Beach Energy (ASX:BPT)

Our investment strategy for Beach Energy (ASX:BPT)

- Buy BPT up to $1.80 per share.

- Our price target is $2.30 and we potentially see upside to the previous high around $2.90, depending on how the company fares late in 2022 and into 2023.

- Use a stop loss at $1.53.

Investment thesis

- We believe Beach Energy stock is heavily undervalued because of the 2021 revision of reserves in the so-called ‘Western Flank’ of the Cooper Basin. Currently, the stock is trading at an EV/EBITDA ratio of only 3x consensus FY23 earnings. That is around 35% lower than comparable company Santos (ASX: STO) at 4.6x and 30% lower than Woodside Petroleum (ASX:WPL) at 4.3x, although both peers are substantially larger than BPT.

- The strong demand for gas in Australia, thanks to looming shortages on both coasts, can help promote a rerating of this stock. Similarly, the expected 2024 start of Stage 2 production at the Waitsia Gas Field in WA, in which Beach owns 50%, may contribute to a further rerating in the medium term. Beach has a production growth target of 28 million barrels of oil equivalent (mmboe) in FY24. The company produced 26.1 mmboe in FY21.

- Near term, BPT has not hedged (sold forward) any of its gas sales, so the company will benefit immediately from any gas price increase. Benchmark prices at the Wallumbilla gas hub in Queensland have already gone up from A$9/GJ in February to A$26/GJ currently.

- We see potential for M&A activity around BPT following the acquisition of Senex at an EV/EBITDA multiple of 10.9x.

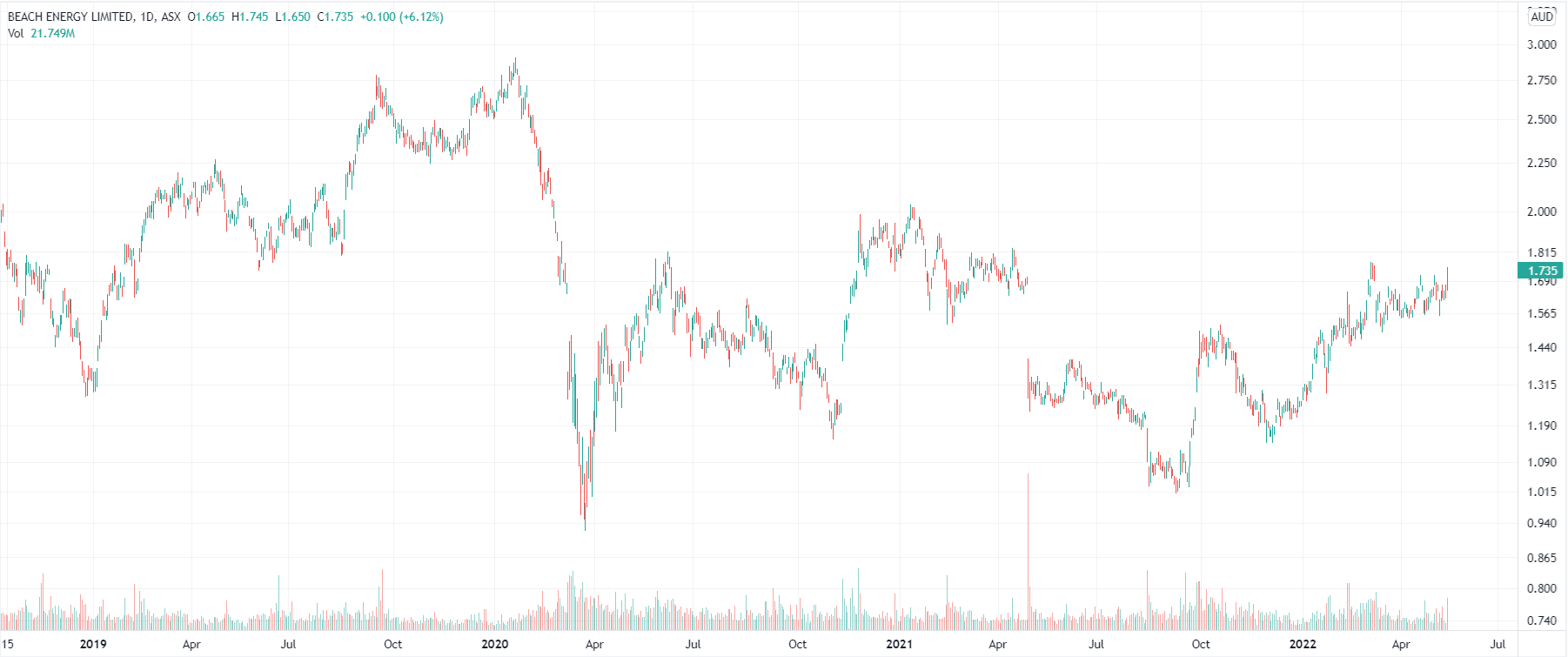

Beach Energy share price chart, log scale (Source: Tradingview)

Who is Beach Energy?

Beach Energy is a mid-tier oil and gas producer in five basins around Australia and New Zealand, and is a key supplier of gas into the Australian east coast gas market. We regard Beach as more of a gas company than an oil company. Seven Group (ASX: SVW) is currently the largest shareholder in Beach Energy with 30% of the stock. Seven Group has been involved in Beach Energy since 2014 and Ryan Stokes serves as a director.

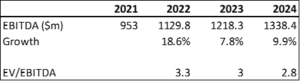

Consensus earnings for the year ended June 30:

The Western Flank matter in 2021

Beach’s Western Flank oil and gas fields substantially outperformed until 2021, but are now regarded as being in decline and in April 2021 Beach reduced its estimate of reserves. That prompted a share price drop to $1.28 at the time.

Beach management had realised that the model it used for reserve estimation failed to consider complex and unusual geological formations between the horizontal wells. Western Flank oil production is now performing better than expected, due to field workovers and development well connections.

Catalysts for the re-rate of Beach Energy

We see nine main catalysts to prompt a re-rating of the stock:

1) Appointment of a new CEO. CEO Matt Kay resigned in November 2021 and has yet to be replaced.

2) The next quarterly result, which is due around Wednesday 20 July. This can potentially show overall production increases as well as improvement in Western Flank output.

3) Near-term increases in wholesale domestic gas prices, thanks to the winter season. Gas prices through the Wallumbilla gas hub in Queensland have increased to A$26/GJ, as against a mere A$9/GJ in February.

4) Medium-term increases in wholesale domestic gas prices, due to increasing shortfalls of gas on the East Coast expected from 2023.

5) Continued high gas prices globally, driven by moves to secure more gas supply that is not dependent on Russia. US natural gas futures have been rising strongly in 2022. The northern summer is likely to keep gas prices high.

6) Progress towards commencement of Stage 2 production from the Waitsia Gas Field in WA’s Perth Basin. Waitsia was one of the largest gas discoveries in Australia of the last fifty years when it was made in 2014. Beach Energy acquired 50% of this field with its acquisition of Lattice Energy from Origin Energy in 2018. Waitsia Stage 2 will see the gas shipped north to be turned into LNG for export. Waitsia is now half completed and remains on time and budget. Production here starts in 2024.

7) Commencement of production from a new Otway Basin field, called Thylacine, from the middle of calendar 2023, as well as other Otway Basin activity including a pipeline to the Enterprise field.

8) Further M&A activity in the sector, following on from the recent acquisition of Senex by POSCO and Gina Rinehart, at an EV/EBITDA multiple of 10.9x. Senex is primarily known for the Roma North and Atlas Projects in the western Surat Basin in Queensland.

9) Exploration activity, with a number of exploration wells planned, including Trigg 1 in the Perth Basin, slated for calendar 2023.

Risks

1. There is currently a class action underway spearheaded by Slater and Gordon related to the Western Flank matter. This will likely take years to either settle or progress to court, so is unlikely to impact the company in the near term.

2. A decline in global gas prices.

3. More difficult regulatory environment for hydrocarbons in some jurisdictions.

4. Potential delays in Waitsia Stage 2 commencement.

BPT update 20 July 2022

Preliminary FY22 results look good

Our Concierge stock Beach Energy had a solid June 2022 quarter, increasing production by 9% to 5.6 million barrels of oil equivalent. A couple of new wells in the Otway Basin were major contributors, but also encouraging was the fact that Western Flank production was only down 4%. These fields, on the western flank of the Cooper Basin, were the cause of last year’s downgrade because of reservoir miss-estimates. It looks like Beach Energy management has started getting on top of these issues so that Western Flank production for the year to date is slightly better than guidance.

It’s a gas gas gas…!

Beach Energy is well placed in a gas-hungry world. One of the things we like about Beach is the high levels of gas demand globally since Russia was taken off-line as a country a few months ago. This bodes particularly well for the Waitsia field gas when it starts being turned into LNG next year. In June, US natural gas prices eased back, but have since turned upwards to close at US$7.30 per MMBTU yesterday.

Russia’s Gazprom has informed its European customers that it cannot guarantee gas supplies due to ‘extraordinary’ circumstances. We all know what those extraordinary circumstances are. However, some news outlets are now reporting Gazprom may bring part of deliveries to Europe back on line shortly.

Rerating of BPT to continue

Beach Energy is headed for a good FY23, with Waitsia Stage 2 on track, more exploration in the Cooper Basin and more Otway Basin wells set to come on stream. We think this forward development, combined with a potential closing of the ‘multiple gap’ with Santos and Woodside, bode well for a continued re-rating of BPT stock.

Update following BPT’s annual results announcement on 15 August 2022

Mr. Market was not happy with the annual results of oil and gas producer Beach Energy. The overall results were good – revenues grew 13%, EBITDA was up 17% and NPAT jumped 39%. However, to some observers the FY23 outlook did not look promising.

Beach Energy set for a transition and we thought it was well positioned

Beach Energy owns oil and gas infrastructure assets as well as offshore and onshore development projects. We have backed Beach, making it a Concierge Stock back in May 2022, on the basis that it was set to benefit from the gas shortage on the East Coast in the longer term.

In addition to positive market fundamentals, the company was setting itself up well for the future, anticipating a 2024 start-up of Stage 2 production at Waitsia, one of the largest gas fields ever discovered onshore in Australia and will deliver 250TJ per day over 15-year life cycle. Just last week, Beach signed an offtake agreement for Waitsia with BP. Remember, this deal would formally christen it as an LNG exporter.

And in the short term, it was benefiting from higher gas prices due to Russian gas being cut off from the global economy as the world retaliates to its invasion of Ukraine. Not to mention, it was (and still is) trading at a reasonable valuation of around 3x EV/EBITDA and around 6x P/E for FY23.

Internal issues drag Beach down

However, things weren’t all smooth sailing. Beach Energy lagged for several months after the Corona Crash as energy prices hit rock bottom and stagnated. And even as energy prices recovered, it spooked the market several times with multiple production downgrades (leading to a legal action against the company) and the unexplained exit of its CEO.

Today’s results were arguably not too bad. After all, it grew its revenue and profit despite lower production thanks to increased pricing. But we think investors were spooked by the short-term outlook, which at first glance appears a step backwards.

FY23 set to be a year of transition

The company said FY23 would be a year that would set it up for the longer term – FY24 and beyond. It has a number of initiatives to grow its production set to begin from mid-CY23 with work on those initiatives set to continue until then. These include bringing the Otway Gas Plant back to full capacity and tying in the Thylacine 1-4 wells.

These are set to have an impact on Beach’s books. Capex is set to be $800m-$1bn, compared with $872m in FY22, and unit field operating costs will be $12-$13 per boe compared with $11.74 in FY22. The latter numbers had people worried because it looked like Beach’s costs in the current financial year could end up being 10% higher than in FY22. The company hasn’t guided on revenue and this is where the upside in FY23 could come from. It’s also important to remember that Beach Energy still has some uncontracted East Coast gas capacity for FY23 and that allows it to take advantage of higher wholesale prices. And Beach itself noted that the company provides investors with ‘unhedged exposure to Brent and liquids pricing’.

The big bump in production should come in FY24

Beach’s production is set to takeoff in FY24 with the company forecasting up to 28MMboe. But in FY23, it expects production to be 20m – 22.5m barrels of oil equivalent (MMboe), which compared to FY22 would be 3% growth at best and an 8% reduction at worst.

Bear in mind, this assumes all other assets perform to forecast and everything runs on time. Some critics would argue that this assumption is arguably optimistic given its past record of production downgrades and the unforeseen issues that have impacted the industry during the pandemic. One analyst in the Q&A session of the results briefing on Monday morning asked management if the company’s production assumptions were conservative or not, observing that if it downgraded production this would be the fourth instance in as many years. CEO Morne Engelbrecht replied that these were targets the company was setting for itself.

We still like Beach Energy’s prospects

Where do we stand on Beach Energy after these results? We remain optimistic on this story given high ongoing demand for gas both domestically and internationally, the favourable pricing environment generally and the potential for exploration success in FY23, particularly in the Perth Basin. We think $1.60 may turn out to be a great entry point for people who missed the initial ride to $1.85. Our stop loss is $1.53.

SELL BEACH ENERGY (ASX:BPT), 28 September 2022

Our investment thesis for Beach Energy (ASX:BPT) is not playing out.

While BPT was initially up 17.3% (to $1.89) after we included it in Concierge at $1.61 back on 11 May, the stock has come down in the last two weeks on the back of a very rapidly changing macro environment, in which oil prices have ameliorated and the general market environment has turned noticeably bearish.

The stock has now closed below our $1.53 stop loss, which is why we recommend selling BPT today at a 15% loss.

What went wrong

Oil peaked in June at just over US$120 per barrel for Brent Crude and has since trended downwards, to the point where it is just over US$80 a barrel. We think oil prices will remain weak in the near term due to concerns about a global economic slowdown. We see Beach Energy as more leveraged to gas, particularly LNG, where prices remain high (US natural gas, as per ‘Henry Hub’, remains above US$7 per MMBtu). However, the decline in oil prices has caused investors to move away from the energy sector generally.

What does this mean for BPT?

Even if the US does not go into recession later this year or early 2023, we believe the global economy will cool off to the point that demand for a number of commodities, including oil, will come down. Gas will remain strong both in Australia and globally, particularly as the weather cools in the Northern Hemisphere, but Beach’s big step forward with the new Waitsia field in WA isn’t expected until later in 2023.

BPT stock has been trading at or below our $1.53 stop loss level in the last few trading days and we don’t see it going back up to $1.85 level of August, let alone higher than that, in the near term.

From the current level, we see more risk to the downside than to the upside, which is why we are selling BPT at a small loss now, rather than letting it simmer and drift lower over time.