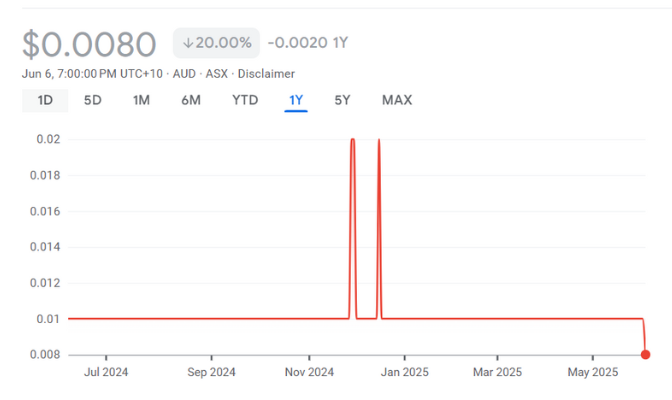

King River Resources (ASX: KRR)Share Price and News

About King River Resources

King River Resources is a mining exploration company focused on discovering and developing high-value mineral resources in Australia. It has a key interest in the rare earth sector, specifically targeting strategic minerals such as vanadium, titanium, and lithium. The company’s flagship asset was the Speewah Vanadium-Titanium-Iron Project, located in Western Australia, though the project was sold in early 2025. King River Resources also holds several other promising exploration assets.

The company aims to bring these projects to development, capitalising on the increasing global demand for minerals critical to green technologies, electric vehicles, and other sectors. King River Resources differentiates itself by its commitment to innovative exploration techniques and a long-term approach to sustainability, making it an appealing player in the growing resource sector.

King River Resources Company History

King River Resources was founded in 2002, originally focused on the exploration of base and precious metals. Over the years, it has shifted its focus to the rapidly growing market for rare earth elements. The company’s pivotal moment came with the acquisition of the Speewah Vanadium-Titanium Project, one of the largest undeveloped vanadium resources globally. This shift marked a strategic move towards diversifying its portfolio and positioning itself at the forefront of the critical minerals market. Since then, King River Resources has attracted attention from investors and industry experts as it continues to advance its exploration activities. Its ability to adapt to market demands, coupled with its strong exploration assets, has helped maintain a solid foundation in the competitive mining industry.

Future Outlook of King River Resources (ASX: KRR)

King River Resources is well-positioned to capitalise on the growing demand for critical minerals, particularly in the context of Australia’s push towards clean energy and sustainability. The company’s focus on the emerging battery metal market, particularly vanadium, lithium, and rare earth elements, is expected to continue its upward trajectory due to increasing demand for energy storage solutions.

King River Resources is also focused on advancing its lithium and rare earth assets, which further supports its growth potential in the clean energy sector. The mining industry, particularly the rare earths sector, has attracted significant capital and attention due to increasing demand from high-tech industries, including electric vehicle manufacturing.

King River’s exposure to these trends is expected to strengthen its market position. However, risks remain, particularly about the volatility of commodity prices, regulatory changes, and operational challenges. Given that many of King River’s projects are still in the early stages of development, the company must execute its exploration and development plans effectively to unlock value.

Ongoing exploration activities will be critical in ensuring that these projects reach their full potential. Investors should monitor updates on exploration progress and any potential partnerships that could accelerate the company’s path to production.

Is King River Resources (ASX: KRR) a Good Stock to Buy?

Evaluating King River Resources (ASX: KRR) as a potential investment requires examining its fundamentals and broader market dynamics. On the valuation front, KRR remains in the exploration phase, which means the company has yet to generate significant revenue. This makes its stock more speculative compared to established miners.

However, the potential upside is substantial, as demand for critical minerals like vanadium, lithium, and rare earth elements is expected to rise in the coming years. From a dividend perspective, King River Resources does not currently offer a dividend, as it reinvests its capital into exploration and project development. As the company moves closer to production, there could be opportunities for dividends, but this remains a longer-term consideration.

The stock’s risk profile is elevated due to the early-stage nature of its projects. The volatility in the commodities market, particularly for rare earths, adds further uncertainty. Despite these risks, analysts remain bullish on King River’s long-term potential, given its exposure to high-demand minerals essential for global technological advancements. Institutional investors have shown interest, with some viewing the stock as a growth play in the resource sector.

Overall, King River Resources may be an attractive stock for investors with a higher risk tolerance and a long-term outlook, particularly those interested in the renewable energy and critical minerals markets. The company’s future performance will depend on its ability to bring its projects to fruition and capitalise on the growing demand for rare earth and battery metals.

Our Stock Analysis

Sorry, we couldn't find any posts. Please try a different search.

Frequently Asked Questions

King River Resources does not currently pay a dividend as it is focused on reinvesting its capital into exploration and development activities.