Leo Lithium (ASX:LLL)

Our investment strategy for Leo Lithium (ASX:LLL)

- Buy LLL up to $0.65.

- Our minimum target price for LLL is $0.85.

- Use a stop loss at $0.50.

Leo Lithium investment case

- Leo Lithium is developing the Goulamina Lithium Mine in Mali, and is set to become West Africa’s first spodumene concentrate producer;

- The mine is currently under construction and the first 6% spodumene concentrate product is expected in mid-2024;

- Early and accelerated revenue opportunity from targeted export of Direct Shipped Ore (DSO) on track for H2 2023;

- Leo Lithium is currently capitalised at A$677m, but the fully-expanded Goulamina project has an after-tax NPV of US$2.9bn – allowing Leo Lithium a 40% stake should the Mali government take 20%, and that 40% is notionally worth A$1.7bn;

- Surging lithium demand globally can underpin Goulamina’s growth over the next decade.

- Additionally, M&A activity in the lithium space is picking up as valuations have come down in line with the lithium price in the last 6 months. The rejected bid on Liontown Resources (ASX: LTR) is a case in point and has almost doubled LTR’s valuation in just five weeks. We’re not saying LLL will see a takeover bid, but we think the LTR offer illustrates the undervaluation for lithium plays, at the moment.

Leo Lithium (ASX:LLL) share price chart, log scale (Source: Tradingview)

Who is Leo Lithium?

Leo Lithium is a Perth-based resource developer whose flagship project is the Goulamina Lithium Project in the West African nation of Mali. In 2022 the company was spun out of the gold miner Firefinch (ASX: FFX), which had worked on the project since 2016. The Leo Lithium IPO raised $100m at 70 cents per share to fund Leo’s share of Goulamina construction. Firefinch retained a 17.6% stake and is currently the only substantial shareholder, escrowed until June 2024.

Goulamina is a 50/50 joint venture with Ganfeng, China’s largest lithium chemicals producer by capacity. The Goulamina mine is fully funded and under construction, with first 6% spodumene (SC6) production expected in mid-2024.

Goulamina, an open-pit hard rock lithium mine, is located near Bougouni in Sikasso Region of southern Mali, approximately 150 km by road from Mali’s capital, Bamako. Ore will be trucked to the coast for export, likely from the Cote d’Ivoire port of Abidjan, with the company requiring a fleet of about 250 trucks over a 6-7-day cycle at full production. Leo Lithium, as project operator, is currently working on a Direct Shipping Ore (DSO) option for Goulamina that would bring forward revenue.

The current intention of Leo Lithium and Ganfeng is to develop Goulamina in two stages.

- Stage 1, 506,000 tonnes of spodumene concentrate per annum, with first product expected mid-2024 but with early revenue from DSO in the second half of 2023;

- Stage 2, 831,000 tonnes of spodumene concentrate per annum, potentially commissioning in 2025-26.

A December 2021 Definitive Feasibility Study update valued Goulamina, when fully expanded to Stage 2, at US$2.9bn post-tax. This figure was obtained using an 8% discount rate and a conservative spodumene price of US$1,250 per tonne for the first five years and US$900 per tonne thereafter (right now, 6% spodumene concentrate is trading in China at around US$3,735 per tonne). Allow Leo Lithium a 40% stake should the Mali government take 20%, and that 40% is notionally worth A$1.7bn at an AUDUSD exchange rate of 0.67.

Mali is an established pro-mining jurisdiction that is rapidly emerging as one of the world’s largest gold producers. Goulamina would be the first lithium mine not just in Mali but in the whole of West Africa. The project resource, at 142 million tonnes at 1.38% lithium oxide (Li2O), is amongst ten largest spodumene resources in the world, but Leo Lithium expects further resource and reserve growth as a result of current drilling campaigns.

Check out our interview with Leo Lithium CEO Simon Hay below!

Our investment thesis for Leo Lithium

- The long run lithium price is headed up. Since Leo Lithium went public in June 2022 the Chinese price of lithium has peaked and then declined. We expect that lithium can stabilise and then re-rate in the near term.

- Long-run lithium demand is headed up. World demand for lithium is expected to be five-to-seven times higher in the early 2030s compared to the present, thanks to the widespread electrification of the economy in the current decade, leading to increasing demand for lithium-ion batteries in Electric Vehicles and other products.

- The market is markedly underpricing Leo’s share of the Goulamina project. A December 2021 Definitive Feasibility Study update valued Goulamina, when fully expanded to Stage 2, at US$2.9bn post-tax. This figure was obtained using an 8% discount rate and a conservative spodumene price of US$1,250 per tonne for the first five years and US$900 per tonne thereafter. Should the Mali government take 20%, that 40% is notionally worth A$1.7bn at an AUDUSD exchange rate of 0.67. By comparison Leo Lithium is capitalised at only ~$677m.

- Goulamina is a long-life, low-cost operation. Average Life-of-Mine Cash Cost of just US$312 per tonne of SC6 produced while All-In Sustaining Cost is US$365 a tonne. Mine life is a minimum of 21 years.

- Goulamina is a big project. The current resource base at Goulamina of 142 million tonnes at 1.38% Li2O is notable because it is one of only a few projects in the world where the resource is greater than 100 million tonnes and the grade is greater than 1.0%.

- The Goulamina resource will continue to grow for a while yet, because as Leo continues to drill and explore across the 101 sq km project area, which has proved highly prospective for hard rock lithium pegmatites. In January 2023 the resource increased by 33.8 million tonnes, to the present 142.3 million tonnes, after just $4m worth of drilling conducted over four months. Another resource upgrade is expected in June 2023. An April 2023 transaction saw the Goulamina Project area expanded to 287 sq km.

- The Goulamina product is high quality, with its 6% Li2O spodumene concentrate (SC6) having less than 0.6% Fe2O3 content and low mica. This should help ensure that pricing stay good for Leo and its partners.

- Leo Lithium regularly generates good exploration results. For example, on 13 April 2023 the company reported high grade, thick intercept results from the Danaya and Northeast domains of the project area. Significant intercepts include 115.7 metres at 1.74% Li2O and 71 metres at 2.00% Li2

- Ganfeng is a strong partner for Leo Lithium. Ganfeng[1], which became Firefinch’s joint venture partner for Goulamina in June 2021, is China’s largest lithium chemicals producer by capacity, supplying downstream to the likes of BMW, LG Chem and Tesla. The company, which is not a State-Owned Enterprise, is currently capitalised on the Shanghai Stock Exchange (SHE: 002460) at about US$17.7bn. Ganfeng has a track record of operating successfully with Western companies, as evidenced by its partnership with Mineral Resources (ASX: MRL) over the Mt Marion Lithium Project in WA. Ganfeng has not only provided credibility but also provided substantial funding as well as offtake, and technical support[2]. We believe that Ganfeng’s involvement increases the likelihood that Goulamina can go to Stage 2.

- Goulamina has a low level of capital intensity. To initiate the 506,000 tpa Stage 1 of Goulamina, Leo Lithium only needs to spend US$318m. Initially Leo had estimated US$255, but then in April 2023 allowed an additional contingency of US$25m and added US$33m for ‘operational readiness’, as it more comprehensive costed plan for commissioning spodumene production in Mali. Even at the higher price, Goulamina has one of the lowest capital intensity projects globally in terms of the ratio of capital to value. It’s worth noting that Stage 2 only requires another US$70m in capex as per the 2021 DFS, and the post-tax IRR for Goulamina on the DFS is a massive 83%.

- Leo Lithium is going after an early revenue opportunity with Direct Shipping Ore. In mining a ‘Direct Shipping Ore’ product is one where the ore is shipped to the customers after mining with no further processing. From 2024 Leo will be processing its ore so that it ships a 6% spodumene concentrate product. However, in 2023 it hopes to enjoy early revenue from an unprocessed 1.2-1.5% lithium product. An initial 60,000 tonnes of DSO is being targeted, at an estimated production cost of US$300 per tonne FOB. The timing, terms, funding, discharge port etc are currently being worked out but at this stage first DSO shipments are planned for Q4 2023.

- Leo Lithium has managed its risks well. For example, in April 2023, the company announced that the port of San Pedro, in Cote d’Ivoire, was being considered as an export port for Goulamina ore, alongside the port of Abidjan. That way the operation can avoid potential logistics issues that may arise from a single export port.

- Mali is a pro-mining jurisdiction, with the country having grown into a major gold producer in recent years with major companies operating well. The coups of 2020 and 2021 have not impacted the mining industry in any material way. The government of Mali has the right to a 10% free-carried interest in Goulamina, and a further right to an additional 10% in the project at fair market value. The required 10% free-carried interest is lower than other jurisdictions.

- Goulamina commissioning is fully funded. The US$318m in pre-production capex is mostly funded by Ganfeng in debt and equity. Leo believes that its corporate cash and sales of DSO ore can fund its share of the project. As at March 2023 Leo Lithium held A$71.2 in cash. At present there is only US$40m in project debt, from Ganfeng. This facility is expandable.

- As at early March 2023 the project was on schedule. In a May 2023 presentation Leo Lithium indicated that the project is on schedule, with construction having started in February 2022 and expected to take 27 months until first spodumene concentrate.

- Leo Lithium has solid leadership. Managing Director Simon Hay was formerly CEO of Galaxy Lithium, a pioneering lithium producer that operated the Mt Cattlin hard rock mine in Western Australia. When Hay started at Galaxy Resources, the lithium industry was struggling. By 2021 Galaxy had become part of the $7.5bn megamerger which created Allkem (ASX: AKE). Before Galaxy, Hay gained valuable African experience in his ten years at Iluka Resources, which included three years as Head of Resource Development where his team oversaw developments in Sierra Leone.

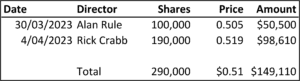

- There has been some recent buying by directors, with Chairman Rick Crabb and non-executive director Alan Rule both buying on-market at just over 50 cents (see table below). Rule was CFO of Galaxy Resources with Simon Hay.

[1] See ganfenglithium.com/index_en.html.

[2] For example, a ball mill with a normal lead time of two years took just nine months with Ganfeng’s help.

Director buying

Mali is a safe place in which Leo Lithium can operate

Mali is a pro-mining jurisdiction. Mali, capital Bamako, population 21.4 million, is a large landlocked country in West Africa that is known as a major gold producer as well as an exporter of cotton, sesame seeds, lumber, and vegetable oils. Mali is a low-income country, with GDP per capita in 2021 of only US$2,100, and it has experienced political instability in recent years as well as some problems with terrorism. However major mining companies have a long track record of successful operation in Mali.

Mali has emerged as a major gold producer, with output of 66.2 tonnes in 2022, around 4.4% higher than the previous year. Mali is now Africa’s fourth biggest gold producer after Ghana, South Africa and Sudan. Gold miners active in Mali include Barrick (NYSE: GOLD), B2Gold (TSX: BTO), Resolute Mining (ASX: RSG[1]), AngloGold Ashanti (JSE: ANG) and Hummingbird Resources (LSE: HUM).

Mali has reasonable fiscal terms. We noted above that the government of Mali can take 20% of the project, being 10% free-carried and another 10% purchased at fair market value. Corporate tax in Mali is 30%, VAT is 17% and royalties are 6%.

Mali has had two coups recently, but that has not impacted the mining industry in any material way. Mali has been a country in political transition since President Ibrahim Boubacar Keita was rolled from office by an Army mutiny after nearly seven years in the job. That coup was led by Colonel Assimi Goita, who allowed a retired colonel and former defence minister named Bah Ndaw to serve as President until May 2021 before Goïta named himself as interim President. The transitional government has laid out a roadmap toward 2024 elections. The important thing to note about these coups is that they were bloodless and there was no serious impact to the mining industry[2], just as nothing much changed for the miners and explorers after a military coup in 2012.

Goulamina is a long way from trouble. Mali is a country of two halves. The sparsely populated and mostly desert northern half above the 15th parallel (which includes the legendary Timbuktu) has, over the last decade or so, become a badlands associated with terrorism and extremism. The more fertile southern half, where the capital of Bamako lies, is also where you find the gold mines and where the security risks are much lower. Goulamina is 150 km southeast of Bamako in Mali’s southernmost region, Sikasso, and 50 km west of a town called Bougouni.

Strong support from the Mali Government. Throughout Leo Lithium’s corporate life, the company and its employees have been warmly supported by the Malian Government and the local communities that surround the Goulamina Project. Leo Lithium is also committed to ensuring that the people of Mali receive the significant economic and social benefits that the project can provide.

[1] Operator of the Syama Gold Mine 300 km southeast of Bamako.

[2] Firefinch announced it experienced difficulties with ECOWAS borders being closed. All other gold miners were okay. Leaders of the Economic Community of West African States (ECOWAS) put economic and financial sanctions on Mali after the 2021 coup, and Mali closed its borders in response, but the sanctions were lifted in July 2022 after Mali proposed a 24-month transition to democracy and published a new electoral law.

Location of the Goulamina mine in Mali

Why has Leo Lithium stock been trending down since September 2022?

Leo Lithium did its IPO at 70 cents per share in an oversubscribed IPO. The stock peaked at 79.5 cents in September 2022. Two factors have impacted sentiment towards Leo Lithium since then:

- The decline in the spot price of lithium in China, which has been dropping in 2023 (see chart below). Lithium Carbonate as traded in China (99.5% minimum Li2CO3, battery grade) peaked at around CNY 598,000 a tonne, which was US$87,000 a tonne. It has since declined to as low as CNY 166,000 per tonne and appears to be stabilising around CNY 177,500 We believe this reflects the current market for lithium in China rather than global trends – we note, for example, that the subsidies for EVs in China, which had been offered since 2010, ended in January 2023.

- Concern over inflation risk on Goulamina construction. We noted above that Leo had experienced ‘moderate inflation experienced at package level’. We expect that any inflation can be modest given Ganfeng’s role in sourcing equipment. However, we see multiple ways to cover a budget shortfall, such as DSO sales, pre-payments for SC6, and, as we noted above, expansion of the Goulamina joint venture debt facility.

Lithium price (Lithium carbonate in CNY/t)

Why should Leo Lithium re-rate in 2023?

We see four main reasons:

- Stabilisation in, and recovery of, the Chinese price of lithium.

- First DSO ore being shipped from Goulamina.

- Completion of Goulamina construction and first spodumene concentrate.

- Accelerating M&A activity in the lithium sector.

Our initial price target is $0.85 per share

- As we noted above, the peak for Leo Lithium stock was $0.795 cents in in September 2022.

- Goulamina as per the December 2021 DFS update can be valued at $1.45 per share, assuming Leo ends up with 40% of the post-tax NPV.

- The current share price values the project at 40% of that adjusted DFS value.

- $0.85 values the project at 60% of that adjusted DFS value.

- We think $0.85 is reasonable given the way in which the project has been de-risked since IPO and because that DFS was, itself, conservative.

- However, there may be additional upside on the back of ongoing exploration and drilling that may expand the resource.

- Our buy range is up to $0.65.

- Our Stop Loss level is $0.50.

Catalysts for the re-rate of Leo Lithium

We see eight main catalysts to prompt a re-rating of the stock from here:

- The June 2023 resource upgrade.

- Further exploration drilling results.

- Further details around the DSO opportunity.

- Progress on Goulamina construction.

- First DSO ore.

- Structural completion and commissioning of Goulamina.

- Recovery of the lithium price.

- M&A activity in the lithium space.

Key risks

- Continued weakness in the Chinese lithium price.

- Political instability in Mali.

- Cost overruns in Goulamina construction, or lateness in completion.

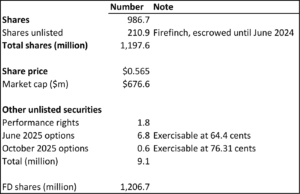

Capital structure

Leo Lithium capital structure per 8 May 2023

UPDATE 31 May 2023

We are selling Leo Lithium following an amazing share price run in just 3 weeks.

Even though we only put a BUY rating on LEO LITHIUM (ASX:LLL) on 8 May, the stock has hit our target price of $0.85.

We’re sitting on a nice 56%+ profit. And no-one ever went broke taking a profit.

Although longer term we believe there is plenty of upside to this stock, we may see weakness in the near term, i.e. down to the $0.73-0.75 range.

Concierge subscribers who want to stick with LLL longer term, may want to sell a proportion of their holding to cover acquisition cost.