ASX Energy Stocks

Australia’s energy sector is shifting fast. Oil and gas majors like Woodside Energy (ASX: WDS) and Santos (ASX: STO) are moving into renewables such as hydrogen, while utilities like Origin Energy (ASX: ORG) and AGL Energy phase out coal. This creates a split market: traditional producers offering dividends versus renewable-focused players chasing growth.

With Brent crude averaging US$65 per barrel in October 2025, rising inventories are pressuring prices. In this environment, companies with low costs and diversified revenue stand out as better positioned to handle short-term volatility and the long-term clean energy transition.

What are Energy Stocks?

Energy stocks are companies that produce or supply energy, from traditional oil and gas firms to renewable power providers like wind, solar, and hydro. They matter for Australian investors because energy demand stays steady regardless of economic cycles, offering stability. Established producers often deliver reliable dividends from strong cash flows, while renewable players provide growth opportunities as Australia shifts toward clean energy, with billions in cleantech investment expected. For investors, this sector offers both income security and long‑term growth potential, making it a key part of diversified portfolios. The challenge is choosing companies that can balance short‑term commodity price swings with the long‑term energy transition.

Key Features of ASX Energy Stocks

Exposure to the Renewable Energy Transition

Australia targets 82% renewable electricity by 2030, driving growth in solar, wind, batteries, and hydrogen. This policy support gives renewable companies strong demand visibility and long-term growth potential. For investors, this means early exposure to one of the fastest-growing sectors globally.

Steady Growth

Energy assets often run under long-term contracts or regulated frameworks, ensuring predictable revenue. This stability supports consistent dividends, making energy stocks attractive for income investors. Even during commodity price swings, established players can maintain payouts, offering defensive portfolio value.

Diverse Sub-Sectors

The sector spans oil & gas majors, utilities, and renewable developers, offering varied risk profiles. Investors can choose steady dividend payers or growth-focused plays like green hydrogen projects. This diversity allows portfolios to balance short-term income with long-term growth opportunities in clean energy.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

Types of Energy Stocks

Energy stocks can be categorized into different sub-sectors based on the type of energy business they are involved.

Woodside Energy (ASX: WDS) and Santos (ASX: STO) dominate Australia’s LNG exports, generating strong cash flow and dividends. They benefit from Asian demand but face long-term transition risks as crude prices moderate, making them better suited as dividend plays than pure commodity bets

3 Best ASX Energy Stocks to Buy Now

Woodside Energy (ASX: WDS)

Woodside combines immediate cash generation with strategic positioning in the energy transition. Over the next couple of years it has the Scarborough and Louisiana LNG projects coming online....

Origin Energy (ASX: ORG)

Origin offers the most comprehensive exposure to Australia's renewable transition among major utilities. The company is actively expanding battery storage capacity, with significant projects coming online through 2025 that will help stabilise the grid as intermitten...

Ampol (ASX: ALD)

Ampol is one of Australia’s largest downstream energy companies, focused on fuel supply, refining, distribution, and retail convenience operations across Australia and New Zealand. The company operates the Lytton refinery in Queensland and runs a large service-station network supplying petrol, diesel, and related products ...

Our Top 3 ASX Energy Stocks

Why Invest in ASX Energy Shares

Energy use grows with economies and populations, ensuring steady demand even in volatile markets. The transition to cleaner sources changes how energy is produced, not whether it’s needed. This structural demand gives investors confidence that energy stocks remain relevant long-term.

Factors Influencing Energy Stocks

Oil and gas stocks move with commodity prices. Brent crude fell to US$65 in October, pressuring margins, while natural gas prices are forecast to rise this winter. Australian LNG exporters benefit from higher Asian prices compared to US benchmarks.

Are ASX Energy Stocks a Good Investment?

ASX energy stocks can be a good investment for those seeking both income and long-term growth, offering reliable dividends from established producers alongside upside from Australia’s clean energy transition. The best opportunities lie in diversified utilities balancing fossil fuels and renewables, low-cost conventional producers generating steady cash flow, and targeted renewable plays with clear paths to revenue. Risks include commodity price volatility and execution challenges in project delivery, but with strong policy support for clean power and the sector’s income potential, energy stocks remain a valuable addition to diversified portfolios tailored to individual risk tolerance and timeframes.

FAQs on Investing in Energy Stocks

Yes. Established producers like Woodside (ASX: WDS) and Santos (ASX: STO) generate strong cash flows that support regular dividend payments, often franked for tax benefits.

Our Analysis on ASX Energy Stocks

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

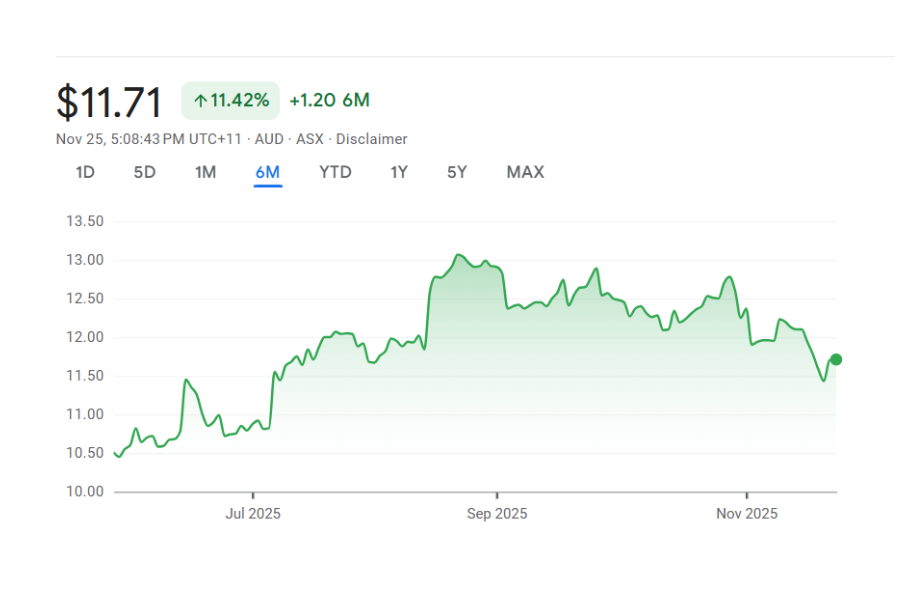

Origin Energy (ASX:ORG) Surges Despite 45% Profit Drop- Is the Market Right to Be Bullish?

Origin Energy Surges on Upgraded Guidance Origin Energy (ASX: ORG) climbed as much as 8.1 per cent on Thursday after…

What is the VIX and what are the factors that cause it to violently surge and go into tailspins?

You may hear the occasional passing comment that the market is volatile, but the VIX Index (also known as the…

Omega Oil & Gas (ASX: OMA) Surges on Beach Energy JV Deal- Is It a Buy Before Drilling Begins?

Omega Oil & Gas (ASX: OMA) surged as much as 18 per cent on Tuesday after landing a major vote…

Beach Energy (ASX:BPT) Slides 4% on Weaker Half-Year Profit- Is the Dip a Buying Opportunity as Waitsia Ramps Up?

Beach Energy dips on profit, while Waitsia lifts the outlook Beach Energy (ASX: BPT) dropped more than 4 per cent…

The 50% CGT discount on shares: Here’s how it works, and if it is under threat

The 50% CGT discount on shares is one of the key mechanisms that helps investors keep as much of their…

Get in touch

contact@stocksdownunder.com