The Calmer Co International Ltd

(ASX: CCO)Share Price and News

The Calmer Co

The Calmer Co International Ltd is a consumer-driven company focused on delivering high-quality wellness and self-care products to the market, particularly kava.

Kava is a beverage in the South Pacific derived from Indigenous plants. It has traditionally been confined to the Pacific Islands but has been growing in popularity around the world because of its sedative, anaesthetic and euphoriant properties.

It has grown in popularity for many reasons including destigmatisation of it in Western countries, growing awareness about mood and health benefits that can be derived from it not to mention the lifting of long-standing prohibitions on imports.

With an expanding presence in both domestic and international markets, The Calmer Co is well-positioned to capitalise on the rising demand for wellness products. Its commitment to quality and innovation sets it apart from its competitors, making it a strong contender in the wellness sector.

Calmer Co's History

Founded with the vision of creating wellness products that address the increasing need for relaxation and mental health support, The Calmer Co has made significant strides in a short time.

The company was established in Australia and listed in 2018. Initially it did not have success because its original approach was to focus efforts on attempting to sell Fiji Kava products via Chinese cross border channels, coupled with unprofitable sales at Chemist Warehouse in Australia under a distribution agreement announced in April 2021.

But things have improved in the past few years through several initiatives that focused on profitable sales and distribution agreements, not to mention increased product innovation and liberalisation.

Until December 2021, the company was only able to import products as complimentary medicines, but it obtained approval to import drinking kava into Australia under the Kava Pilot Importation Program facilitated by DFAT.

The company's recent major milestones include partnerships with retail giants and a strategic focus on international markets, particularly in Asia and North America. With these key developments, The Calmer Co has been able to diversify its revenue streams and build a more resilient business model. Moving forward, its focus on expanding its product lines and maintaining high standards of quality positions it for continued growth.

Future Outlook of The Calmer Co International (ASX: CCO)

Looking ahead, the future outlook for The Calmer Co appears promising, driven by several key factors. These include that the global wellness industry is on an upward trajectory, and the liberalisation of kava globally. CCO is well positioned to benefit as it expands globally.

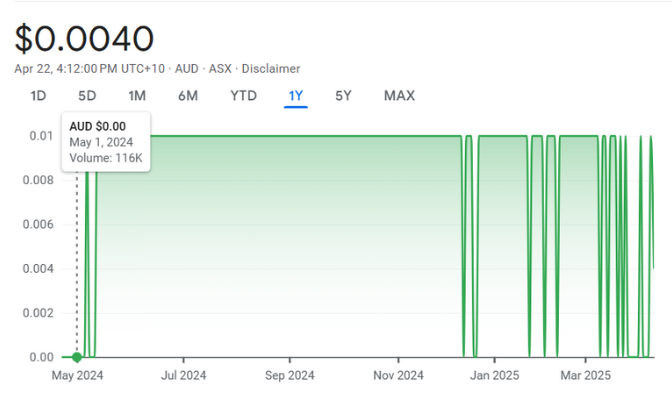

The challenge is that the company is still loss-making and is considered a 'penny stock' with a share price of less than 1c - giving rise to the perception that it is risky.

Is Calmer Co (ASX: CCO) a Good Stock to Buy?

Whether The Calmer Co (ASX: CCO) is a good stock to buy depends on various factors, including its valuation, growth potential, and risk profile. The company has strong potential with its market position.

However, the kava industry remains nauseant outside the South Pacific and there remains some stigmatisation of it. Moreover, the company will need to become profitable eventually and even though strides have been made, it is proving difficult. So for the time being, CCO would only be a good stock to buy for the most risk-averse investors.

Our Stock Analysis

The Calmer Co. (ASX:CCO): Why we’re so excited about this growth stock!

The Calmer Co. (ASX:CCO) This article is about a company, called The Calmer Co. (ASX:CCO), in which we at Stocks…

Calmer Co (ASX:CCO): It’s the only ASX stock in the fast-growing kava space!

If you haven’t heard of kava before, you probably haven’t heard of Calmer Co (ASX:CCO), but you’ll be hearing a…

Frequently Asked Questions

The Calmer Co currently does not offer a high dividend yield as the company is focused on reinvesting its profits to fuel growth and expansion. However, dividends may be considered in the future as the company matures.