GreenHy2 Ltd

(ASX:H2G) Share Price and News

Introduction to GreenHy2 (ASX:H2G)

GreenHy2 (ASX:H2G) is a provider of Solid-State Hydrogen Storage (SSHS) batteries. The technology leverages metal hydrides for hydrogen storage, storing the hydrogen molecules directly in a ferrous titanium lattice.

It is the only provider of this kind of technology resolving the issue of energy storage in a way that is environmentally-friendly (by not relying on fossil-fuel-backed diesel generators) and safe.

The eight key benefits are: Environmental sustainability, exceptional density, ability to operate at an extremely low pressure, an extended lifespan and reliability, the ability to store power indefinitely, reduced safety concerns, versatility and uniqueness.

GreenHy2's History

The company was incepted in 2011 by Charlie Bontempo. It was formerly known as Tempo Australia, only changing its name in 2022. The technology owned by the company was developed in Germany with GKN. H2G and GKN have the exclusive right to integrate, assembly and supply the equipment in Australia and New Zealand, as well as the right to act on a non-exclusive basis throughout Southeast Asia on a project-by-project basis subject to GKN's approval.

Future Outlook of GreenHy2

GreenHy2 is at an early stage but has a handful of key partnerships with industry players. In particular, it has run a 12-month trial with Essential Energy to use its hydrogen-powered batteries to power a heritage accommodation cottage on the NSW North Coast.

Is GreenHy2 Ltd (ASX:H2G) a Good Stock to Buy?

Investing in GreenHy2 presents a futuristic opportunity, albeit with risks typical of an early-stage company in an early-stage sector like Hydrogen. Overall, there's too much risk for most investors (particularly retail investors) to consider it.

Our Stock Analysis

Investing in stocks for retirement: Here’s why you should give it serious thought

Investing in stocks for retirement is an excellent option to consider. Investing in stocks can help you build a substantial nest…

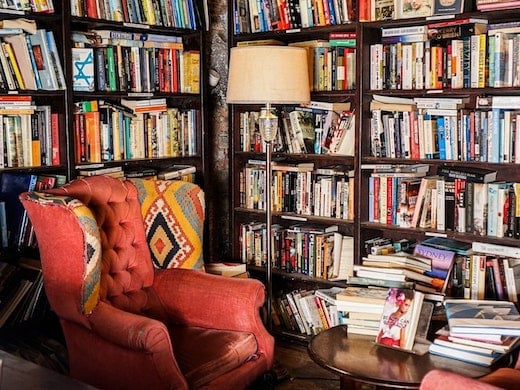

Here are the 5 best books about share trading

Books about share trading are a great way for beginners to get started and for more experienced investors to gain…

Want to invest in ASX coal stocks in 2024? Here’s what you need to know

Investing in ASX coal stocks in 2024 is not at all vogue or woke, but could it be moneymaking? Not…

ASX stocks in voluntary administration: Here are 4 that have bitten the dust recently

There are a number of ASX stocks in voluntary administration right now. For varying reasons, the utopia promised by company’s…

Investing in IPOs (Initial Public Offerings) in 2024: Here’s what investors need to know

Investing in IPOs offers the opportunity for investors to make gains they couldn’t make with any other company, but also…

Frequently Asked Questions

GreenHy2 specializes in developing Solid State Hydrogen Storage Batteries integrated with 100% renewable energy generation.