Why has the Aussie dollar been weak in 2023 and is this good or bad for shares?

![]() Nick Sundich, October 16, 2023

Nick Sundich, October 16, 2023

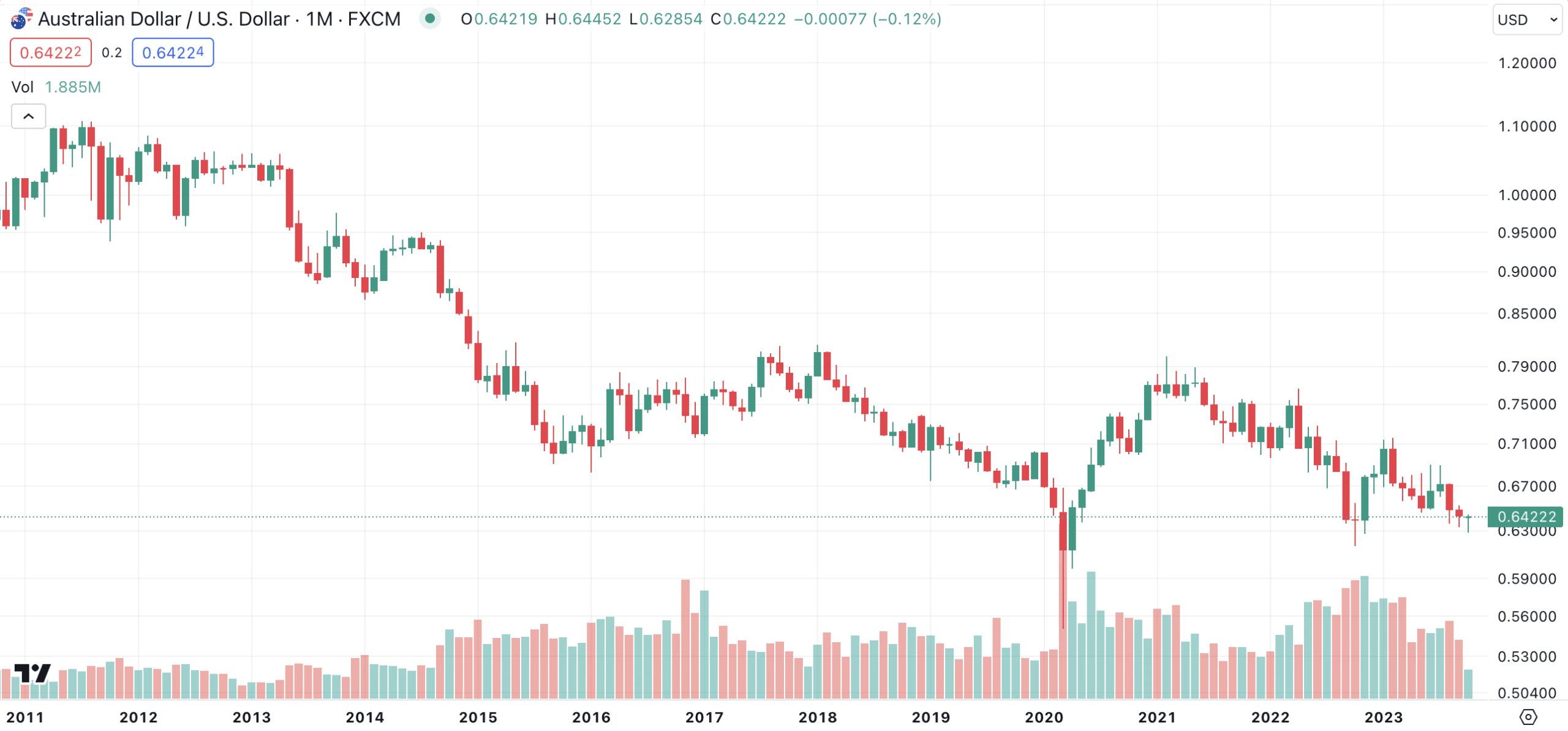

Just over a decade ago, the Aussie dollar was on parity with the US dollar, meaning you could buy a US dollar with a dollar Down Under. Today, you can buy just ~67c with the same amount. Why does our dollar fluctuate? Why has it been weaker since hitting parity early in the 2010s? And is it good or bad for shares?

First published March 27, 2023 – last updated December 4, 2023

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

How is the value of the Aussie dollar determined?

The Australian dollar is a floating currency, meaning it is primarily determined by the dynamics of market forces, in particular supply and demand. Prior to the 1980s it was pegged to other currencies (the British pound until the 1970s before the US dollar for the 1970s). The changes made by the Hawke government soon after it came to power mean that changes in global economic conditions, international trade flows and geopolitical events can have a significant effect on the value of the AUD against other currencies.

Central bank activity is also important, as interest rate shifts or monetary policies can influence investor confidence about acquiring and holding foreign currency, including our dollar. The resources sector has traditionally been a key factor affecting levels of national income and employment that impact overall demand for local currency.

Finally, government fiscal policy and regulations also play a role as they shape business performance which affects investments both domestically as well as internationally. You may remember in 2011, our dollar was above parity with the US dollar. But it has not returned to these levels ever since.

Our dollar vs the greenback, log scale (Source: TradingView)

Why has the AUD/USD been weak recently?

First of all we would like to note that it is easy to forget that currency appreciation and depreciation works both ways – it is not only the case that the AUD is depreciating but other currencies are appreciating. The Australian dollar has been weak recently due to a number of factors, including:

- Lower interest rates in Australia relative to other countries,

- The appreciation of the US dollar against the AUD, and

- Weak commodity prices.

In addition, uncertainty around international trade, geopolitical tensions, the US debt ceiling and instability in the US regional bank sector have caused investors to move away from riskier assets like the AUD. This combination of factors has caused our dollar to be weaker than its peers in recent months.

However, it is easy to forget that the AUD/USD is one foreign exchange link. It is also important to look at other relationships including AUD/NZD, AUD/GBP and AUD/Euro. The AUD is actually performing strong against certain other currencies, in particular the Japanese yen and New Zealand dollar. Nonetheless, it is said that the Aussie dollar is weak just because it is not as strong against the USD as it has been in the past.

Is a weak AUD good or bad for shares?

A weak Australian dollar can be seen as both good and bad for shares. On the one hand, it can lead to lower prices for investments in foreign stocks, which makes them more attractive to Australian investors due to the reduced cost of acquiring them in foreign currencies. In addition, profits from foreign companies paid in their local currency will be greater when their currency is stronger against the weaker Australian dollar.

On the other hand, a weak Australian dollar could also make domestic companies less competitive on an international level, since their products will become more expensive for buyers abroad. For example, if a company sells products that are priced in Australian dollars but are sold outside of Australia, then a weaker currency can mean less interest from international customers due to higher prices.

Furthermore, this could also have an impact on domestic employment as businesses may not be able to generate enough revenue with their products being priced too high outside of Australia. Overall, there’s no clear cut answer.

Ultimately, it depends on individual shares

Whether or not a weak Australian dollar is good or bad for shares depends on the individual company and how it can navigate those changes. Companies with strong international presence may benefit from the increased profits by selling their goods at lower prices while still maintaining reasonable margins.

Similarly, domestic businesses with strong export capabilities may also benefit if they are able to create economies of scale and reduce costs efficiently in order to keep up with international competition.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…