Has Whitehaven just sent a shiver down the spines of coal investors?

![]() Nick Sundich, April 12, 2023

Nick Sundich, April 12, 2023

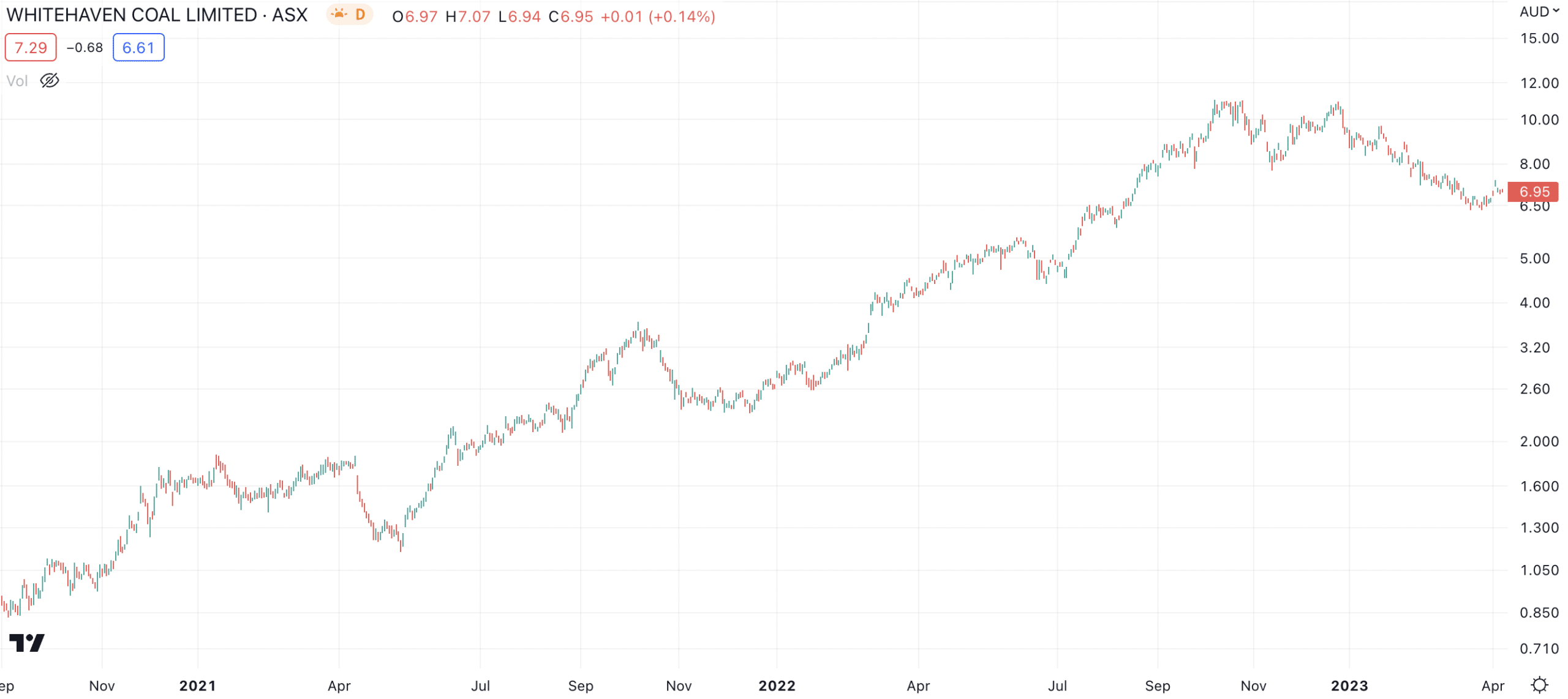

Whitehaven Coal (ASX:WHC) is one of several ASX coal stocks that have enjoyed a stellar run in the past couple of years. The company’s shares are up over 700% since September 2020. The key catalyst has been surging coal prices, driven by energy shortages resulting from the Russia-Ukraine war, consequently boosting the profits of coal companies, such as Whitehaven.

It also has helped that coal stocks have hardly put a foot wrong – until now.

Whitehaven Coal (ASX:WHC) share price chart, log scale (Source: TradingView)

Whitehaven updates its guidance

9 days ahead of its quarterly production report, Whitehaven updated its guidance for FY23. It warned labour shortages and other operational constraints were impacting production. Although the company expectes things to improve in the June quarter, some sales volumes would be pushed into FY24.

As a consequence, Whitehaven is expecting 18-19.2Mt production, down from 19.0-20.4Mt before. It is expecting to sell 15.3-16Mt, down from 16.5-18Mt previously. The unit cost of coal (excluding royalties) would be $100$107/t, up from $95-$102/t.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Hardly doomsday, but perhaps the end of the bull run

Whitehaven still told its shareholders that it would be a good quarter. It expects to report a $2.7bn net cash position and $1.2bn in cash from operations. And coal prices remain high, with an averages sales price of ~$400/t.

But this morning’s announcement illustrates that dream runs cannot last forever. The stock was down more than 7% in early morning trading, but has recovered some of the lost ground during the day.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…