Weebit Nano (ASX: WBT)

Our investment strategy for Weebit Nano (ASX:WBT) – UPDATED 14 September 2023

- Our price target is $ 9.54 (was $4.75 and $6.10 previously).

- Our buy range (per 14 September 2023) is up to $5.00.

- Use a stop loss at $3.50 (Updated 14 September 2023), or $3.00 for investors with more risk appetite.

Disclosure: Stocks Down Under staff and/or director(s) own Weebit Nano shares.

Investment thesis:

- Weebit Nano (ASX:WBT) is a secular technology play, i.e. the share price responds more to company specific news than to broader market and macro economic developments. If sentiment on Tech stocks sours further, WBT will be impacted as well. However, we believe company specific announcements, e.g. on new customers, will be much more important for the company’s share price than the general sentiment on Tech stocks.

- Completing the final steps of product development for embedded ReRAM will further open up a very substantial market for Weebit Nano in the near to medium term.

- Further development of stand alone memory solutions will only add to that market opportunity, e.g. in the Storage Class Memory, which is used in laptops, mobile phones, data centers etc.

- Longer term, i.e. 3 years out, we expect ReRAM will have applications in neuromorphic processing as well.

- The company signed its first commercial customer in 2021. Semiconductor foundry SkyWater Technology (NASDAQ:SKYT) is currently qualifying the technology before it gets put into commercial production. The fact that WBT was able to sign a first customer validates market demand for ReRAM.

- The next step is to build on this first customer by signing additional ones. We expect the company to be able to sign additional customers this calendar year (2023). It has said on several occasions that it is in discussions with a number of potential customers.

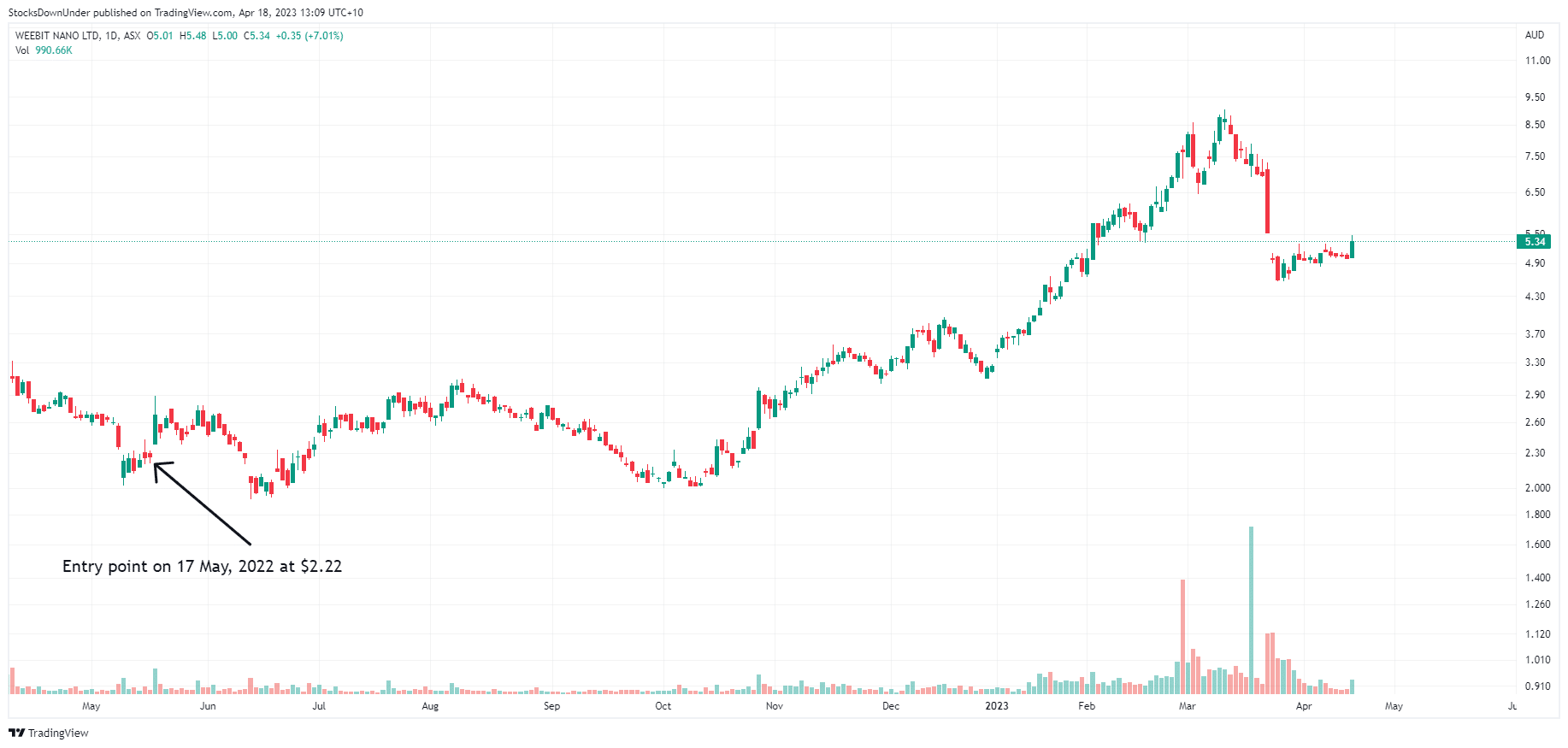

Weebit Nano (ASX:WBT) share price, log scale (Source: TradingView).

Who is Weebit Nano?

In information technology ‘non-volatile’ memory is the memory that is retained even after the power gets cut, e.g. when you turn off your computer. For the last few decades, NAND Flash has been the dominant technology used for non-volatile memory. Weebit Nano aims to replace Flash with its silicon oxide ReRAM memory, potentially working 1,000 times faster and using 1,000x less energy, as well as lasting 100 times longer than Flash. Weebit Nano went public on ASX in 2016 in order to fund the development of this technology.

The overall market size for Flash memory is currently estimated at over US$60bn and is growing rapidly because the world’s storage requirements are doubling every two years. Weebit is currently working on multiple products (embedded and stand alone ReRAM) that can replace Flash as well as embedded SRAM in certain applications.

WBT’s embedded ReRAM module is furthest advanced

Weebit has been able to productise its silicon oxide ReRAM cost-competitively with the standard materials and semiconductor manufacturing equipment currently used by semiconductor manufacturers globally.

The company has developed an embedded memory module (where memory is combined with processors and other elements on the same chip). Demonstration chips have already been successfully tested. They will allow prospective customers to test and try out the technology.

WBT is also working on scaling down its embedded ReRAM to 22nm (nanometers), from 28nm currently. This will enable integration with FDSOI (fully depleted silicon on insulator) manufacturing processes, which presents a very attractive market opportunity.

Stand alone ReRAM to service the storage market

Additionally, the company is developing standalone memory for Storage Class Memory (SCM), which is used in mobile phones, computers and datacenters. To this end, the company recently demonstrated its first crossbar ReRAM arrays, which combines WBT’s ReRAM technology with a so-called selector. Selectors are crucial for stand alone memory as it allows addressing individual memory cells.

Funded for the next stage of its growth

In it’s 3Q22 earnings release, the company mentioned a cash position in excess of $50m, which provides a very substantial development runway as the company ramps up commercialisation.

Substantially undervalued

We believe Weebit Nano should be valued around A$750m to A$850m, which is in line with past industry M&A deals. That would suggest a share price of $4.50 to $4.75, which signals substantial upside. Longer term, we see valuations above A$1bn as very realistic as WBT builds its customer base and product portfolio.

The recent share price action for BrainChip (ASX:BRN), where it briefly hit a A$4bn valuation, demonstrates the upside for ASX-listed semiconductor stocks that successfully commercialise.

Share price catalysts

- A key share price catalyst will be announcements of additional commercial deals with a semiconductor foundry, an integrated device manufacturer (IDM) or a fabless chip company. The company has flagged that it expects more deals in the course of 2022.

- Completion of the embedded memory module qualification by SkyWater should kickstart actual commercialisation.

- Additional progress on the stand alone memory development should be received favourably.

- Potential announcements around neuromorphic computing may bring additional upside to the share price longer term.

Update 13 October 2022

Weebit Nano is making significant progress with its “selector”

Weebit Nano announced that it has made significant progress with the development of its selector. A selector is used to address individual memory cells (read and write information to that cell), rather than a string of cells, like in Flash memory, which uses relatively large transistors.

The benefit of addressing individual cells is that it lowers energy consumption of the memory chip as a whole and increases the speed. In other words, memory chips become faster while using less energy. And because selectors are smaller than transistors, more cells can be fitted on the same piece of chip real estate. Those 3 things are what every chip producer wants!

Selector also to be used in embedded ReRAM

In addition, WBT said that its selector is aimed for use in both its embedded and its discrete ReRAM technology. Initially, WBT thought that selectors would mainly be used in discrete memory (large memory chips, e.g. used for large scale storage of data).

However, the company is now saying the selector will also be used in embedded memory (where the memory component is designed into the actual chipset). This is highly beneficial because most advanced SOC applications (System on a Chip) are increasingly requiring large amounts of embedded memory. This makes WBT’s ReRAM ideally suited for these applications.

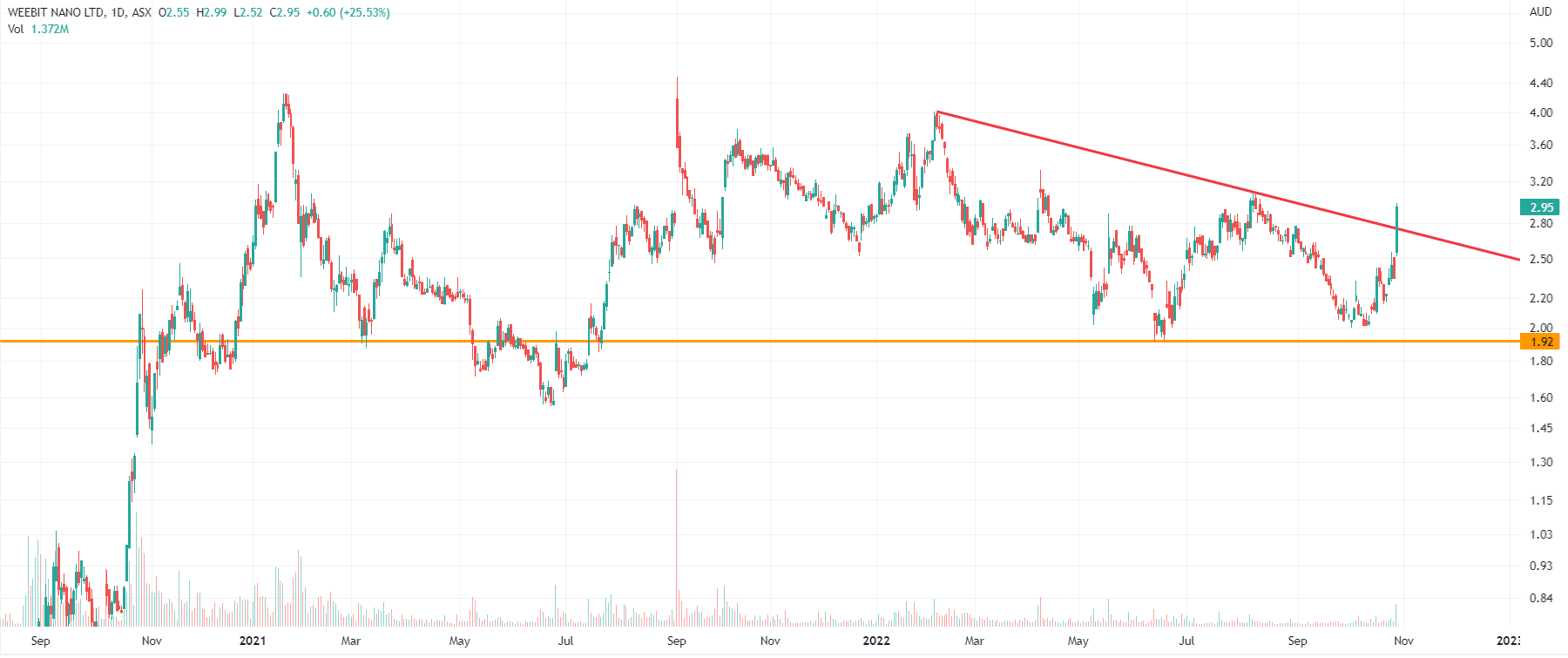

Our target price for WBT remains unchanged at $4.50. At the current level of $2.04 we believe the shares are highly attractive, even for a run up to just $3.00 instead of our target!

UPDATE 28 OCTOBER 2022

Weebit Nano touched $3 yesterday on the back of very good news!

- Weebit Nano (ASX:WBT) reached an intraday level of $2.99 yesterday.

- The company announced that SOCs (System-on-a-Chip) using WBT’s embedded ReRAM technology have been manufactured and qualified by WBT’s development partner Leti in France.

- Although Leti is not a commercial manufacturer, this qualification (done according to industry standards) is significant because the chips have been manufactured on a production line that uses the exact same tools a commercial chip fab does.

- This means that WBT’s prospects can take these qualification results and use them in their evaluation of WBT’s technology.

- WBT already said that this qualification by Leti is accelerating its discussions with prospects.

Additionally, on Tuesday in its presentation for the Goldman Sachs Emerging Companies conference, WBT said that it is now in discussions with multiple Tier-1 chip foundries and companies.

In that same presentation it said that it expects additional deals before the end of 2022!

While Tuesday’s news only pushed the stock up by 4.5%, Thursday announcement drove the stock 27% higher intraday ($2.99), to close 25% higher at $2.95.

You may want to take some money off the table

Those of you who got in at $2.22 back in May 2022 are now sitting on a paper profit of 33% in just 5 months. And no one has ever become poorer by taking a profit. So, you may want to take some money off the table at the moment and lock in those gains, because WBT is a volatile stock and it could easiliy retrace to around $2.65. We just wanted to flag this with you.

We are not selling though

However, as most of our subscribers will know, we are big fans of WBT….we think big things are coming for this company.

We have owned the stock since just after its ASX listing…and we are not selling. We believe strong news flow is around the corner, i.e. between now and mid-2023, which will drive the share price up further.

UPDATE 7 FEBRUARY 2023

Move up your stop loss to $5.00 (was $2.60)

Our initial price target was $4.75, but has been increased to $6.10 on 3 February 2023

We have also increased our stop loss level to $5.00 (on 7 February 2023).

UPDATE 7 MARCH 2023

Weebit Nano’s ReRAM will be on the shelfs imminently

This morning Weebit Nano (ASX:WBT) announced that its ReRAM technology is now commercially available in SkyWater’s S130 process. SkyWater customers can now use WBT’s ReRAM intellectual property and embed it in their System-on-a-Chip (SOC) designs at 130nm resolutions. This achievement marks a multi-year process in which WBT has worked closely with SkyWater to get ReRAM technology to market.

Final qualification before monetisation starts

There is some final qualification to do in SkyWater’s fab, which WBT expects will be completed in the first half of 2023, i.e. within the next four months. Once that’s completed, commercial sales can start, which should see WBT receive a percentage of the sales price of the chips that use its technology. This is typically between 1% and 3%.

More good things to come

In our view, this major milestone for WBT, i.e. first commercialisation of its embedded memory module, is just the beginning of many good things to come. Specifically, we expect to see embedded ReRAM extended to commercial applications at 22nm and below, while discrete (stand alone) memory applications will likely be the company’s big money-maker, although large scale production will be a few years away. Additionally, we expect to see ReRAM applied to Neuromorphic Processing (NP) in the long run.

Increase stop loss level to $6.10

In the meantime, we advise to increase the stop loss level on WBT from $5.00 to $6.10, following the stock’s strong rise in the last few months, to ~$7.30 today.

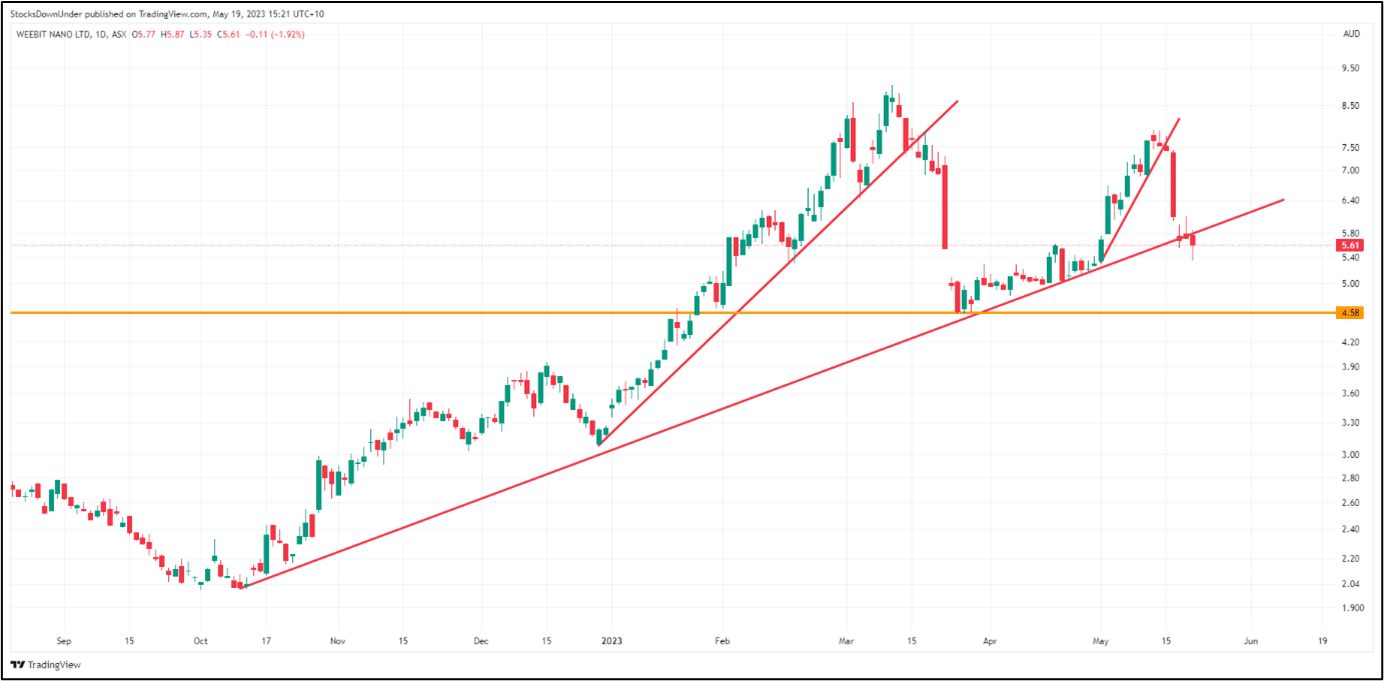

Weebit Nano (ASX:WBT) price chart per 7 March 2023, log scale (Source: TradingView)

Update 22 May 2023

Weebit Nano: Conflicting forces at play

Ever since WBT was admitted to the ASX300, in March this year, we have seen substantially increased volatility in the stock. Shorters are now able to borrow WBT stock and sell it short on market, meaning there is an additional force at play.

It’s no longer just the long-only investors that buy and sell WBT…it’s another category entirely…institutional investors with the ability to sell stocks short, i.e. shares that they don’t own, but have borrowed from other investors. They sell these stocks on-market with the intention of buying them back at lower prices before giving them back to the investors they borrowed the shares from.

Big increase in volatility

So, what we have seen since early March is a price ranging from a high of $9.03 on 10 March to a low of $4.56 on 28 March. Since that low late March, the stock bounced up to $7.89 before falling back again to a close of $5.64 on Friday 19 May.

The short interest is currently around 2.5% after having peaked above 4% late March.

Weebit Nano (ASX:WBT) share price chart, log scale (Source: TradingView)

What to expect in the next few months

The best way to squeeze out the shorters would be for WBT to announce some good news, like final qualification at SkyWater, which means its embedded ReRAM can actually go into production. Or a new customer, like GlobalFoundries, Samsung, UMC or Tower/Intel (if that M&A deal gets regulatory approval).

We believe both announcements are due in the near future. The SkyWater qualification should be almost done, while WBT has alluded to signing a new customer around mid-2023 multiple times.

So, where does that leave investors

Naturally, if you’re trading oriented, WBT’s trading patterns in the last 2 months are a dream come true. But for the Buy & Hold investors, this volatility is frustrating.

Looking at the chart above, we can see that the stock broke through the red medium-term upward trend line on Friday. If it doesn’t move back above that line on today or tomorrow, we could see prices hit the orange support line again around $4.60. In our view, that would be an excellent buying opportunity.

Remember that WBT is a 3-stage rocket

However, with the upcoming announcements in the next few months, we believe the stock is attractive even between $5 and $6. Remember, this is a long-term story of capturing share of 3 separate semiconductor market segments over time, i.e. embedded memory (near term), discrete memory (medium term) and neuromorphic processing (long term).

We can break out the discrete segment further by distinguishing between stand alone ReRAM memory chips that need a selector (high-capacity memory chips) and the ones that don’t (lower capacity memory chips). The latter will come to market much faster than the former and we could potentially see announcements around that as well later this year.

In other words, there is so much happening at the moment that could trigger a renewed share price rally that we believe current levels are attractive as well. Simply put, medium to longer term investors don’t want to miss potential share price appreciation, triggered by announcements, because they were waiting to buy the stock 20c or 50c cheaper.

Near term investment strategy

We advise investors to wait and see what happens in the next few days, i.e. can WBT get back above the rising trendline in the $5.80-$5.90 range (see chart)?

If it does, it will likely resume its uptrend again, in which case you want to own the stock.

If WBT fails to get back above the trendline this week, we believe first support will be around $5.00 and second support will be around $4.60. In our view, these levels would present great buying opportunities if you want to top up or build a position in WBT.

Investors who got stopped out at $6.10 and are looking to get back into WBT, should use a stop loss level of $4.60.

Our target price of $6.10 is unchanged at the moment, but we will be reviewing that in the next few weeks or months. We increased our target price on 3 February (from $4.75) based on WBT’s ongoing technical and commercial progress. But we’ll need to see new signs of progress, like new customer wins, to take that target higher.

Current valuation leaves a lot of upside

At the current share price (the close at $5.64 on 19 May 2023), WBT is valued at A$1.13bn (fully diluted). At $6.10 per share, the company would be valued at A$1.23bn, which we believe leaves a lot of upside if we start to think of WBT in terms of a potential M&A target.

Even at the recent share price high of $9.03 in March, WBT was “only” valued at A$1.82bn. Even though this may seem like a lot for an ASX-listed IP development company without revenue, in the global market, valuations for high-potential IP companies in the semiconductor industry have gone a lot higher than that in the past. WBT’s added benefit is that is actually commercialising the technology as we speak.

So, we remain very happy holders of Weebit Nano in anticipation of many positive things to come, in the near, medium and longer term.

Update 19 June 2023

Increased our price target to $9.56 per share

Our previous valuation for WBT of A$6.10 has been reached and exceeded. Given the company’s progress so far in 2023 and the expected news flow during the remainder of 2023 and into 2024, we believe WBT’s valuation gap with a peer like eMemory is likely to narrow in the next 12 months. On that basis, we believe WBT should be valued at A$9.56 per share.

You can read the full research update that our parent company Pitt Street Research published here.

Update 14 September 2023

Weebit Nano (ASX:WBT) is our longest running Concierge pick, i.e. since 17 May 2022 when we picked it at $2.22. The stock has done phenomenally well since then and peaked at $9.03 intraday on 10 March 2023.

Unfortunately, as the stock entered the ASX300 in March 2023, it got on the radar screen of institutional shorters, which have pushed the shares down to around $4 currently. Even at that level, we’re still up nearly 80%. But obviously, we would have liked the stock to stay up at higher levels as we await new customers and maiden revenue.

What we think of the current share price level

So, the questions now are: Should investors average down at these levels and should people who are new to Weebit jump in? We think the answer to both questions is a resounding yes! The stock seems to be finding support around $3.90.

The company is on track to achieve maiden revenues this calendar year and is working hard to sign new customers in addition to SkyWater, also in 2023. Given the company’s track record over the last 6 years, we are very confident Weebit can achieve these goals.

What is the downside risk?

Purely looking at the chart, we see downside risk to around $3.10 in case the $3.90 and $3.50 support levels are broken. In terms of price target, we believe there is upside all the way to $9.50, although the stock will have to break through recent highs at $6.35, $7.80 and $8.75 on the way up.

Trading strategy for WBT right now

From the current share price level around $3.87 we believe a cautious stop loss at $3.50 can be used, which is a downside margin of ~12%. Less risk-averse investors could use $3.00 as a stop loss (~22%).

As a maximum buy range from the current level we suggest $5.00, which gives investors 27% upside to the first significant resistance level of $6.35 (if they were to buy at $5.00). Of course, we’re aiming for much more upside, but 27% isn’t bad, right?

News flow in the next little while

Firstly, WBT will become an ASX200 company on Monday 18 September (next week), which will bring in some new, institutional investors.

We also expect at least one new customer to be announced in the near term.

And WBT should be recording its first revenues through the SkyWater relationship, e.g. a license fee, non-recurring engineering fees etc.

So, there is plenty of good things to look forward to.

We are certainly sticking with WBT… Marc and Stuart both own WBT shares.

Disclosure: Stocks Down Under staff and/or director(s) own Weebit Nano shares.