Halo Technologies

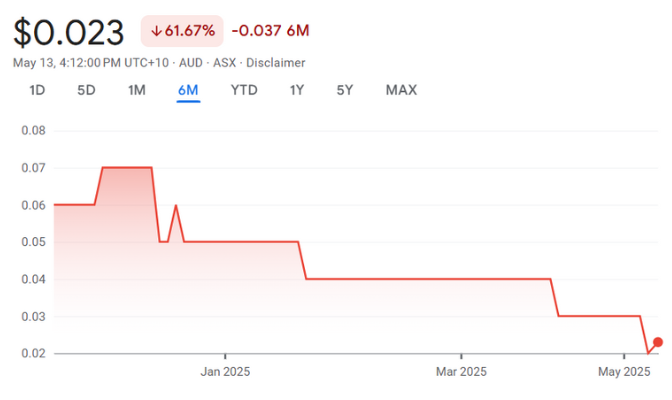

(ASX: HAL)Share Price and News

About Halo Technologies

Halo Technologies is a financial technology company that offers a suite of digital tools and platforms designed to simplify and enhance investment management. The company's flagship product, Halo Global, provides integrated market research, trading, and portfolio management capabilities. This powerful platform includes advanced features such as real-time market data, AI-driven investment insights, and sophisticated risk management tools, making it a versatile choice for Australian investors.

Halo Technologies aims to bridge the gap between retail and institutional investors by delivering cutting-edge analytical tools that were traditionally accessible only to professional traders. Its solutions cover a wide range of asset classes, such as equities, ETFs, bonds, managed funds, and alternative investments, ensuring comprehensive coverage for all types of investors. The company also focuses on education, offering webinars and training sessions to help users maximise their platform's potential.

HAL Company History

Founded to transform the way investors access and manage financial information, Halo Technologies has grown rapidly within the fintech space. Over the years, the company has expanded its platform capabilities, incorporating AI-driven analytics and data visualisation tools to stay ahead in the competitive financial services market. Halo Technologies has invested in innovation and platform development.

However, its recent financial performance and shrinking market valuation pose challenges in maintaining industry traction. Key milestones in the company's history include significant technological advancements, strategic partnerships, and successful capital raises that have strengthened its financial position and supported its global expansion plans.

Future Outlook of Halo Technologies (ASX: HAL)

Halo Technologies is well-positioned for future growth, driven by increasing demand for digital trading solutions and market analytics. The company is working to enhance its platform's capabilities by incorporating AI and machine learning; however, its financial constraints may impact the pace of these developments.

In its latest financial report, Halo Technologies highlighted a strategic push towards expanding its global footprint, targeting markets in Europe and Asia to capture a larger share of the rapidly growing fintech industry. Additionally, the company is investing in cloud infrastructure, cybersecurity, and data analytics to improve platform scalability and security, crucial for attracting large institutional clients.

Key growth drivers for the company include its innovative technology stack, recurring subscription revenues, and a scalable platform that can accommodate a growing user base. As more investors seek digital-first solutions, Halo Technologies is well-positioned to capture this expanding market, supported by a robust R&D pipeline and strategic alliances.

Is HAL a Good Stock to Buy?

Investing in Halo Technologies (ASX: HAL) may appeal to those interested in the fintech sector. However, caution is advised due to recent financial losses and concerns about the company's ability to continue as a going concern. The company's competitive advantage lies in its robust technology, diversified revenue streams, and strong client retention rates.

Halo Technologies benefits from a subscription-based revenue model, which provides predictable cash flows and high customer lifetime value. However, like all tech-focused companies, it faces risks, including market competition, cybersecurity threats, and regulatory changes. Additionally, its valuation can be sensitive to market sentiment towards technology stocks, which tend to be more volatile.

Potential investors should consider these factors alongside the company's growth prospects, solid balance sheet, and commitment to technological innovation before making an investment decision.

Our Stock Analysis

The November Property Bear Massacre

19 November 2020 The month of November has really sent the property bears running for cover as the S&P/ASX 200…

Cromwell Property Group: Everything spilled, now for the cleanup

19 November 2020 In a reminder to boards everywhere not to discount the ability of their major shareholders to cause…

Pfizer delivers the goods on a COVID-19 vaccine

10 November 2020 One of the reasons investors can be optimistic about 2021 is the speed with which the first…

Crown Resorts: From bad to worse

9 November 2020 We rated Crown Resorts two stars back on 19 October 2020 for two main reasons: the NSW…

AMP Limited: Breaking up is the best thing to do

5 November 2020 When we rated AMP four stars back on 4 September 2020, we placed a fairly significant requirement…

Bank of Queensland: On the road to recovery

27 October 2020 Since our four-star rating back in March, a lot has gone right for the Bank of Queensland…

Frequently Asked Questions

Halo Technologies specialises in financial technology, offering advanced trading platforms and market analytics for investors and financial professionals.