ASX ETFs (Exchange Traded Funds): Here’s why they’re a good option for investors to consider, and here are our Top 4!

![]() Nick Sundich, January 18, 2024

Nick Sundich, January 18, 2024

There are a variety of options available for investors looking to invest in the stock market, with ASX ETFs (Exchange-Traded Funds) being one of the most popular.

According to BetaShares, the ETF industry has $177.4bn in FUM as of January 2024 and has seen $15bn in net inflows during CY23. The former figure is expected to surpass $200bn in another 12 months and there are over 2 million Australians investing in this asset class. But what exactly is an ETF and why should you consider investing in one?

What is an ETF?

An ETF is a type of investment fund that holds a basket of assets such as stocks, bonds, or commodities. It can be bought and sold on an exchange, similar to a stock, making it a more accessible option for investors compared to traditional mutual funds.

In other words, it is like having your money invested by professional fund managers, but instead of handing all the money to them and leaving it at the mercy of the fundies, you just buy and sell shares in the ETF and have exposure to a broad portfolio of stocks.

ETFs can be exposed to a variety of assets or thematics – from regular currencies to cryptocurrencies, from commodities to forex fluctuations, from Australian indices to foreign indices, from healthcare to technology…there are even so-called ‘anti-woke ETFs‘. With over a hundred options on the ASX so far as this asset class, there’s something for just about all investors.

This being said, it does not mean that investors should necessarily invest in them, at least not without due diligence. Remember when the Obama administration lifted restrictions on Cuba and an ETF with that code rose roughly 50% in a day even though it had very little to do with Cuba specifically?

The rise of trading apps and Millennial/Gen Z investors has made it easier than ever for people to gain exposure to broader investment trends than at any point in the history of investing. Notwithstanding that the above is an extreme example, we don’t think it is totally irrelevant to point out in order to highlight that investors should do further due diligence rather than just looking at a fund’s name and/or code.

Advantages of ETFs

Several advantages of investing in ETFs exist. One of these is their low cost, they typically have lower management fees compared to actively managed funds, making them a more affordable option for investors. Additionally, since these funds are traded on exchanges, there are no sales loads or commissions involved, further reducing the costs for investors.

Another advantage (as we’ve briefly touched on) is their diversification. By investing in an ETF, you are essentially buying a basket of stocks, which helps spread out your risk. This means that if one stock within the fund performs poorly, it may be offset by the performance of other stocks in the fund.

ETFs also provide investors with flexibility. Unlike mutual funds, which can only be bought or sold at the end of the day, these funds can be traded throughout the day just like stocks. This allows investors to make quick buying or selling decisions in response to market changes.

Disadvantages of ETFs

However, there are also disadvantages to investing in ETFs. One major disadvantage is that you have less control over the assets held in the fund. Unlike individual stocks, where you can choose which companies to invest in, ETFs have a predetermined portfolio determined by the fund manager. And you may not know all of the stocks it holds. Most will disclose the top 10 or so, but you’ll need a professional financial data source (like a Bloomberg Terminal) to see the full list.

ETFs may also be subject to volatility and market fluctuations. Since they are traded on exchanges like stocks, their prices can fluctuate throughout the day based on market demand. This means that investors may experience more short-term volatility compared to traditional mutual funds.

Another potential disadvantage of ETFs is the lack of personalised advice. Unlike actively managed funds, where a fund manager makes investment decisions on behalf of investors, ETFs are passively managed and do not offer personalized advice or guidance.

And finally, unlike regular stocks, management fees will eat into returns you might get from the fund. Given it is a fixed fee of FUM and is rarely over 1.5% or so, it may not even be noticed if the ETF makes a return. However, the fee is liable to be paid (indirectly) regardless of performance.

The 4 best ASX ETFs

VanEck Morningstar Wide Moat ETF (ASX:MOAT)

This one purports to give investors exposure to a diversified portfolio of attractively priced US companies with sustainable competitive advantages according to Morningstar’s equity research team. It has about 50 companies and total net assets of A$794.2m.

This fund is focused on companies with a so-called ‘moat’. As we’ve written about previously, companies with moats have a competitive advantage, or the factor that sets it apart from its rivals and allows it to maintain its position in the market. This may take the form of a proprietary technology or product, a strong brand reputation, or exclusive access to key resources or distribution channels. If you look at just a handful of the companies this one holds – such as Alphabet, Nike, Microsoft, Thermo Fisher and Wells Fargo – you might be able to see why.

Global X FANG+ ETF (ASX:FANG)

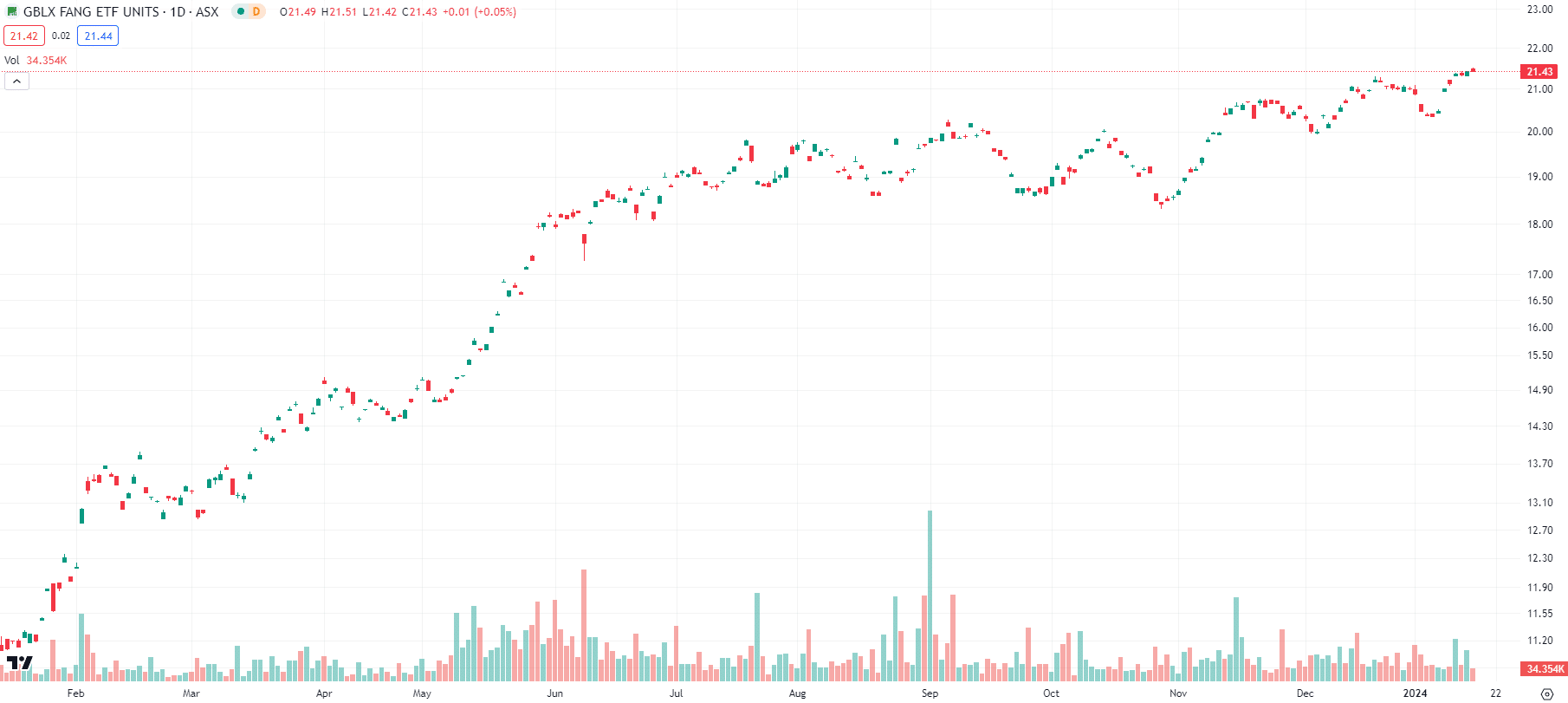

This ETF is the 4th best performer with a 94% gain. We will get to the top 3 shortly. It invests in the so-called FAANG stocks (and the whole Magnificent Seven as it has gradually evolved with the emergence of Nividia and reemergence of Microsoft), but also a handful of other high-growth tech stocks.

GlobalX FANG ETF (ASX:FANG) share price chart, log scale (Source: TradingView)

iShares S&P 500 ETF (ASX:IVV)

The S&P500 is the most famous indice in the world, and this ETF tracks the indice by investing in companies that are a part of it. This ETF went up 25% in CY23. Investing in US stocks can be difficult because it comes with several caveats not true with ASX stocks including American tax implications and different market hours. This ETF overcomes these obstacles.

BetaShares Crypto Innovators ETF (ASX:CRYP)

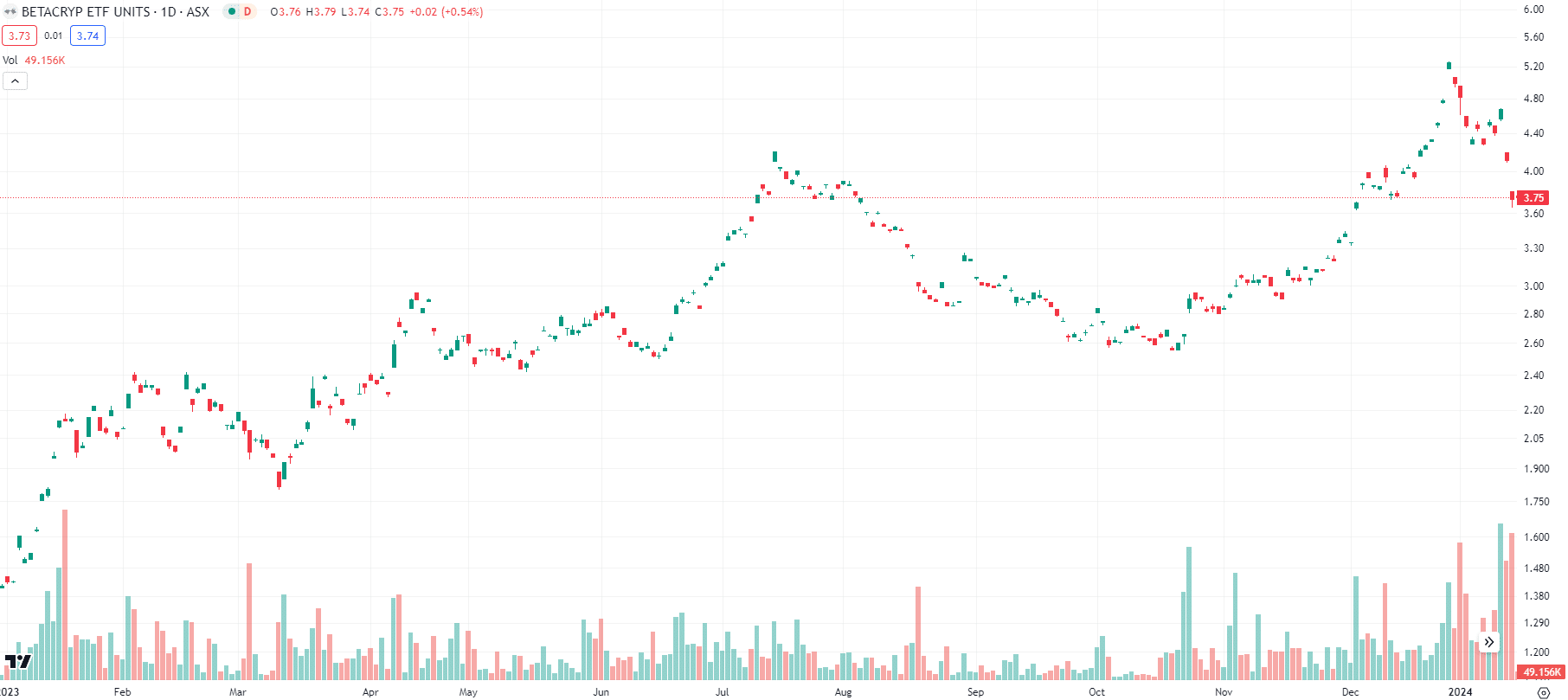

The CRYP ETF invests in listed companies that are exposed to cryptocurrencies. The top 3 are: Marathon Digital Holdings, Galaxy Digital Holdings and Coinbase. This is also the best performing ASX ETF in 12 months with a 214.5% across CY23.

BetaShares CryptoCurrency Innovators ETF (ASX:CRYP) share price chart, log scale (Source: TradingView)

The Global X 21Shares Bitcoin took bronze place with a 130% gain, thus illustrating the increasing interest in investing in cryptocurrencies, but in an easy way. The silver spot was taken by the Global X Ultra Long Nasdaq 100 Hedge Fund, in case you were wondering. The worst was a Global X ETF that was short on the NASDAQ, and it fell 64%!

Conclusion

As you can see, ETFs are a viable investment option for investors to consider. However, there are disadvantages as well as advantages, and so it is important for investors to carefully consider their investment goals and risk tolerance before deciding to invest in ETFs or other types of funds. The decision to invest in ETFs should align with an individual’s overall investment strategy and portfolio diversification goals.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…