Here are the 5 Top investing mistakes and how to avoid them

![]() Nick Sundich, February 12, 2024

Nick Sundich, February 12, 2024

Sometimes, losing money in the stock market can occur due to bad luck, but other times it is due to mistakes investors make, particularly those ones that we think are top investing mistakes.

These mistakes are not the only ones investors make, but they are the most common that we see with ASX stocks. It was said by Otto Von Bismarck that the wise learn from the mistakes of others while ‘the fool’ learns from his (or her) own mistakes. We hope that by outlining the top mistakes, investors reading this article can prevent themselves from making them.

What are the best stocks to buy right now?

Check out buy/sell stock tips

Top investing mistakes

1. Buying on vibe

The first of the top investing mistakes. Buying on vibe is a very broad term but it involves investors buying a stock just because:

- The market generally is hot

- The sector is hot (with examples including the cannabis and BNPL sectors).

- The individual stock is hot for a particular reason

Investors think the market, sector or individual stock will continue to run hot. This may be a legitimate belief to have at particular points in time.

But it can only take one piece of bad news to turn the tide. There’s no better way to illustrate this than with the example of junior explorers – a company may have recorded several spectacular drilling hits but it only takes one bad one or a government order to half activities to send shares plunging.

2. Not doing due diligence

This is a few years ago now but we think this is a perfect example of this point. Remember when the Obama administration lifted restrictions on Cuba and the ETF with the ticket CUBA rose? And this ETF in question Herzfeld Caribbean Basin Fund had nothing to do with Cuba at the time? Investors thought it did just because of its ticker.

In our view, successful investing requires due diligence beyond simply looking at the company’s name and one or two announcements. You need to look through several months worth of news and the company’s annual reports as a bare minimum.

Better yet, if you look at competing stocks and compare them if the one you are interested in investing in.

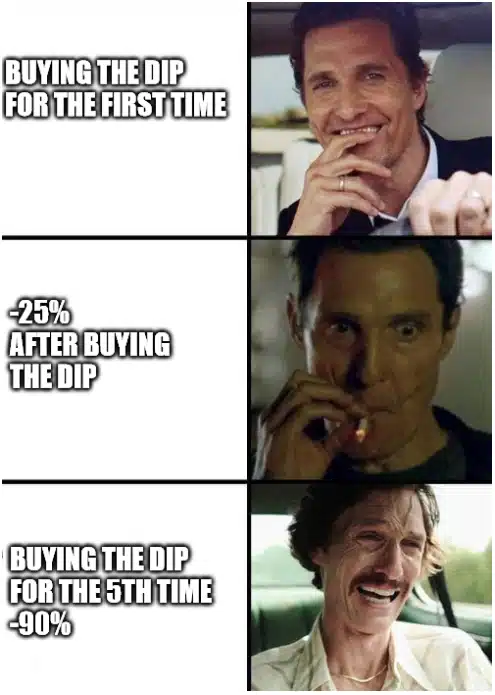

3. Not walking away from bad investments

When a stock is falling, there’s a risk of buying into it (or buying more if you’re already a holder) thinking it’ll bounce back. At best, this stock may go nowhere, denying you of alternative opportunities that may’ve turned out better for you. At worst, you may compound your losses.

Source: WallStBets/Reddit

The best way to avoid this is by using stop losses. Sell a stock when it hits a certain price point or percentage below your price – and sell no matter what.

4. Not monitoring investments

It was once said that if due diligence has been done when a stock is bought, the time to sell is never. But sometimes your investment thesis may change on a certain company dependant on circumstances that occur.

By regularly monitoring the market you might find new opportunities or new information on companies you are invested in which may cause you to rethink the company.

Of course, there is a risk that in monitoring too much (i.e. watching the share price all the time), you become distracted from why you invested in the first place and risk selling ut of a god company.

5. Putting in more than you’re willing to lose

Lastly, the #5 of top investing mistakes. Don’t invest any more than you’re willing lose. When investing, you are seeking to make money and not lose it. So you shouldn’t use money you need to fund short-term needs.

Hopefully, investors reading this article will make the right decisions about what to invest in and employ stop losses so this prospect won’t be significant. But you still shouldn’t use money you need in the short-term.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…