‘Don’t Catch a Falling Knife’: Here’s what this saying means and 3 ways to avoid it

Don’t Catch a Falling Knife: Have you ever heard that phase? If you haven’t, this article is for you because we will outline what it means. But even if you have, you will also find this article useful, because we will outline how investors can avoid it.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

What does the saying don’t catch a falling knife mean?

This term refers to the act of trying to buy a stock or other security at its lowest point, usually after it has experienced a sharp decline in value. This can be a risky move, as there is no guarantee that the stock will recover and could potentially continue to decrease in value.

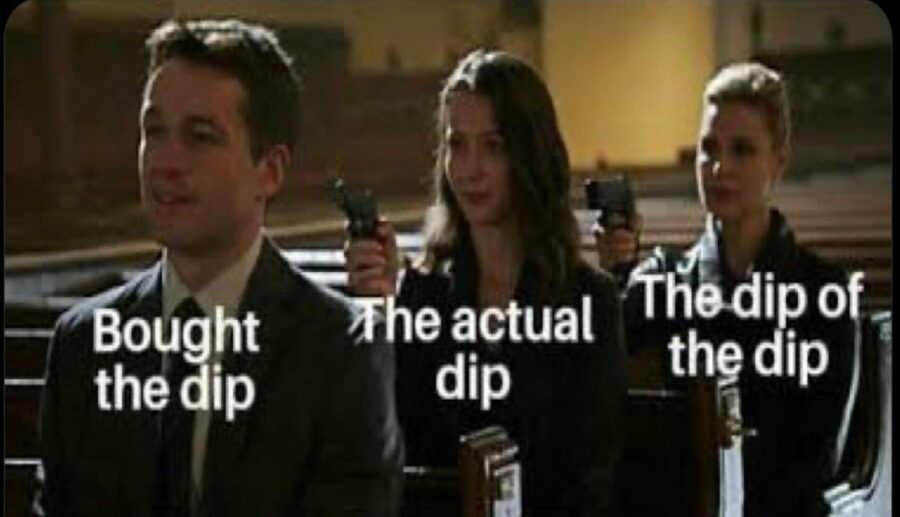

The phrase ‘catching a falling knife’ comes from the idea of trying to catch an actual falling knife. Just like with a real knife, attempting to catch a stock at its lowest point can be dangerous and lead to potential losses. The downward momentum of the knife, or in this case, the stock, could continue and cause harm to the one trying to catch it.

Source: WallStBets/Reddit

There are plenty of real life examples but we’ll focus on a couple that our regular readers would be familiar with.

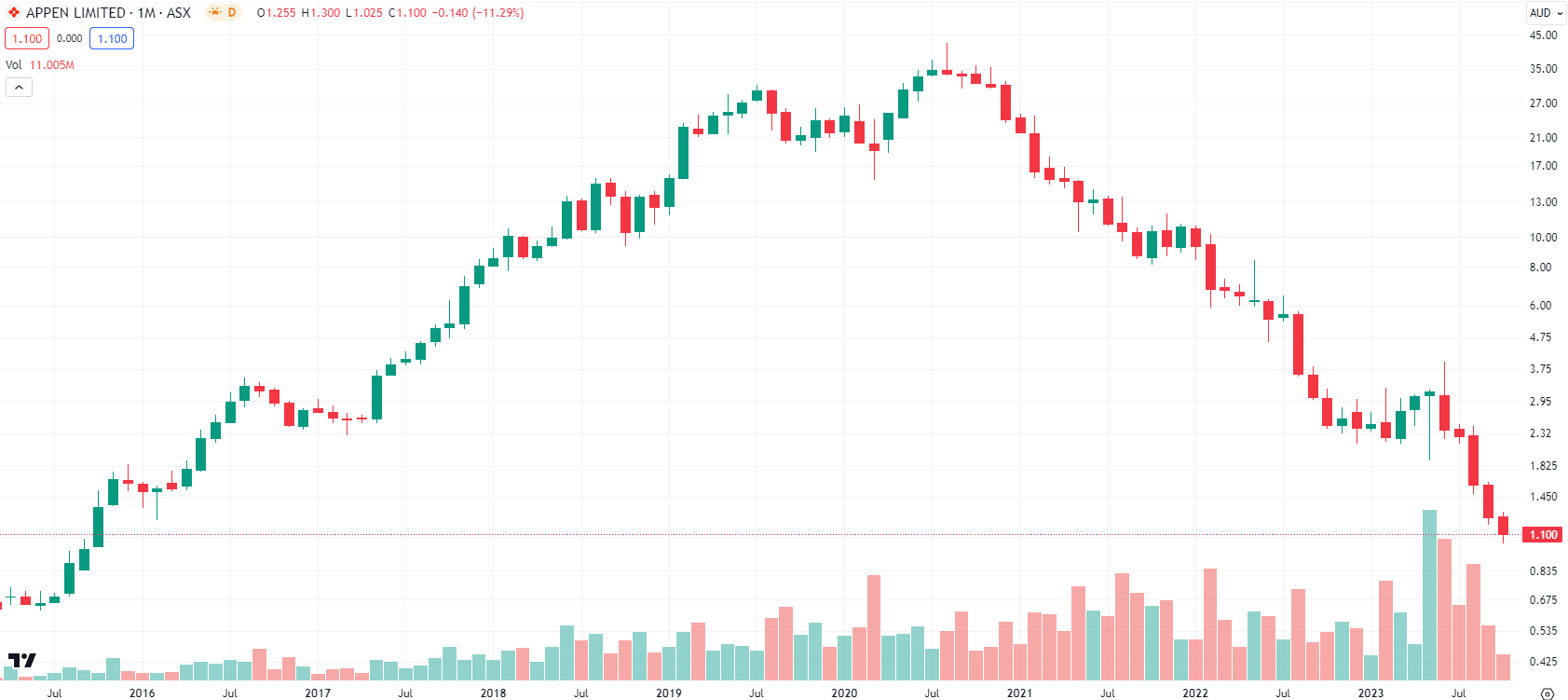

One is former tech-darling Appen (ASX:APX). The company has been in terminal decline for over 3 years, crashing every single result because it keeps missing its own estimates. Considering the hype about AI, you’d be forgiven for thinking it would go the opposite. Or maybe it isn’t so much that you can’t believe it can reach underlying cash EBITDA profitability on an annualised, run-rate basis‘ but not understanding what on earth that is.

Appen (ASX:APX) share price chart, log scale (Source: TradingView)

Another is AMA Group (ASX:AMA). Investors thought it was a sure bet to bounce back as we emerged from lockdowns and hit the roads. But the company was hit by labour shortages, inflation and supply chain issues that have not gone away.

Investors have kept getting burnt by the stock because they thought the dramas were over – or at least the worst of them. But almost every quarter, they were proven wrong and paid the price.

So how Can You Avoid Catching a Falling Knife?

1. Do Your Research

One of the best ways to avoid catching a falling knife is by doing your research on the stock or security you are considering buying. Look into its financial health, future prospects, and any recent news or events that may have caused its value to decrease.

Most importantly, look for evidence that the issues causing the decline are ceasing. Don’t just think the worst is over just because the company says so, especially if it has a proven track record of letting investors down. This is the trap investors often fall into. Doing your own research will give you a better understanding of the potential risks and rewards associated with the investment.

What research should you do? With Google as your oyster, look for data – general macroeconomic data and data specific to your stock’s industry.

2. Set a stop loss

It can be tempting to try and buy a stock at its lowest point, especially if it is a company that you believe in or have had previous success with.

However, it’s important not to let emotions cloud your judgement when making investment decisions. Stick to your research and avoid impulsive moves based on emotions. And be careful to set stop losses to minimise your losses.

3. Diversify Your Portfolio

Diversifying your portfolio is always a good strategy in investing and will likely minimise your losses. By spreading your investments across different industries and types of securities, you can reduce the impact of one particular stock or security experiencing a sharp decline. This can help protect your investments from the risk of catching a falling knife.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Anthropic Eyes US$10B Raise at US$350B Valuation, Led by GIC and Coatue

Anthropic’s Next Act Anthropic is reportedly preparing for a new US$10 billion funding round at an implied valuation of around…

Alcidion (ASX:ALC) Surges 15% After Winning Preferred Supplier Role for A$35M NHS Contract

Alcidion Secures Preferred Supplier Status for Major UK EPR System Worth Over A$35M Alcidion shares rose 15% today following a…

Elsight (ASX:ELS) Breaks New Ground, A$682K US Order Marks First Civilian Contract Win

From Battlefield to Main Street Elsight (ASX:ELS) has secured its first commercial order in calendar year 2026 from a US…