Investing in Gold: Here’s why investors should consider it and 4 ways they are able to

![]() Nick Sundich, January 15, 2024

Nick Sundich, January 15, 2024

With gold as the pre-eminent symbol of wealth and prosperity throughout history, investing in gold is a very popular investing option. Gold remains an important asset for investors seeking to diversify their portfolios and protect against inflation. Sure, it lacks the long-term growth story that battery metals do, and arguably hasn’t been as much of an inflation hedge as in the past, there are much risker investments that can be made.

In this article, we look at why investors may consider investing in gold, and four ways in which they can do so.

Why investors may consider investing in gold

1. Safe Haven Investment

During times of economic turmoil, investors often turn to gold as a safe haven investment. This is because gold has proven to hold its value over time, making it a reliable store of wealth. When stock markets are volatile or currencies lose value, gold can provide stability and security for investors.

2. Hedge Against Inflation

Inflation refers to the increase in prices of goods and services over time. This means that the purchasing power of a currency decreases, making it more expensive to buy goods and services. Gold has historically been seen as a hedge against inflation because its value tends to rise when there is high inflation. Investing in gold can help protect your wealth from the effects of inflation.

3. Portfolio diversification

Investing in gold can also help diversify your investment portfolio. Diversification means spreading out your investments across different asset classes such as stocks, bonds, and commodities. This helps reduce the overall risk of your portfolio because if one asset class is performing poorly, other assets may perform well and balance it out. Gold has a low correlation with other asset classes, making it an excellent way to diversify your portfolio and reduce risk.

4. Demand for Gold

The demand for gold is constantly increasing, making it a valuable investment opportunity. In addition to its traditional uses in jewelry and currency, gold also has industrial applications in electronics, dentistry, and medicine. The demand for these industries is expected to grow in the future, driving up the price of gold.

How to invest in gold

Investing in gold can take various forms, depending on an investor’s goals and risk tolerance. Here are 4 ways you can invest in gold:

1. Physical Gold

The most traditional way of investing in gold is by purchasing physical gold, such as coins or bars. This form of investment allows investors to own the actual metal and store it themselves. However, storing physical gold comes with its own set of challenges, including storage fees and insurance costs.

The key advantage of investing in physical gold is that it provides a tangible form of investment. Unlike stocks or ETFs, which are essentially paper assets and may not hold any physical value, physical gold can be held in your hand and has inherent value. Moreover, investing in physical gold allows for direct ownership and control over your investment. You can choose where and how to store your gold, giving you more control over its security and accessibility.

One potential downside of investing in physical gold is the cost and logistics involved in purchasing, storing, and insuring the gold – especially if you have a lot of it. These expenses can add up and reduce the overall return on investment. Another con of investing in physical gold is that it may not be a liquid asset. In times of financial crisis, it may be challenging to find a buyer for your gold at a fair price, making it difficult to turn your investment into cash quickly. Additionally, physical gold is subject to wear and tear, potential theft, and loss of value due to market fluctuations. These risks can affect the overall return on investment and may require additional costs for security measures or insurance.

2. Gold ETFs

An Exchange-Traded Fund (ETF) is a type of security that tracks the performance of an underlying asset, in this case, gold. Gold ETFs are traded on stock exchanges, making them easily accessible to investors through their brokerage accounts. They provide a convenient way of investing in gold without having to worry about storage or transaction fees.

One of the main advantages of investing in gold ETFs, whether on the ASX or another exchange, is their ease of access and high liquidity. Investors can buy buy and sell them at any time during market hours. This makes them a more convenient option compared to physical gold or even gold stocks. They also offer a degree of diversification not plausible with other options, because gold ETFs will have a number of investments in them. And finally, they are more cost-effective as investors only pay a small management fee that is significantly lower than the expenses associated with physical gold.

At the same time, there are some cons. Unlike investing in physical gold or even gold stocks, investing in gold ETFs does not give you actual ownership of the underlying asset. This means that investors will not be able to physically hold or own the gold represented by the ETF. This can be a disadvantage for those who prefer to have tangible assets. Also consider that although gold ETFs are generally lower cost compared to physical gold, they still come with management fees that can eat into investors’ returns. These fees are usually a percentage of the total investment and can add up over time, especially for long-term investments.

3. Gold Mining Companies

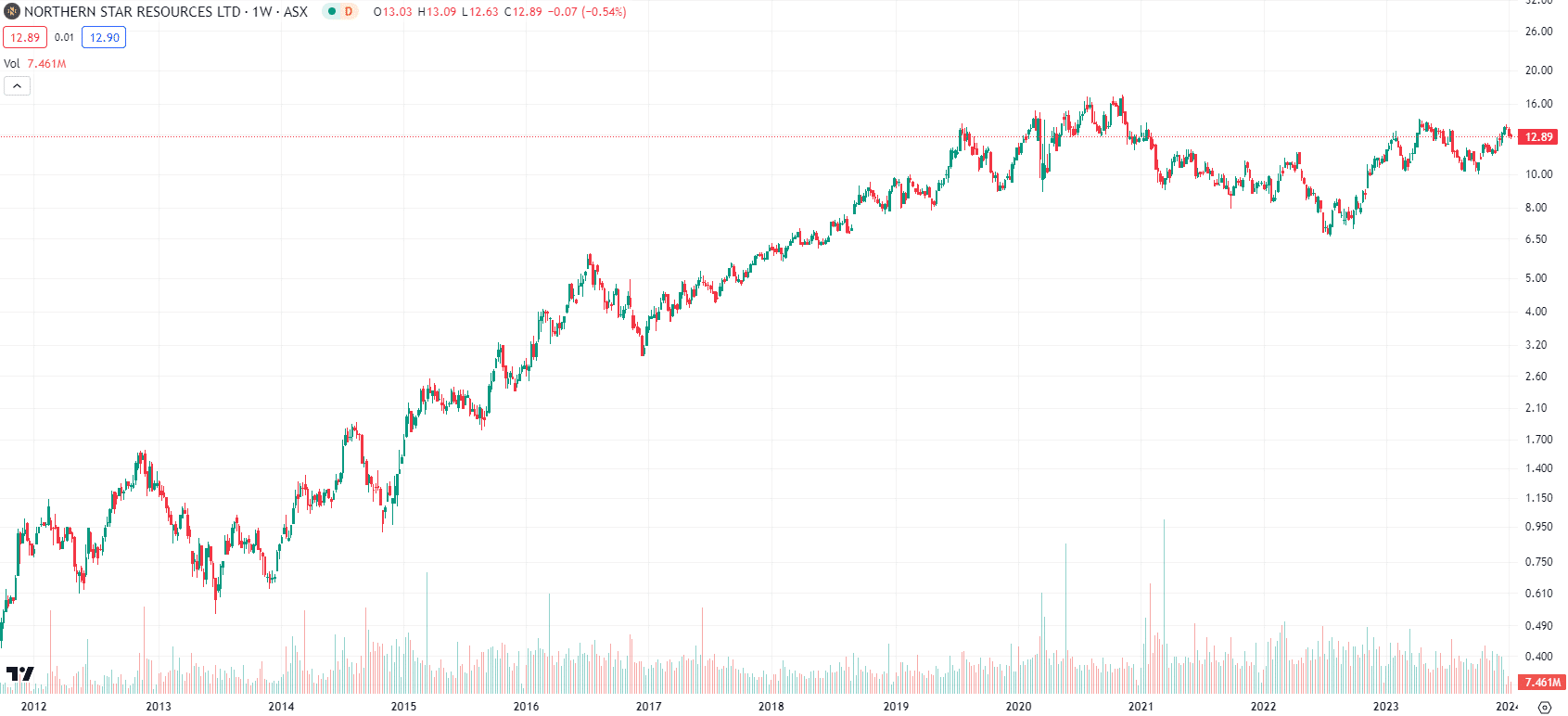

Investing in gold mining companies is another way to gain exposure to the precious metal. With this investment, investors buy shares of a company that mines gold and potentially profit from the rise in its value. Of all the options on this list, these offer the potential for highest yielding returns. Shares can substantially re-rate if a company has good production figures, or if it is an explorer and stumbles across a major deposit. Some of the best performing companies in the last decade have been gold mining stocks like Ramelius (ASX:RMS) and Northern Star (ASX:NST).

However, investing in gold mining companies comes with higher risk factors compared to purchasing physical gold or ETFs. Like any stock, the value of gold mining stocks can be highly volatile. They are subject to market fluctuations and company-specific risks, making them riskier than owning physical gold. Also consider that investing in a specific gold mining company carries the risk of that company underperforming or facing financial difficulties. This can result in a decline in the value of the stocks, even if the price of gold remains stable.

Northern Star (ASX:NST) share price chart (Graph: TradingView)

4. Futures Contracts

Investors looking to make short-term bets on the price of gold may choose to invest in futures contracts. A futures contract is an agreement to buy or sell a specific amount of gold at a predetermined price and date in the future.

One of the main advantages of investing in gold futures is leverage. Futures contracts require only a fraction of the total value as margin, allowing investors to control a larger amount of gold with a smaller investment. This can lead to significant profits if the price of gold moves in the expected direction. Additionally, futures contracts are highly liquid, meaning they can be bought and sold easily on major exchanges.

However, the leverage that comes with futures trading also presents a significant risk. If the price of gold moves against an investor’s position, it can result in substantial losses. This risk is further increased by the fact that futures contracts have expiration dates, and if the investor does not close their position before the expiration, they may be required to take delivery of physical gold or roll over the contract for a fee.

Conclusion

Investing in gold is a popular investment option. It is one of the best ways that investors can diversify their portfolios and protect against inflation. This being said, there are multiple ways to invest in gold that carry their own pros and cons. It is important that investors wanting to invest in gold consider them all and choose what is best for their own financial circumstances.

What are the Best shares to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…