April 2023 acquisition by Meteoric Resources (ASX: MEI) of its amazing Caldeira project in southern Minas Gerais state. Caldeira is a large, very high grade rare earths project, and Axel REE’s Caldas Project is right next door, as is Viridis Mining and Minerals (ASX: VMM) with its Colossus Project.

Source: Company

There’s a lot to like about Meteoric’s flagship project. For one thing, it’s big. Under Meteoric’s stewardship, Caldeira has grown to a JORC resource of 740 million tonnes at a massive 2,572 ppm Total Rare Earth Oxides (TREO) where the mineralisation starts at surface. For another, it’s an ionic clay-hosted project with the orebody close to surface, so that’s it’s likely to be inexpensive to mine and process. And it comes with both the light rare earths like praseodymium and neodymium as well as the really valuable heavy rare earths like dysprosium and terbium. Meteoric recently published a Scoping Study on Caldeira that gave the project a pre-tax NPV of US$1,235m using an 8% discount rate and after US$403m in capital costs.

Axel REE believes the Poços de Caldas Alkaline Intrusive Complex that yielded Caldeira can also yield a decent deposit in the 232 sq km it holds in its Caldas Project. So far, it’s only done some trenching and mapping work, but it now knows where all the good kaolinite-rich clay zones to look at and auger drilling is underway. However, the reason to look at Axel REE right now isn’t Caldas, but a project called Caladao further to the north in Minas Gerais.

Caladao

Caladao is in Brazil’s ‘Lithium Valley’, the Vale do Jequitinhonha, where Sigma Lithium hit the big time a few years back with a monster lithium discovery called Grota do Cirilo. And where that Canadian company intends to build the world’s 4th largest operating industrial pre-chemical lithium beneficiation complex. Axel REE with its 400 sq km represents the first district-scale rare earths discovery in the Valley, only 30 km or so from Grota do Cirilo. Axel REE’s geologists have identified about 25 km of strike where rare earths and showing up in clays and where auger drilling has come up with intercepts up to 2m at 7,612 ppm TREO. Everything that’s been drilled so far has ended in mineralisation, but the interpreted high grade orebody has yet to be found. The company has budgeted for 20,000 metres of drillholes to find out how big this one can be. 2,600 of diamond drilling commenced earlier this month and there’ll be three auger drill rigs following the diamond drill rig around, so this programme is likely to yield plenty of interesting hits.

Itiquira

Then’s there Itiquira, in Mato Gross state, far to the west of Caladao and Caldos. The reason Axel REE likes Itiquira is the geological setting. Often interesting mineral deposits show up at points where two continent-scale lineal structures meet. Axel REE’s geologists took two such structures, one called the ‘Transbraziliano Lineament’ and another called the ‘125 AZ Lineament’ and decided that the point where they cross, roughly midway between the Brazilian Federal capital of Brasilia and the Mato Gross capital of Cuiaba, was going to be great for mantle-derived alkaline intrusions of the kind that could host rare earths, phosphates and, potentially, that valuable critical metal called niobium. They’ve identified a 20 km diameter circular magnetic anomaly that similar to the kind of alkaline-carbonatite complexes known to be associated with rare earths. We’ll be very interested to see what happens when the drill bits start to probe that anomaly but that might be a while away yet. Right now, mapping, soil sampling and scout auger drilling is just getting started.

Rare earth prices fell off a cliff, but are recovering

Rare earths prices seem to be stabilising right now, which can be good for sentiment towards explorers like Axel REE. Back in early 2022 neodymium, for example, was trading in Shanghai at 1.51 million yuan a tonne. By March 2024 it was down about 70% to 440,000 yuan a tonne. Some people think the Chinese government has engineered a general fall in the price of rare earths in order to put the squeeze on current or future non-Chinese producers. The downside of that is that prices a few months ago were at levels no rare-earths operation could be profitable. The recent rally reflects the Chinese effort to raise the price.

The right jurisdiction

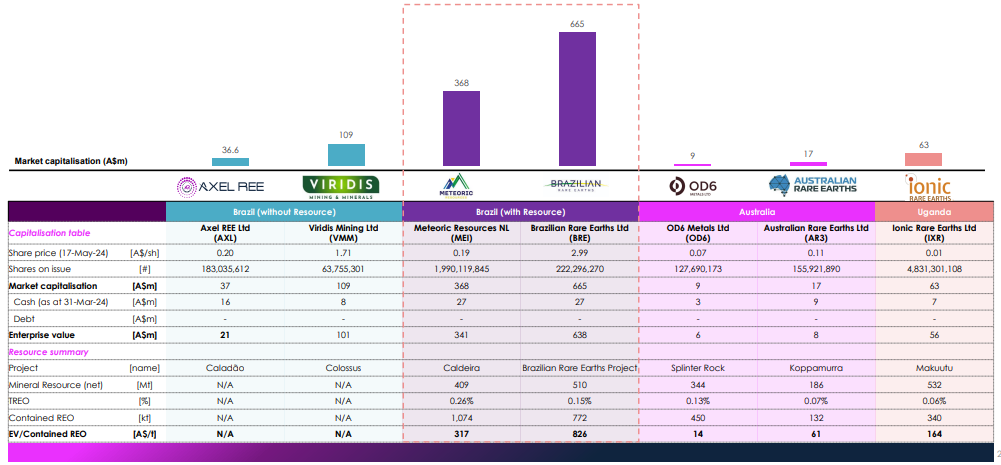

The other thing working in Axel’s REE’s favour is that it is in Brazil. The world is crying out for new sources of rare earths that aren’t controlled by China, and it wants to find those rare earths in easy-to-process ionic clays like those to be found in abundance in Brazil. Throw in the fact that Brazil is a mining-friendly country where mining costs are going to be low, and that makes the country a very attractive destination. Indeed, this is reflected in the fact that rare earths stocks with projects in Brazil trade at a premium.

Source: Company

The trouble for Axel REE is getting air time with investors in a space where there is already Meteoric and Viridis, the Gina Rinehart-backed Brazilian Rare Earths (ASX: BRE), Resouro Strategic Metals (ASX: RAU), and others. That said, we think that if the 20,000 metres planned for Caladao yields the sort of intersections the auger work has suggested, Axel REE can re-rate smartly.

Check it out.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

WiseTech Global (ASX:WTC) CEO Buys $1m of Shares, Here’s What It Signals

WiseTech $1m Insider Buy, The Synergy Curve Is the Thesis WiseTech Global (ASX: WTC) has just given investors a simple…

Block (ASX:XYZ) Up 28% as a 40% Headcount Cut Rewrites the Earnings Outlook

Jack Dorsey Goes Lean, The Market Pays Up Block shares surged 28% following the announcement that the company intends to…

AML3D (ASX:AL3): Order Book at $16.5m, The Growth Runway Stays Intact

A $150m to $200m Navy Opportunity, But Execution Comes First AML3D has reported its interim half-year results, and while revenue…