Adore Beauty’s COVID-19 boom shows no signs of a triumphant return

Nick Sundich, May 1, 2023

You have to feel sorry for Adore Beauty (ASX:ABY) and its shareholders (at least some of them). Its 3Q23 was more of the same in the post-COVID era for the online beauty retailer, except it had the additional news that the company’s founders were stepping down from the business.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

A good business, but a bad listing

Adore Beauty was founded back in 1999 and listed in the ASX in October 2020.

The company had recorded substantial growth during its existence, but it particularly grew during the pandemic when people were locked down and shopping online.

The bankers who priced the float, the company and investors who backed the company overestimated the loyalty of those COVID customers.

They also priced the float at a ridiculously high price – at 96x of its FY21 EV/EBITDA. In fairness, all but $40m of the $269.5m in proceeds raised went to cash out existing shareholders so

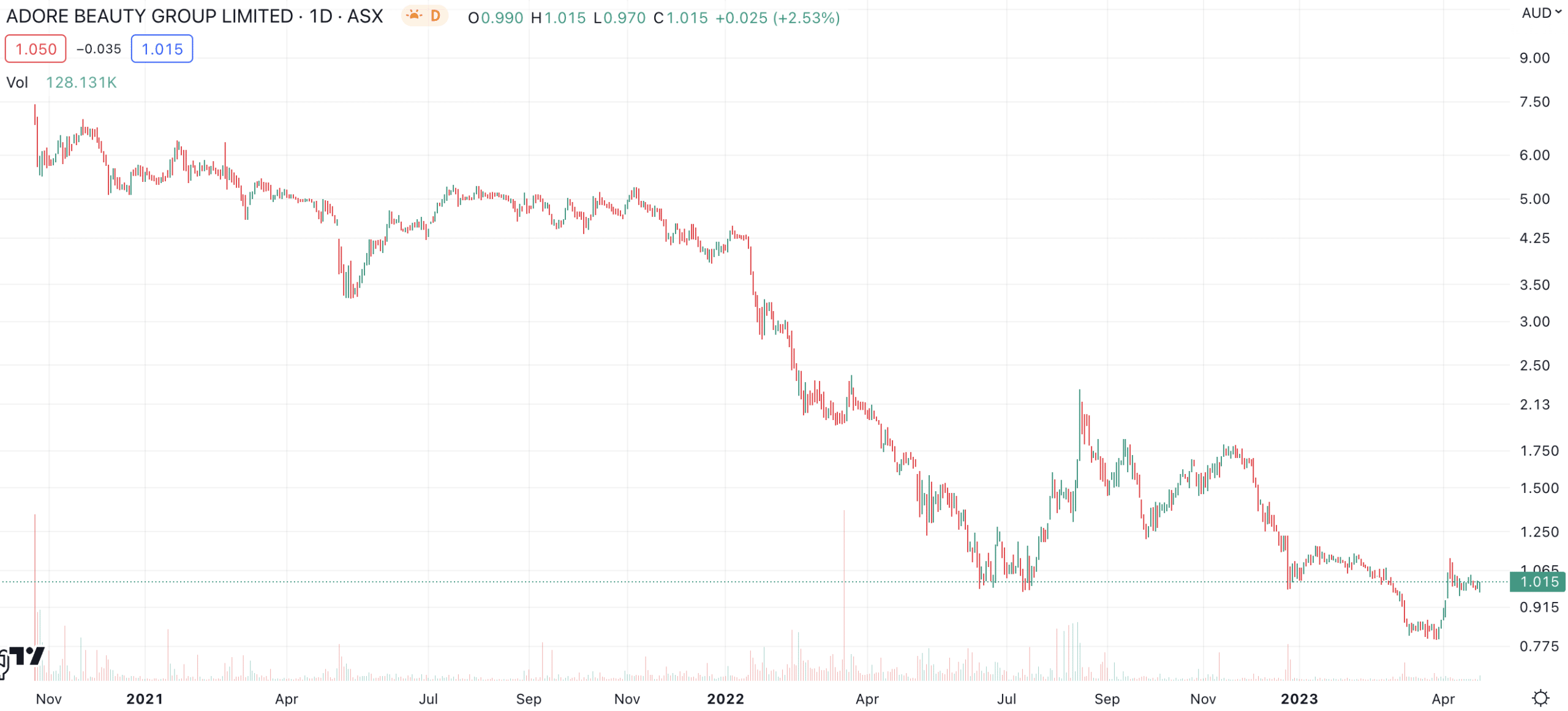

After listing at $6.75, shares are barely over $1 – a decline of nearly 85%.

Adore Beauty (ASX:ABY) share price chart, log scale (Source: TradingView)

3Q23 results more of the same?

Almost all companies will spin their results as better than they are and that’s what Adore Beauty did.

Revenue was $41.3m, down 3.3% in 12 months and up 4.9% in two years. Active customers were 793,000 – down 3% in 2 years and down 10% on the prior corresponding period.

The company also announced that co-founders Kate Morris and James Height would be stepping down as part-time executives.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Recent Posts

Bapcor (ASX:BAP): Its been a horror week with a 3rd profit downgrade in less than a year

This week investors in Bapcor (ASX:BAP) saw a 3rd profit downgrade in less than a year and its CEO-elect walk…

Is there another Asian financial crisis brewing? How would stocks be impacted?

Is there another Asian financial crisis brewing? There is increasing concern there might be as many Asian countries’ currencies struggle…

Why can’t ASX small bank stocks beat the Big 4?

Be disappointed all you like at the performance of some of the Big 4, but ASX small bank stocks have…