Reliance Worldwide (ASX:RWC): Plumbing supplies as a 4-decade high inflation hedge

Nick Sundich, February 23, 2024

Reliance Worldwide (ASX:RWC) is one of the best companies to hold amidst record-high inflation, in our view. As a plumbing supplies company, it can easily pass costs on to customers because emergency plumbing works typically can’t be put off.

Although the company’s share price has not been immune from decline, as the pandemic-fuelled renovation boom ended, the worst of the decline appears to be over.

Who is Reliance Worldwide?

Reliance Worldwide is a plumbing supplies company that is the largest manufacturer of PTC (Push to connect) behind the wall plumbing fittings. It traces its origins to Brisbane in the late 1940s but today is headquartered in Atlanta, has 58 facilities (distribution hubs, manufacturing plants and innovation centres) all over the world and employs 2,800 people.

Since 2016, it has been led by Heath Sharp, who first joined the company in 1990 and worked his way up to the hot seat. Preceding him was a 3-decade stint of ownership by the Munz family who built it up over that time only to catch up.

Although the company isn’t one that is afraid of undertaking M&A, it is selective in what it purchases. In 2018, it spent $1.2bn to acquire the John Guest businesses in the UK. John Guest provides water delivery, control and optimisation products, and the purchase gave Reliance a significant footprint in the UK. In November 2021, Reliance bought American plumbing products maker EZ-FLO for US$325m. EZ-FLO contributed US$70m in sales during the first four months of Reliance’s ownership.

Meet Sharkbite

Reliance Worldwide’s flagship product is the Sharkbite range of brass push-to-connect fittings (as pictured below). These devices avoid the traditional soldering of parts into place, saving plumbers time. If you look closely, you can see the logo on the fitting. Another example is the Eastman brand of appliance connection products used by plumbers to connect washing machines, dishwashers, water heaters and fridge ice-makers to household water supplies.

How it can overcome inflation

As we mentioned in the introduction, Reliance Worldwide is attempting to overcome inflation by increasing prices – having done so by 10% during CY22. Getting customers to accept price increases isn’t troublesome, given that plumbing work is typically urgent.

Two things are troublesome instead. Firstly, it has so many prices to monitor including the materials it uses in product manufacturing (copper, brass, steel and resins). It also is on the hook for higher packaging and freight costs, not to mention higher energy bills, while getting less bang for its buck than prior to the pre-pandemic. It now takes 12 weeks for goods manufactured in Australia to be shipped to the US, double what it took pre-COVID.

Secondly, it can take Reliance Worldwide several months to discuss price increases with customers. By the time they agree to them, prices may have increased even further. At its FY22 results, CEO Heath Sharp told shareholders it had moved prices on some items in the UK four times in the last 12 months.

Also keep in mind that even if customers can stomach price increases, other factors are impacting demand as well. These include heavy stockpiling of fixtures and fittings to guard against supply chain disruption, and a shortage of professional tradespeople – leaving a large backlog of work that cannot be completed.

Strong results were made in FY22 and FY23

In FY22 (the 12 months to 30 June 2022), Reliance Worldwide’s sales increased 17% to US$1.2bn and EBITDA increased 3% to US$268.7m. The company’s statutory net profit declined 3% (at US$137.4m), however, due to amortised goodwill, acquisition costs and asset impairment charges. The company’s cash flow from operating activities was down 44% in 12 months due to high working capital investments. The latter figure, however, was still in positive territory, at US$139.6m. Reliance paid out 9.5c per share as a dividend, which was less than half of the company’s adjusted earnings per share.

Looking to FY23, Reliance Worldwide increased its net sales by 6% to $1.24bn. The Americas has been a strong contributor with sales growing 13% in that region, compared to a 4% decline in the Asia-Pacific and 3% growth in EMEA. Although its NPAT came in at $155.7m (down 4%), its cash from operations more than doubled to $292.7m. It paid a dividend of 9.5 cents per share.

For 1HY24, its net sales were down 2% to $589m, although this was in line with guidance. Its NPAT was flat, at US$67.7m, but cash flow from operations was up 61% at US$151.6m. The company reduced its net debt by US$142m within 12 months. It told investors future distributions would be a 50-50 split between dividends and an on market share buyback, so would pay 4.5c per share and spend US$17.8m in buybacks. All up, it would be 40-60% of its NPAT.

The future looks bright

There are 15 analysts covering Reliance Worldwide and they expect US$1.23bn in sales and 0.19c per share. Fr FY25, $1.36bn in revenue and 21c EPS.

In our view, Reliance Worldwide is worth A$6.72 per share using a DCF model. We have gone with consensus estimates for revenue and earnings, used a WAAC of 9% (using a 3.6% risk free rate of return, a 5% equity premium and a 1.08 beta). After assuming 10% cost-inflation in FY23 and 5% in FY24, we assume inflation moderates to 3% per annum thereafter. It is important to note we did the entire model in USD and returned US$4.48 per share, a 33% premium to the $3.37 share price on February 20, 2024. The current exchange rate returns A$6.72, although forex rates can be volatile.

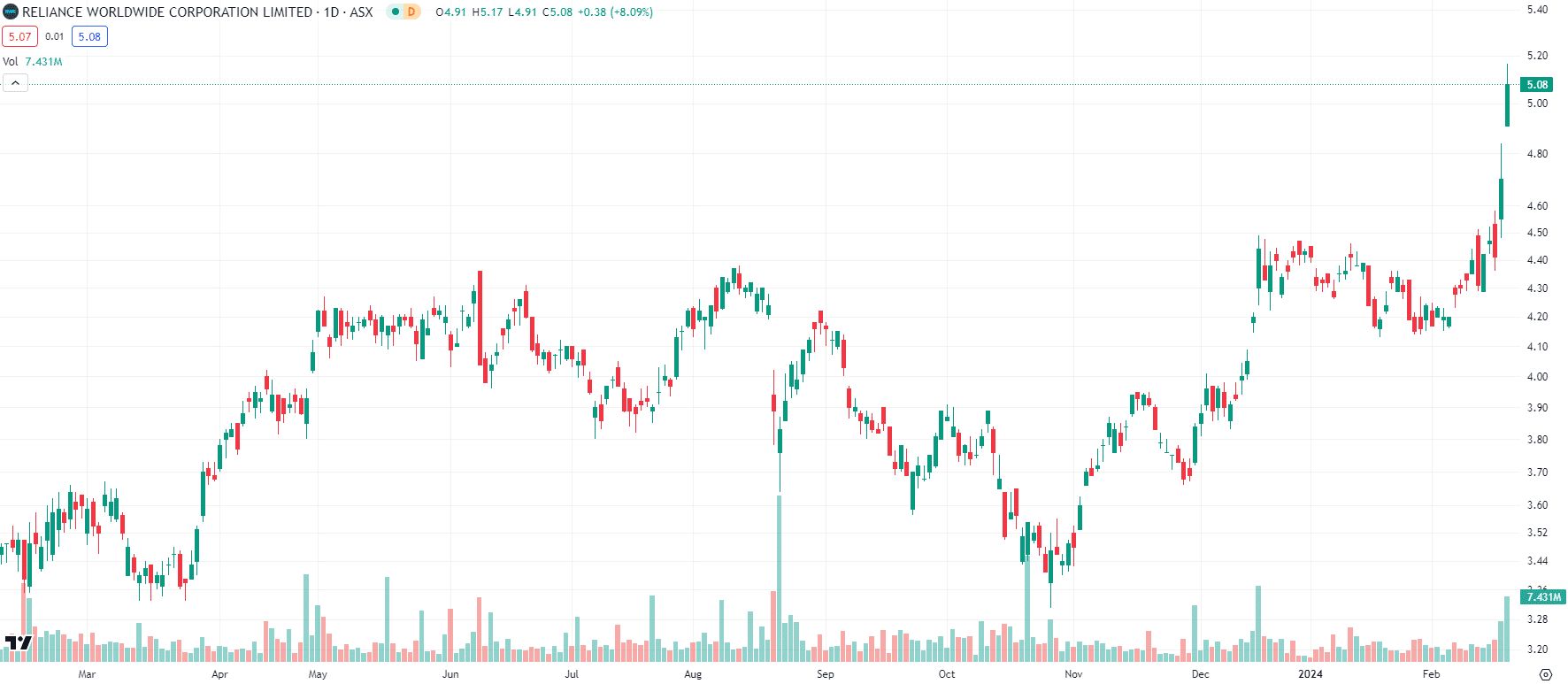

Judging by the company’s 70% share price growth since December 2022, it appears investors are optimistic about the company.

Reliance Worldwide (ASX:RWC) share price chart, log scale (Source: TradingView)

Reliance Worldwide is not for dividend investors, but a good one for growth investors

The key risks with Reliance Worldwide are inflation, supply chain issues and inventory management, all of which we have addressed elsewhere in this article. We think the company has proven resilient to these conditions so far since the current inflation spike first emerged, and throughout the company’s entire seven-decade history

We also acknowledge that Reliance Worldwide does not pay out the highest dividend as a percentage of earnings, nor does it have the highest yield (just 2.2% on an annualised basis). And of course, as noted above, it intends to split its returns to shareholders between dividends and share buybacks in the future.

But investors looking for a growth stock in the industrial sector that will be immune from the worst of inflation will find it tough to find a better company (at least in this sector).

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Recent Posts

5 ASX Health stocks to add to your porfolio

5 ASX Health Stocks Stuart Roberts from Stocks Down Under discussed the potential promise of biotech, sharing his perspectives about…

BHP wants to buy Anglo American, but what would the potential $60bn deal mean?

In what was meant to be a quiet week on the markets, investors learned yesterday that BHP wants to buy…