West African Resources (ASX:WAF) increases its Mineral Resources by 1m ounces of gold

![]() Nick Sundich, April 5, 2023

Nick Sundich, April 5, 2023

West African Resources (ASX:WAF) provided an update to its shareholders this morning. This company is a gold producer with a project in Burkina Faso that has brought a gold project from exploration phase to production. But even as it produces gold, the project just gets better and better.

WAF now has Mineral Resources of 12.6Moz

WAF increased its Mineral Resources by 1Moz to 12.6Moz, net of mining depletion and its Ore Reserves by 4.7Moz to 6.4Moz gold – the latter representing Mineral Resources that can be economically mined.

This upgrade came after work by independent resource consultants thatWAF hired. The Ore Reserves were increased mainly through the inclusion of an additional 4.5Moz reserve announced to shareholders last August.

WAF told shareholders it anticipated production of 210,000-230,000 oz at an AISC of <US$1,175/oz in 2023. From 2025, it hopes to increase this to 400,000oz per annum.

The company has $173m in cash, no senior debt and 100% unhedged gold production.

Its a good time for shareholders

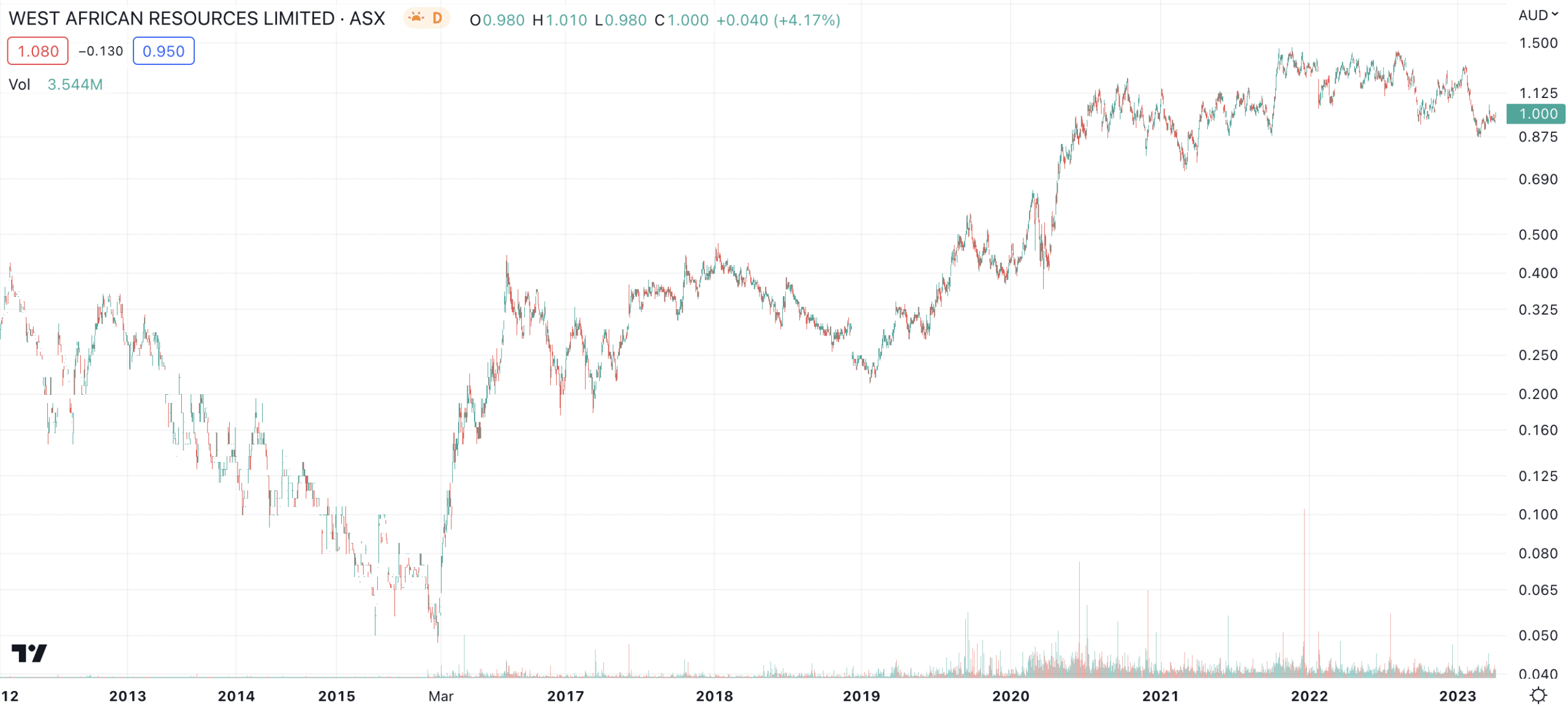

Shareholders who have held this stock for the long term would be satisfied, but the past 12-18 months have been volatile as gold prices have stagnated.

West African Resources (ASX:WAF) share price chart, log scale (Source: TradingView)

But if gold prices hold up, and WAF meets or exceeds its gold production guidance, the future looks bright for the company.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…