Why Regis Resources (ASX: RRL) is jumping 10% higher today!

![]() Nick Sundich, July 1, 2022

Nick Sundich, July 1, 2022

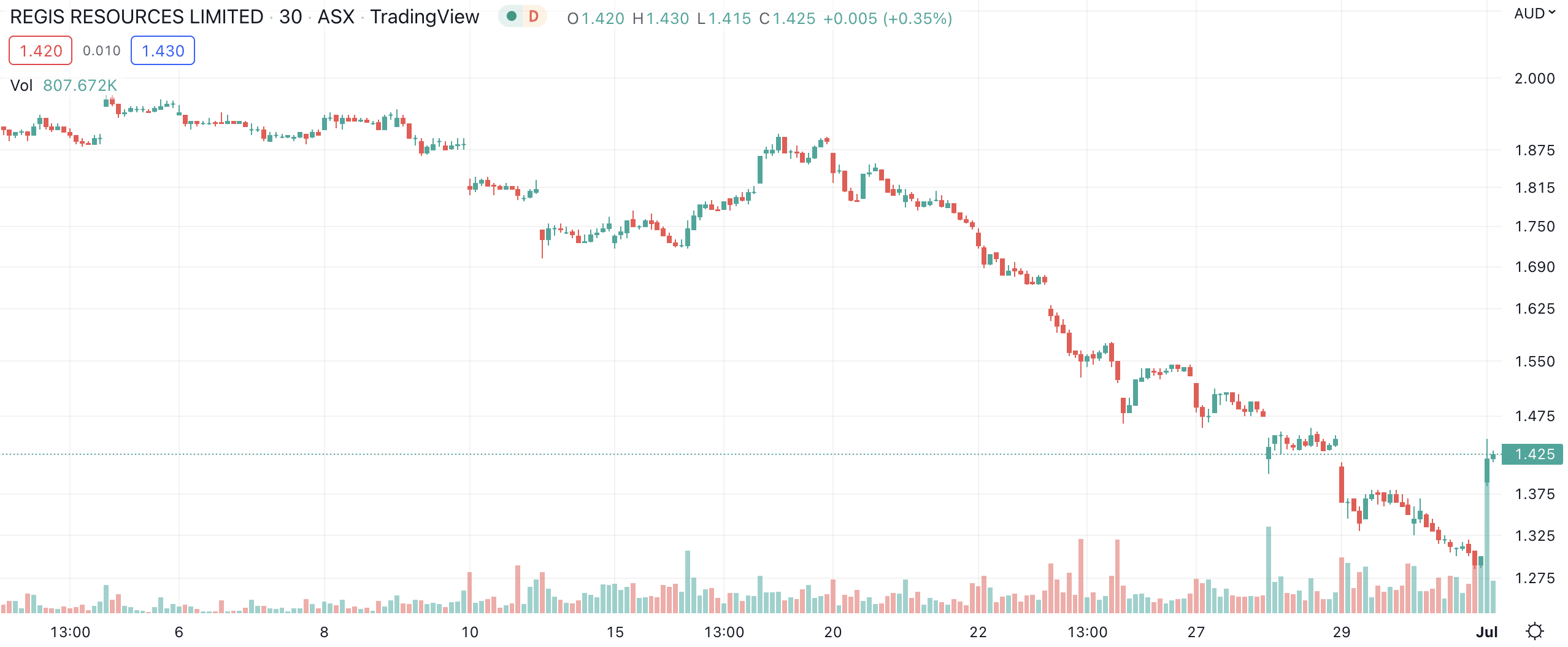

Regis Resources (ASX: RRL), a $980m gold producer, is one of the biggest gainers in the ASX 200 this morning. Regis’ shares dropped 30% in the previous 3 weeks following its annual mineral resource and ore resource statement. But today, share have rebounded ~10%.

Regis Resources (ASX:RRL) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Is Twiggy getting into Regis Resources?

The catalyst for Regis Resources’ climb today has been attempts by billionaire and Fortescue boss Andrew ‘Twiggy’ Forrest to buy into the company. He already had a 4.9% stake in the company, owned through Wyloo – one of his private investment companies.

Forrest’s most famous stake in an ASX company is his iron ore mining company Fortescue (ASX: FMG). But he has picked up stakes in a handful of other companies too, including BWX (ASX: BWX), Bega Cheese (ASX: BGA) and Buru Energy (ASX: BRU).

Regis Resources is another one. He held a ~5% stake, but the AFR reported that he is seeking a further 15% stake.

He was willing to pay $1.48 per share, which is a 13.8% premium to yesterday’s closing price. Unfortunately, his broker Barrenjoeys couldn’t complete a deal for the entire stake, so the deal was put off.

What does this mean for Regis Resources?

Even though the deal collapsed, Regis Resources’ share price is still rising. Investors are evidently taking Twiggy’s bid as a sign that good times are ahead of the company.

And remember, Forrest still owns 4.9% and could easily try to acquire more shares on market in the near future. Taking a stake of 20% would be a particularly significant sign because it is all but certain he would have launched a takeover bid for the company.

As of 31 December 2021, Regis’ mineral resources are 9.9Moz and its ore reserves are 4.1Moz, which represented upgrades of 150koz and 140koz respectively.

Its FY22 results are due in August and the company is expecting to record 420-475koz in annual gold production, up 13% – 27% on FY21.

Regis Resources’ investors will likely be watching the company’s results closely in light of this week’s events.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…