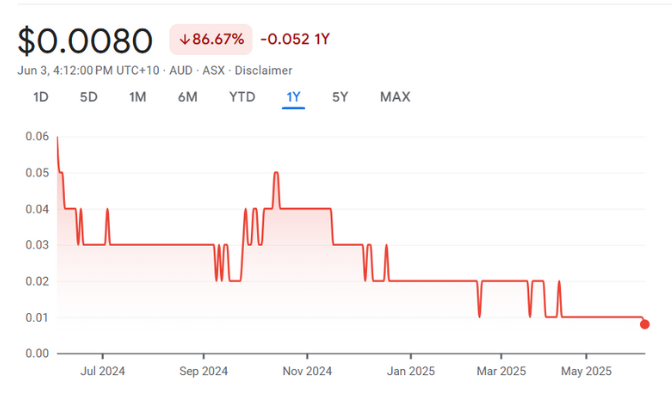

Evolution Energy Minerals (ASX: EV1)Share Price and News

About Evolution Energy Minerals

Evolution Energy Minerals is a resources developer, formed in 2021 following the spin out of the Chilalo project in Tanzania in southern Tanzania. This project hosts a high-grade resource suitable for battery anode material and expandable graphite products.

With graphite in increasing demand for lithium-ion batteries and energy storage, Evolution’s strategy is to build a vertically integrated business serving these rapidly growing sectors based from graphite from Chilalo. Unfortunately, regulatory troubles have meant the company couldn't get this off the ground and is trying to lookg for new opportunities.

EV1's Company History

Evolution Energy Minerals was founded in 2021 when Graphex Mining (then owners of Chilalo) wanted to focus on gold and so renamed itself to Marvel Gold and spun out Chilalo. Graphex listed in 2016 with the project and had good momentum post-IPO but never recovered momentum lost in 2017 when the government cracked down on developers by installing a new Mining Code which provided for government stakes in projects and increased royalties.

The biggest shock was that it was implemented with no notice, leading to a lack of confidence to invest in anything to do with Tanzania. A change of regime in 2021 has done little to reinstall confidence.

Future Outlook of Evolution Energy Minerals (ASX: EV1)

In May 2025, the company announced it was moving into a new direction. It was downsiding the board and management and said it would look for gold development opportunities in Africa. Wihle remaining committed to the Chilalo project in the long-term, it knew it couldn't wait forever as shareholders' patience was wearing thin.

If the company can find a new gold project it would be appetising with record high gold prices right now. The challenge will be finding the right project in the right jurisdiction.

Is EV1 a Good Stock to Buy?

No. Evolution Energy Minerals is clearly back to square one and its future is contingent on finding a new project. This may happen, but even with gold at record highs, it will still take time to find an appropriate project and realise its potential.

Our Stock Analysis

Ramelius Resources (ASX:RMS): A $3bn gold miner, trading at a very cheap P/E

Ramelius Resources‘ (ASX:RMS) $3bn market cap may suggest it is expensive, but its P/E (7x for FY25 and 10.9x for…

Graphite is a misunderstood commodity that’s very important for EV’s and 7 ASX companies

Graphite is no ‘poorer cousin’ of lithium, it is a critically important metal for several industrial and commercial applications –…

Evolution Mining (ASX: EVN) shareholders are set for more pain, here are the 2 reasons why

Evolution Mining (ASX: EVN) shocked shareholders earlier this week when it announced another production downgrade. The news led to shares…

Why ASX gold stocks are due for a bull run

Gold prices are nearing a five-month high touched in the previous session, after strong U.S. consumer price data prompted a…

Frequently Asked Questions

EV1 is still in the pre-production phase, making it riskier than peers with producing assets. However, its high-grade graphite resource and ESG focus offer a strategic edge in future battery supply chains.