Adisyn Ltd

(ASX: AI1)Share Price and News

About Adisyn

Adisyn is an Australian technology company. It has a legacy business focused on providing cloud services from data centres, but in late 2024 entered the semiconductor space. It acquired an Israel-based company called 2D Generation (2DG) seeking to use graphene as a material to connect very small transistors.

Transistors, which regulate or control currents or voltage flow, are usually connected by copper. But as transistors (and the chips they fit into) are required to become smaller and smaller, the copper interconnects are running into limits. Adisyn reckons graphene could be a solution because of its high thermal conductivity and strength.

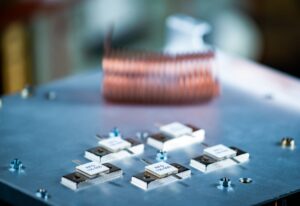

2DG has a technology that uses graphene, based on the principles of Atomic Layer Deposition (ALD). It can be done at temperatures much lower than those needed in other methods, is scalable and repeatable, provides precise control of film thickness and creates uniform layers on the transistors.

Adisyn's Company History

Established in 2012, Adisyn, then known as DC Two , has evolved from a data centre and cloud service provider to a comprehensive technology solutions company. The rebranding to Adisyn in 2023 marked a strategic shift towards integrating AI-driven services and expanding its cybersecurity offerings.

2024 was a key milestone in the company's history when it bought 2D Generation. 2D Generation was founded in 2020 by researchers who had worked on the idea of using graphene to replace copper in transistors. After 4 years of extensive work, it joined forces with Adisyn.

Future Outlook of Adisyn Ltd (ASX: AI1)

Adisyn is an early-stage company but has a number of things going for it. The company has all relevant IP and economic rights to the technology from the university it was developed at. Adisynhas an exclusive commercial license to develop the IP in return for minuscule royalties and a 10% stake in the company by the university.

It is working with imec, a semiconductor R&D powerhouse, based in Belgium, along with ConnectingChips, an EU initiative aimed at driving innovation and collaboration in the semiconductor industry with industry leaders, such as NVIDIA (NASDAQ:NVDA).

The challenge will be that the company is realistically a few years away from commercialisation but it could also be acquired by then, subject to progress being made. In the mid-term, the next major milestone is for the company to have a Demonstration Prototype. This is planned to happen in mid-2026.

Is AI1 a Good Stock to Buy?

Adisyn is probably only suitable for investors comfortable with early-stage, high-risk companies.

As a company at the R&D phase, Adisyn carries inherent risks, including market volatility and shareholder inertia. But there is a major commercial opportunity open to the company.

The challenge will be meeting its self-imposed mid-2026 deadline for a Demonstration Prototype. It is hoped that the company will speed up this process in the June quarter of 2025 once it has a special ALD tool delivered to it.

Our Stock Analysis

Adisyn’s (ASX:AI1) Graphene Interconnects for Computer Chips Pass the Heat Test

Adisyn Hits Development Milestone Adisyn (ASX: AI1), through its subsidiary 2D Generation, announced today that it has successfully deposited a…

Adisyn Nails First Step Toward Graphene Powered Chips

Strong Progress for Adisyn as Graphene Chip Foundations Fall Into Place Adisyn (ASX: AI1) announced on 17 November that its…

This ASX semiconductor play is about to solve a major bottleneck

ASX semiconductor play Adisyn (ASX:AI1) is at a pivotal point in its development journey. By this time next year, the…

ASX Semiconductor Stocks: An Ultimate Guide for Investors (2025 edition)

ASX Semiconductor Stocks are amongst the most complicated and volatile companies on the bourse, but also those with amongst the…

Mark the Pitt Street Research Semiconductor Conference 2025 in your calendars!

The Pitt Street Research Semiconductor Conference 2025 is coming up! Pitt Street Research in partnership with Bell Potter are thrilled…

Adisyn (ASX:AI1): Next generation computer chips

Up until a few months ago, Adisyn (ASX:AI1) was just one of several managed technology services providers. It was in…

Frequently Asked Questions

As of 16 May 2025, Adisyn Ltd's share price is $0.059.