Achiko AG (SWX: ACHI)Share Price and News

About Achiko AG

Achiko AG is a Swiss-based company at the forefront of digital health solutions, primarily focused on innovating and developing new diagnostic tools and software aimed at improving healthcare delivery. With an eye on emerging markets, Achiko’s technology strives to simplify diagnostic processes through digital solutions. One of its flagship products is the AptameX™ test, a saliva-based rapid COVID-19 diagnostic solution that uses DNA aptamers for fast and affordable testing, particularly in emerging markets. This aligns with Achiko's mission to make healthcare more accessible through technology. Additionally, Achiko is investing in the digitalisation of the healthcare industry, seeking to reduce costs and improve efficiency.

Achiko AG Company History

Achiko AG is listed on the Swiss Stock Exchange under the ticker symbol ACHI. Since its inception, the company has been committed to advancing healthcare through technology, with a special focus on diagnostics. One of its earliest milestones was the development of a proprietary diagnostic platform aimed at providing more affordable, accessible, and efficient testing services. The company’s focus on healthcare diagnostics has remained steadfast as it works on expanding its product portfolio and gaining traction in emerging markets.

Future Outlook of Achiko AG (SWX: ACHI)

Achiko AG's future outlook is closely tied to broader trends in the healthcare and technology sectors. Given the increasing demand for digital healthcare solutions, especially in underserved regions, Achiko is well-positioned to capitalise on this growth. Key factors driving its future prospects include revenue and earnings forecasts, sector trends, expansion and capital projects, risks and economic impacts, and strategic alliances. Achiko continues to work towards scaling its innovative diagnostic platforms and expanding its market reach.

Is Achiko AG (SWX: ACHI) a Good Stock to Buy?

Investors considering Achiko AG should weigh the company's growth prospects against the risks inherent in the healthcare technology market. Achiko is currently trading at a relatively low price compared to its potential in the growing healthcare tech market. Its reinvestment strategy into new technologies and market expansions could be appealing to investors seeking growth rather than income generation. The digital health sector is set to continue expanding as healthcare systems evolve and become more reliant on technology.

Our Stock Analysis

Demergers … The 5 most famous break ups!

Demergers are a common organisational restructuring tactic listed companies undertake. In this article we look at why companies undertake them…

Why ASX mining stocks live and die by project jurisdictions

ASX mining stocks have projects in dozens of countries around the world, but some are better than others. There are two…

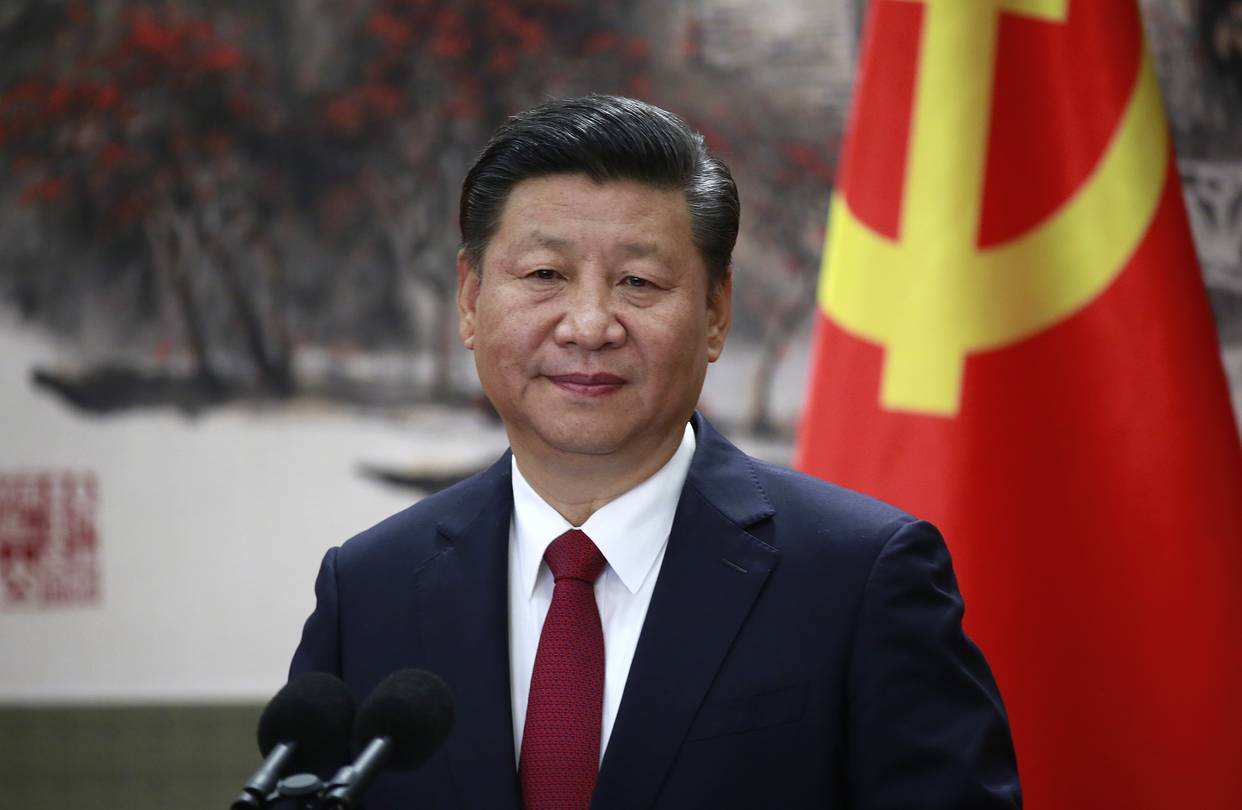

President Jinping, BHP, Aurizon and the transformation of the world energy market.

12 October 2020 On Tuesday, 22 September 2020, President Xi Jinping of China made a significant, and slightly surprising announcement…

- « Previous

- 1

- 2

- 3

Frequently Asked Questions

As of now, Achiko AG does not offer a dividend. The company is focused on reinvesting its earnings into further growth and product development, particularly in digital diagnostics.