Freelancer Ltd

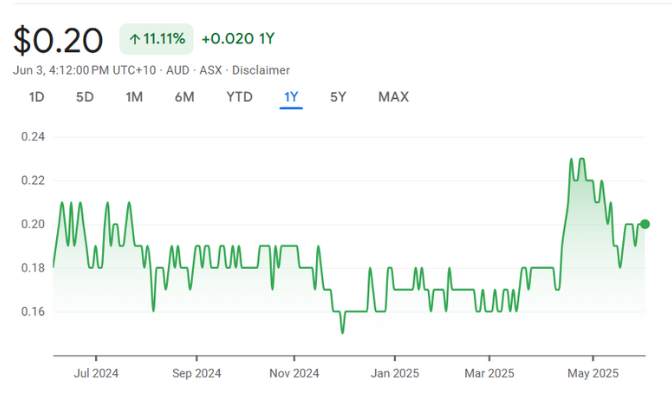

(ASX: FLN)Share Price and News

About Freelancer

Freelancer operates 3 online marketplaces: Freelancer.com, escrow.com and Loadshift. This company has grown to become the world's largest freelancing and crowdsourcing platform by the number of users and projects posted.

With over 60 million registered users globally, Freelancer's namesake platform leverages its technology platform to facilitate project-based work for businesses of all sizes, from startups to large corporations.

Escrow.com enables high-value transactions to take place securely, by holding funds in custody and only transferring them to the seller once the buyer receives the goods. Meanwhile, Loadshift is a heavy haulage marketplace that connects freight owners with transport operators.

What sets Freelancer as an investment prospect apart from many of its peers like Airtasker, Fiverr and Upwork include the consistency of the offering, having enterprise customers as well as Escrow and Loadshift. Directly comparing Freelancer.com to Airtasker, the latter is just a labour-hire platform for manual household jobs and is still Australian centric. FLN's true competitors is conventional service firms in applicable sectors.

Freelancer's Company History

Freelancer began in 2009 when founder Matt Barrie launched the initial platform to harness the growing gig economy.

It listed in 2013 and since then, the company has significantly expanded its services. Key to this were the acquisitions of Escrow.com in 2015, freight marketplace Channel 40 in 2018 and then Loadshift in 2021 which was integrated with Channel 40.

Future Outlook of Freelancer (ASX: FLN)

Key growth drivers include the continuing global shift towards gig economy workforces and Freelancer’s expansion into emerging markets with growing digital adoption. The company is investing heavily in AI-driven matching algorithms and platform security, aiming to improve user retention and transaction values. Capital projects focused on mobile app enhancements and payment gateway improvements are expected to support this growth trajectory.

However, risks persist. Competition from rivals like Upwork and Fiverr remains intense, alongside regulatory scrutiny over gig worker protections and cross-border taxation issues. Economic downturns could also affect corporate spending on freelance projects, impacting Freelancer’s revenue visibility.

We also think the company will struggle to attract investor interest until it becomes profitable (not EBITDA or free cash flow profitable, but NPAT profitable).

Is Freelancer a Good Stock to Buy?

From an investment perspective, Freelancer Ltd offers an interesting mix of growth potential and risks typical of tech marketplace stocks. Those with a medium to long-term horizon and an appetite for growth amid technological disruption may find FLN a compelling addition to their portfolio.

The risk profile includes high competitive pressure and regulatory uncertainty, as well as a bottom line continuing to be in the red. This being said Freelancer’s large user base and scalable business model provide a competitive moat.

The company's growth potential remains strong, particularly as remote and freelance work becomes entrenched across industries worldwide.

Our Stock Analysis

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Freelancer (ASX:FLN): The world’s largest workforce, powered by AI

Freelancer (ASX:FLN) is one of the ASX’s most intriguing stocks. The company is positioning itself as the ‘Amazon of services,’…

Frequently Asked Questions

Freelancer Ltd currently offers a modest dividend yield, reflecting its focus on growth and reinvestment in platform expansion rather than high payouts. Investors looking for steady income might find its dividend less attractive compared to other ASX stocks.