Vicinity Centres (ASX:VCX) has finally put its COVID-19 armageddon in the rear view mirror

Nick Sundich, February 16, 2024

Vicinity Centres (ASX:VCX) is one property stock we’ve been keeping our eyes on for several months. Vicinity Centres has some of the most highly coveted, high-lease retail assets in Australia, but is highly reliant on foreign tourists. This led to the business essentially going into limbo for several months. Even as malls have been permitted to re-open post-pandemic, the company’s share price has continued to lag. But with a 13% gain in 12 months, is it the start of a period of growth?

Who is Vicinity Centres?

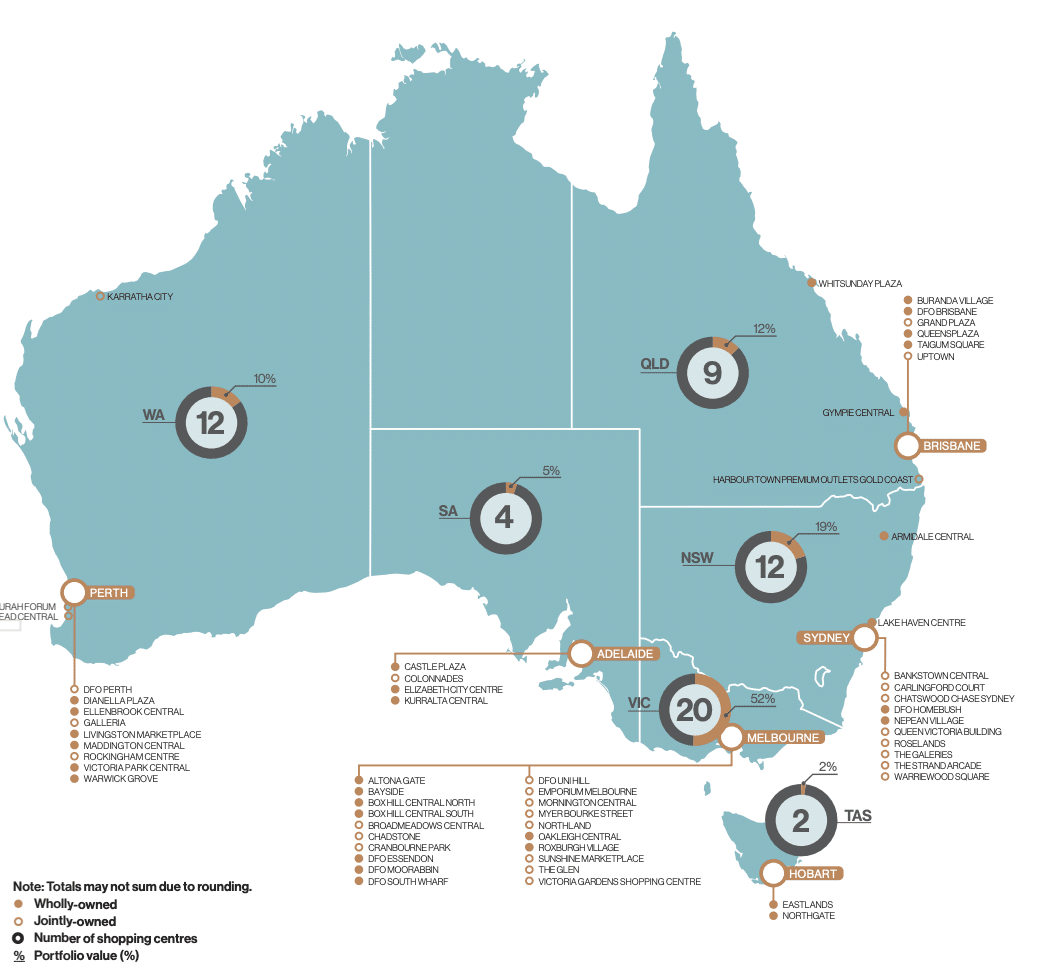

Vicinity Centres is a shopping centre landlord, operating shopping centres and leasing them to tenants. The company was created in 2015 from the merger of Federation Centres and Novion Property Group. It has over 59 shopping centres under management, consisting of ~7,000 individual retailers.

Vicinity’s $14bn portfolio includes several flagship stores, including Chadstone shopping centre in Melbourne, Queens Plaza in Brisbane and Chatswood Chase in Sydney and corporate offices at certain sites.

Source: Company

Vicinity copped a massive hit from the pandemic

COVID-19 forced the shutters down on non-essential retail and sent Vicinity swinging from a $346.1m profit in FY19 to a $1.8bn loss in FY20. Although essential retailers in suburban malls mitigated the damage, its CBD assets were hit by people working from home and the elimination of tourism through border closures. The company undertook a $1.2bn capital raising in the early months of the pandemic and wrote down $1.79bn from its portfolio.

In FY21, Vicinity still made a statutory net loss but only $258.0m. Snap lockdowns impacted store trading and visitor numbers, but visitation numbers quickly returned whenever restrictions were lifted. In every quarter of FY21, visitor numbers at stores excluding Victoria and CBD assets in all states were above 90%, and retail sales were above 2019 levels. Vicinity’s Victorian assets suffered more time in lockdown than any other Australian state and even without lockdowns, CBD flagship stores were impacted by an absence of tourists and office workers.

Nevertheless, by the second half of FY21, retail sales across the entire portfolio were under 4% below pre-COVID levels and visitation numbers at over 75%.

A slow recovery and even slower shareholder response

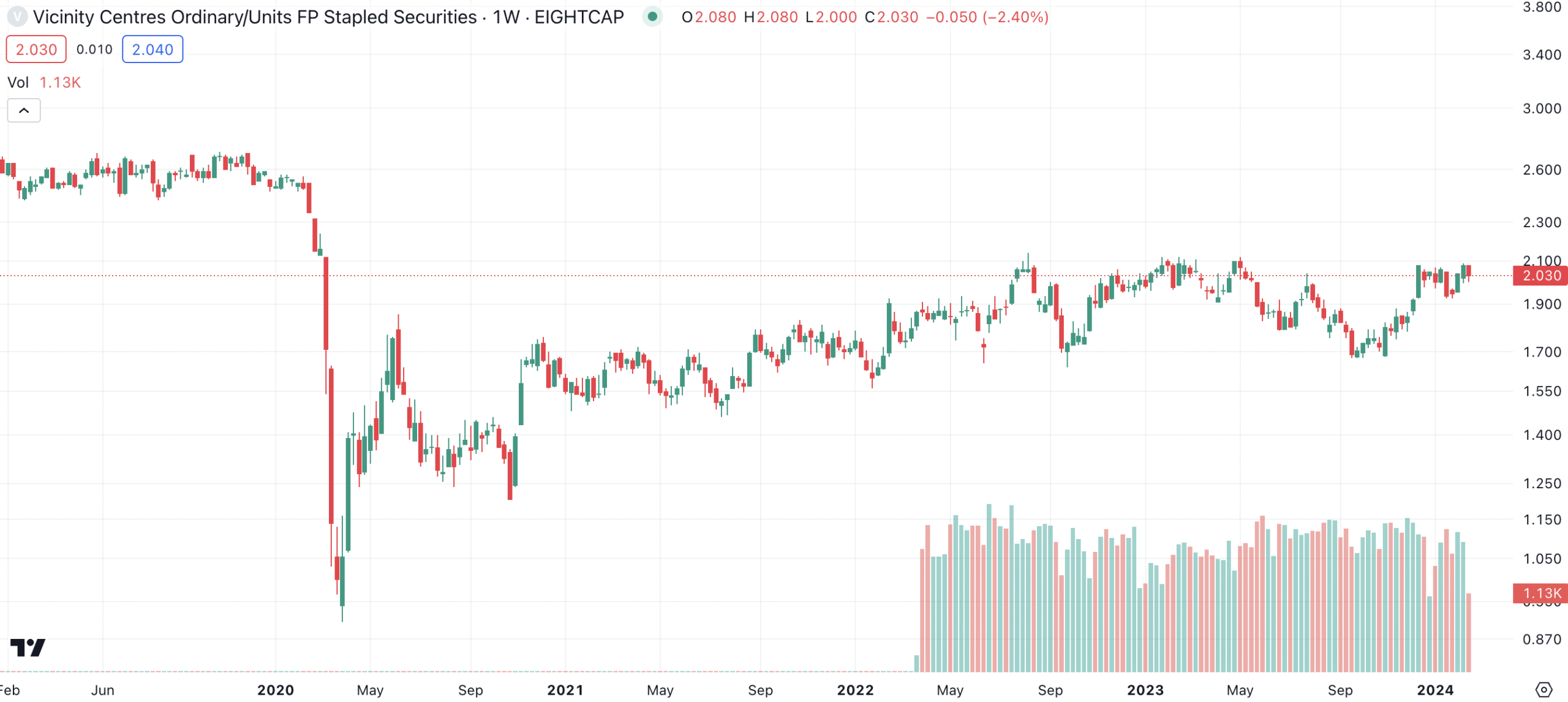

Let’s fast forward to FY22, a period that included the Delta Lockdowns and the Omicron wave but also included the re-opening of Australia’s international borders. The company returned to NPAT profitability, making $1.2bn. Its FFO came in at $598.1m, or 13.1cps, and it paid a distribution of 10.4c, representing a 95.3% payout of Adjusted FFO. So, the only way from here was up, right? Well, yes and no as the share price chart below illustrates. The company remains below its pre-COVID levels.

Vicinity Centres (ASX:VCX) share price chart, log scale (Source: TradingView)

You see, even though shoppers returned to suburban malls, the company’s flagship malls in the CBD that relied on international tourists and office workers were slower to recover. Adding insult to injury was the rapid rise in interest rates that hit property valuations. And so its NPAT in FY23 was was just $271.5m, despite FFO being over $80m higher, at $684.4m (or 15c per share). It paid 12c per share to its investors.

Turning to its 1HY24, released only yesterday, it made an NPAT of $223.5m, up from $176.3m made in the prior corresponding period but not boding well for the hopes of the company’s profit reaching FY22 levels. Its FFO was down 3.2% on a statutory basis at $345.6m, although it is up 2.9% when adjusted for one-off items. The company’s NTA is $2.29 per share and it has told investors to expect FFO of 14.1-14.4c per share, Adjusted FFO to be 11.8-12.2c and to expect a payout of 95-100% of the latter figure. This would be a yield of 5.4-6.0% from best and worst case scenarios here (95% of 11.8c on one hand and 100% of 12.2c on the other).

There is hope now

Clearly, the recovery at Vicinity’s CBD assets will be continue to be slow. This hasn’t stopped the company from paying distributions, so this could be one for dividend investors. We have observed in earlier iterations of this article, investors looking for growth would be better looking elsewhere, in our view, given better growth opportunities elsewhere in the market.

However, given the prospect of interest rate cuts in the next 12 months and for Stage 3 tax cuts from July, we see potential for VCX’s property valuations to increase and spending to increase at its tenants. This could well flow through to the company’s share price and see it return to pre-COVID levels.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Recent Posts

5 ASX Health stocks to add to your porfolio

5 ASX Health Stocks Stuart Roberts from Stocks Down Under discussed the potential promise of biotech, sharing his perspectives about…

BHP wants to buy Anglo American, but what would the potential $60bn deal mean?

In what was meant to be a quiet week on the markets, investors learned yesterday that BHP wants to buy…