Sandfire Resources (ASX:SFR)

SELL Sandfire Resources (ASX:SFR), 23 June 2022

Our investment thesis for Sandfire Resources (ASX:SFR) is not playing out.

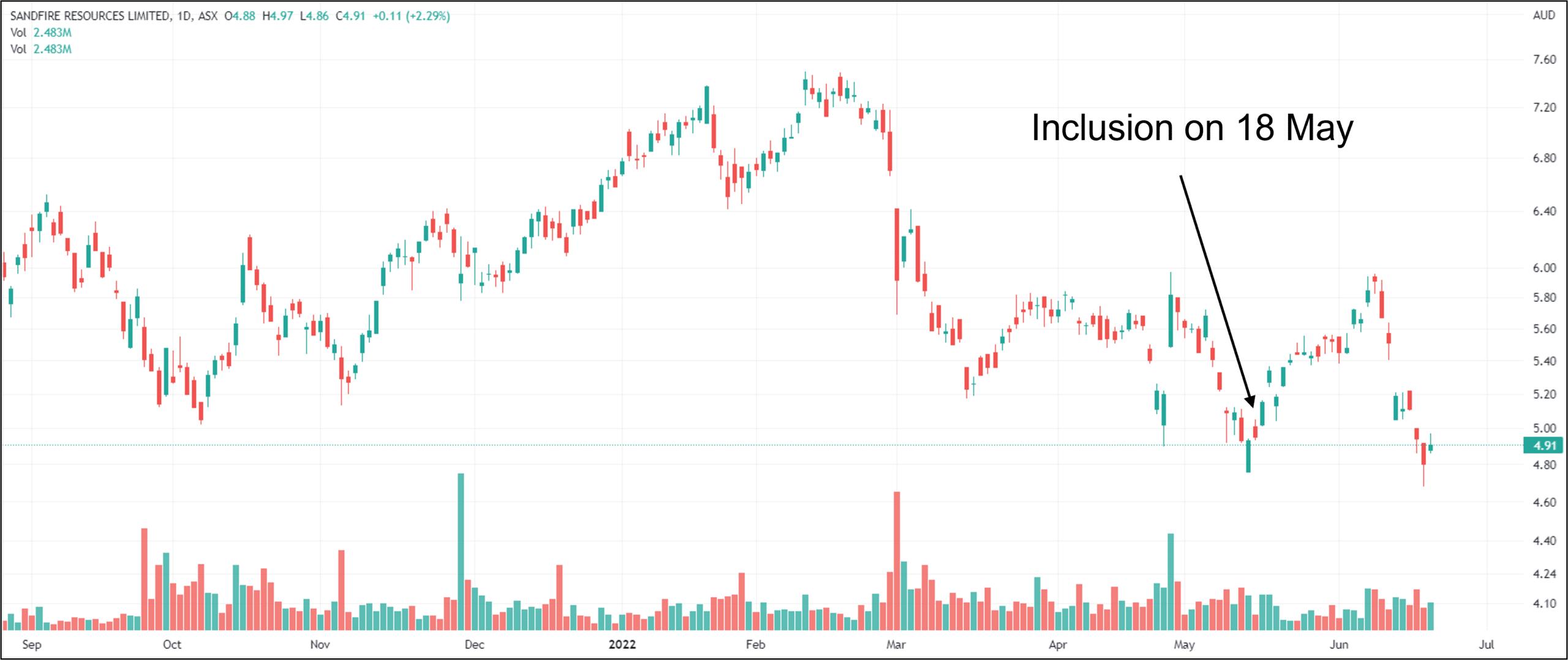

While SFR was initially up 15.7% (to $5.96) after we included it in Concierge at $5.15, the stock has come down in the last two weeks on the back of a very rapidly changing Macro environment.

The upward pressure on the copper price due to the reopening of China has been more than offset by the growing fear of a global recession as central banks are increasing interest rates at a much faster pace than previously expected.

What does this mean for SFR?

We think future demand for copper will be lower than the market had been expecting, which is currently having its effect on the copper price.

Even if the US does not go into recession later this year or early 2023, we believe the global economy will cool off to the point that demand for a number of commodities, including copper, will come down.

SFR stock has been trading around our $4.90 stop loss level in the last few trading days and we don’t see it going back up to $6, let alone higher than that.

From the current level, we see more risk to the downside than to the upside, which is why we are selling SFR at a small loss now, rather than letting it simmer and drift lower over time.

——————————————————————————————————————————————————–

FYI: Our original investment strategy for Sandfire Resources (ASX:SFR) dated 18 May 2022

- The price of copper is temporarily low, in our opinion, because of recent lockdowns in China. Sandfire Resources as a pure-play copper producer should benefit from copper’s expected rebound as China starts to reopen.

- Buy SFR up to a maximum price of $5.50.

- Use a stop loss at $4.90.

- Our target price for SFR is $6.70.

Investment thesis:

- Copper will be a strong commodity in the 2020s because of the rise of the Electric Vehicle at a time when major copper mines are maturing. Conventional cars contain 18-49 pounds of copper, while battery electric vehicles contain 183 pounds.

- We believe that copper can snap back from the 12 May 2022 level of around US$4.11 a pound towards US$4.80, which is the high end of the range that has prevailed since April 2021.

- Sandfire is currently producing at its DeGrussa Copper Mine in Western Australia, but that mine is now in its final year. Replacing it will be the newly-acquired Matsa Copper Mine in Spain. Coming in the June quarter of 2023 is the Motheo Copper Mine in Botswana. Motheo construction is currently on time and on budget.

- Other than hedging some of Matsa’s output for a three-year period, Sandfire’s policy is not to hedge.

- Sandfire will report strong FY22 numbers in August thanks to the high copper prices prevailing during the year. The company is guiding to 92,000-95,000 tonnes of copper and 38,000 tonnes of zinc. Its cash costs will be only US$1.19 per pound of copper.

- On consensus numbers EBITDA is expected to ease back over the next couple of years, but balanced against that is the fact that Sandfire is currently trading on an EV/EBITDA of 4x FY24 consensus.

- We believe a 5-6x multiple such as that given to BHP is more appropriate given that Sandfire is in serious expansion mode. 5x consensus FY24 earnings suggests a valuation of around A$7.00 per share.

- Directors Sally Langer and Jenn Morris have been recent on-market buyers of stock.

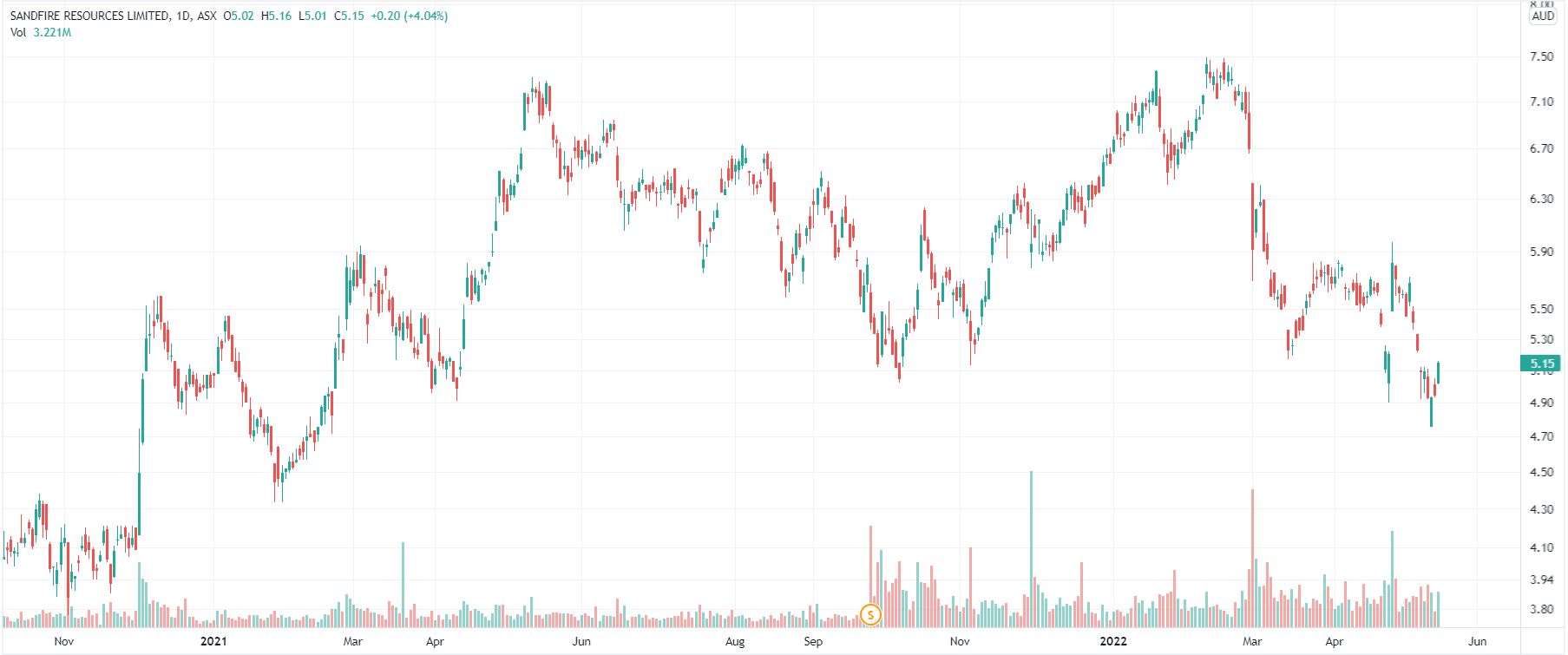

Sandfire Resources share price chart, log scale (Source: Tradingview)

Who is Sandfire?

- Sandfire’s original company-maker was the DeGrussa Copper Mine, 900 km northeast of Perth. This mine was commissioned in 2012 and will end in FY23, having been a solid performer for Sandfire over the last decade.

- In February 2022 Sandfire acquired the producing Matsa Copper mine in Huelva Province of southwestern Spain, at a cost of US$1.9bn. This mine effectively replaces DeGrussa.

- Sandfire made a Final Investment Decision on the Motheo Copper Mine in Botswana in December 2020. The Definitive Feasibility Study for this mine valued it at US$206m post-tax on a 7% discount rate using a copper price of only US$3.16 a pound, where the processing capacity was only 3.2 million tpa. Sandfire is currently evaluating an expansion of Motheo to 5.2 mtpa. The mine is expected to start producing in mid-2023.

- Sandfire maintains an active slate of exploration projects around the world, including the Black Butte Copper Project in the US state of Montana.

Copper is a strong metal

- The high copper price of the last year, or so, has been due to high demand from China, the top copper consumer, combined with low copper inventories.

- Copper demand is projected to rise 16% in the current decade to exceed 25 million tonnes annually, while supply could potentially fall 12% as various large mines, mainly in South America, go past their peak.

- Refined copper is expected to be in deficit in 2022. That could further reduce already low inventories.

- We believe the Chinese lockdowns have temporarily reduced copper demand while not changing the underlying fundamentals. But the city of Shanghai aims to end its current Covid lockdown by June 1, with plans to reopen gradually in the next few weeks.

Share price catalysts

- A re-rating in the price of copper.

- The June quarter production numbers.

- Potential exploration results.

- Completion of the Definitive Feasibility Study for the 5.25 mtpa Motheo expansion.

The risks

- Shortfalls on copper production from DeGrussa.

- Delays in Motheo commissioning.

- High energy prices in Spain and elsewhere.

- Continued lockdowns in China reducing copper demand.

- Declining copper prices.