Apple Inc.

(NDQ: AAPL)Share Price and News

Introduction to Apple (NDQ:AAPL)

Apple Inc. is a technology company that designs, manufactures, and markets a range of consumer electronics, software, and services. Its most notable products include the iPhone, iPad, Mac computers, Apple Watch, and AirPods, while it also offers digital services such as the App Store, iCloud, Apple Music, and Apple TV .

Operating globally, Apple has a strong footprint in just about every country on the planet (even in China which has kept out other tech giants like Google) and continues to focus on integrating hardware, software, and services to create a seamless customer experience.

Apple reigns supreme for its focus on design, user experience, and ecosystem. Its co-founder Steve Jobs continues to be remembered to this day. The brand is synonymous with quality, reliability, innovation, and arguably even luxury.

AAPL Company History

Apple was founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne in Cupertino, California. Wayne ended up selling his 20% stake for US$2,000 - poor him.

The company initially focused on personal computers, first producing the Apple I, Apple II and the Lisa, but it gained true fame with the release of the Macintosh in 1984.

Jobs and Wozniak departed in the mid 1980s and the company struggled for over a decade until Jobs returned. Job’s second stint lasted until 2011 when he stood down for health reasons and died 2 months thereafter. There's never been another run like Job's second stint where it unveiled product after product - the iMac, the iPod, iPhone, iPad.

Obviously things have been different since then. The ‘One More Thing’ days are gone. Those days could’ve realistically continued (not forever but for a few more years at least) – all Apple had to do was replace Steve Jobs with Jony Ive, the chief designer. Instead, the company opted for Tim Cook, who was Chief Operating Officer and had been with the company in various roles since 1998.

It is hard to argue his tenure has not been a success, given the company’s market cap has gone up from $377.5bn at the end of 2011 to over $3tn now, not to mention that the company’s revenue grew from $108bn in FY11 to nearly $400bn in the past couple of years. Considering some, led by Oracle CEO Larry Ellison, were not even sure the company would survive post-Steve Jobs, it is a fair feat.

In the post-Jobs era, there have been some new products, particularly the Apple Watch. None of these have been the gizmos that any of Jobs’ products were. Sure, there has been some talk about VR/AR headsets, but these endeavours are still in their early days. And of course, it keeps rolling out new phones, although the improvements are incremental at best.

Future Outlook of Apple (NDQ: AAPL)

Apple’s future outlook remains solid, driven by several key financial and strategic moves. In the very long-run, it may need a new world-changing innovation to provide a better chance of survival into the 22nd century. At the same time, being the first of the so-called FAANG stocks to have survived and thrived post its founder puts it in good stead.

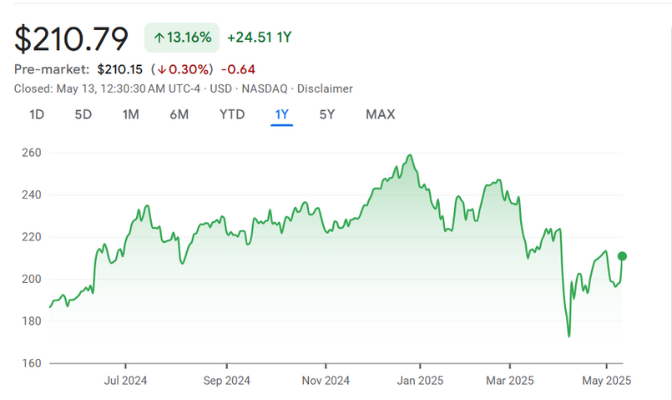

The company is an industry leader, but is still vulnerable to macroeconomic conditions and this can be seen in its share price fluctuations during 2025 as Trump flip-flopped on tariffs. As a company that has made the components of its phones overseas - especially in China; it is vulnerable to an impact even though it is trying to diversify its own supply chains. Apple’s profit margin fell from 25% to 24% in 2024, and its profit fell by 3.4% to $93.7bn.

Is AAPL a Good Stock to Buy?

Apple remains an attractive stock for many investors, but its value proposition varies depending on market conditions and investor goals. The company's US$3tn market cap may suggest it is expensive as only Microsoft and Nvidia are over $3tn too.

Other metrics suggest it is more reasonable. As of May 2025, its P/E ratio stood at approximately 27x for FY26, and the mean consensus price amongst analysts is 8% higher than the current price. Of the other 'Magnificent Seven' stocks, only Meta Platforms has a lower multiple.

Apple’s brand strength and diversified revenue streams puts it in good stead, but it still faces risks, including supply chain disruptions, geopolitical tensions, and regulatory challenges, particularly around app store practices and antitrust scrutiny.

In terms of growth potential, while Apple’s expansion may be slower than in its earlier years, it continues to benefit from growing services, wearables, and potential new products like augmented reality (AR) glasses.

The company is also exploring opportunities in health tech and automotive, which could offer significant growth avenues.

Our Stock Analysis

Cisco Systems (NDQ:CSCO): Will this US$300bn company really be a winner from the AI boom? Investors aren’t so sure

As a big company in the networking equipment space, Cisco Systems (NDQ:CSCO) is a company you could be forgiven for…

Apple Event: Buy, Sell, or Hold? What the ‘Awe Dropping’ Launch Means for Investors

Apple’s product launches are typically major events in the tech world, and their latest “Awe Dropping” launch is no exception.…

Share buybacks: Are they a good sign or a waste of money?

Share buybacks are a controversial topic amongst investors. Some say it is a waste of money, others will welcome it…

Should I buy Apple shares from Australia? Can the US$3.3tn behemoth grow any further?

Investors asking themselves, ‘Should I buy Apple shares from Australia,’ are not just considering buying shares any company, but the…

Frequently Asked Questions

Apple’s dividend yield is typically low compared to other sectors, hovering around 0.6–0.7%. However, its consistent dividend growth makes it an attractive option for income-seeking investors.