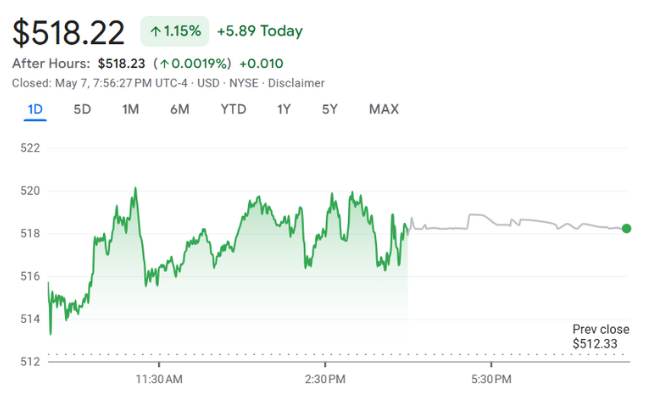

Berkshire Hathaway Inc. (NYSE: BRK.B)Share Price and News

About Berkshire Hathaway Inc.

Berkshire Hathaway Inc., led by renowned value investor Warren Buffett, operates as a multinational conglomerate holding company. Its diversified portfolio spans sectors such as insurance (Geico), energy (Berkshire Hathaway Energy), railroads (BNSF Railway), and manufacturing.

The company holds significant equity stakes in blue-chip companies like Apple, Coca-Cola, American Express, and Bank of America. These stakes contribute to its impressive investment portfolio, valued at over $300 billion in marketable securities. The company operates a diversified portfolio of businesses across sectors, including insurance, energy, railroads, manufacturing, and retail.

Berkshire's subsidiaries include household names such as Geico, BNSF Railway, and Dairy Queen, alongside significant equity stakes in global companies like Apple, Coca-Cola, and American Express. Known for its conservative financial philosophy, Berkshire Hathaway's investment strategy revolves around acquiring companies with strong fundamentals and long-term potential.

Berkshire Hathaway Inc. Company History

Berkshire Hathaway's origins date back to 1839, initially as a textile manufacturer. In the 1960s, Warren Buffett began acquiring shares of the company and eventually assumed control, steering it away from textiles to focus on acquiring companies with strong fundamentals and consistent cash flows. Notable acquisitions include Geico (1996), NetJets (1998), and BNSF Railway (2010), each of which contributed to the company's substantial cash flow generation.

Buffett's shift from textiles to a more profitable, diversified investment model marked a major turning point, transforming the company into a powerhouse of investments. Key milestones include the purchase of Geico in 1996 and BNSF Railway in 2010, which expanded Berkshire's footprint in insurance and transportation. Today, Berkshire Hathaway is not just a company; it's a benchmark of intelligent investing and a model for value-based business strategies.

Future Outlook of Berkshire Hathaway Inc. (NYSE: BRK.B)

Berkshire Hathaway’s future outlook remains strong, supported by its diverse portfolio and robust financial strategies. However, market fluctuations and economic conditions could impact its performance. Berkshire Hathaway’s portfolio is heavily invested in large-cap, blue-chip stocks, with a focus on long-term capital appreciation. The risks are that stocks it invests in do not perform well and this would lead to a decline in its portfolio.

The company’s insurance and reinsurance businesses, including Geico, continue to generate substantial cash flow. With the global insurance market growing, Berkshire Hathaway stands to benefit from increased premiums and favourable underwriting conditions. BNSF Railway and Berkshire’s energy businesses remain central to its strategic expansion. These sectors are poised to grow, given the ongoing demand for infrastructure and renewable energy solutions.

One challenge facing the company is that Warren Buffett is handing over the top job to Greg Abel later in 2025. It remains to be seen if anything major will change and if Abel can continue Berkshire's stellar long-term performance. He has indicated that the same philosophies will continue, but some speculate that Abel might be more hands-on in his management style and that he may have a greater focus on energy companies.

Rising interest rates and inflation always present challenges for the company’s investment portfolio, but particularly in this context.

Is Berkshire Hathaway Inc. (BRK.B) a Good Stock to Buy?

Berkshire Hathaway (BRK.B) remains an attractive stock for long-term investors, though its suitability depends on individual investment goals. The company's valuation is often viewed as high due to its strong historical performance and reputation. However, its long-term growth prospects continue to be solid, especially with its diversified portfolio of businesses. The stock is traditionally considered overvalued by some analysts, particularly after its recent price increase.

Despite this, Berkshire Hathaway's strong financials and potential for further growth could justify the premium price for long-term holders. The company follows a no-dividend policy and reinvests its earnings to fuel growth, which has been highly effective for those focused on capital gains. Berkshire Hathaway’s risk profile is moderate—while it’s a defensive stock due to its diversification, its exposure to equities and the market means it remains subject to market risks.

With Buffett’s commitment to finding value-driven acquisitions, the company’s growth potential remains high. Its continued success in large-cap investments provides confidence in its ability to generate returns. Institutional investors continue to show strong confidence in Berkshire Hathaway’s long-term value, often giving it strong buy ratings for its strategic acquisitions and cash flow generation.

Our Stock Analysis

Warren Buffett is retiring, will hand the top job at Berkshire to Greg Abel by the end of 2025. Here’s what you need to know

After many decades at the helm of Berkshire Hathaway, Warren Buffett is retiring. After founding his empire in 1965, he…

Why has Warren Buffett been so admired by investors for the last 50 years?

Everyone knows the name Warren Buffett as one of the most successful and well-known investors in history. But why is he…

Frequently Asked Questions

Berkshire Hathaway has not paid dividends historically. The company has followed a policy of reinvesting its profits back into the business to fuel long-term growth, which appeals to capital appreciation-focused investors. There has been speculation this may change under Greg Abel, but only time will tell.