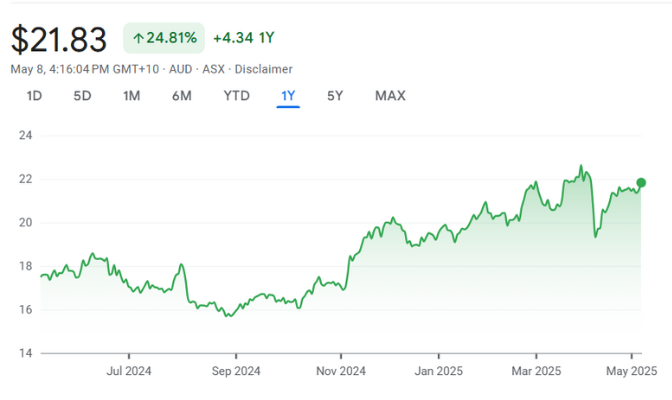

QBE Insurance Group Limited (ASX: QBE)Share Price and News

About QBE Insurance (ASX:QBE)

QBE Insurance Group is an international insurer with a strong presence in Australia and across the globe. Established in 1886, the company provides a wide variety of insurance services, including personal, business, and specialty lines across multiple sectors such as property, casualty, health, and life insurance. It operates in over 30 countries, with a particularly significant footprint in North America, Europe, and the Asia-Pacific region.

QBE sets itself apart by offering customised insurance products, strong risk management strategies, and an extensive distribution network. With a track record of stability, QBE’s emphasis on diversification and prudent underwriting has helped it weather economic and market challenges, making it an appealing investment for many.

In 2024, the company made US$22.4bn in premiums, a statutory net profit of $1.8bn and a ROE of 18.2%. It has a heavier focus on corporate insurance rather than the retail market, making just 3% of revenue from the Australian retail space and focusing more on lenders' mortgage and commercial insurances.

QBE's Company History

Founded in 1886, QBE’s origins trace back to Queensland, where the company began its operations as the North Queensland Insurance Company (QI). Over the years, it expanded rapidly, both organically and through strategic acquisitions. By 1890, it already was operating 36 agencies worldwide.

In 1921, one of QI's founders set up the Bankers' and Traders Insurance Company (B&T) and both companies in 1959 bought large stakes in The Equitable Probate and General Insurance Companies. The name QBE was born when the trio of companies merged in 1973 - the same year the company became publicly listed.

The company continued M&A after that with a key acquisition being the purchase of New Zealand's largest insurer in 1994 and another being the purchase of PMI Australia in 2008.

In recent years, QBE has concentrated on refining its risk management practices and expanding its global reach, ensuring it remains one of the foremost global insurers.

Future Outlook of QBE (ASX: QBE)

QBE’s future outlook is promising, driven by strong global market dynamics and a strategic focus on profitability and risk management. The insurance industry is dealing with rising claims due to climate change, pressure from regulators accusing insurers of gouging consumers and consumers dealing with high inflation.

But QBE appears to be coping better than many of its peers for many reasons including its focus on business insurance rather than insurance for retail consumers. Its catastrophe claims ratio (in other words, the amount of claims as a percentage of net insurance revenue) in 2024 was 5.9%, down from 6.6% the year before and it was $232m below the company's allocated allowance.

One risk facing the company is the increased incidences of extreme weather events which may lead to higher payouts. Although last US hurricane season wasn't as bad as immediately previous seasons, it had a US$200m exposure to the LA wildfires in January 2025.

In CY25, the company has guided to a premium growth in the 'mid-single digits' on a constant currency basis, a combined operating ratio of ~92.5% and an exit core fixed income yield of 4.3%.

Is QBE a Good Stock to Buy?

QBE Insurance is a stand-out in the insurance sector, although the insurance sector may not be the best sector to look at for investors.

The company’s stock is currently trading at a price-to-earnings ratio (P/E) of around 12x, which reflects its stable earnings growth and market-leading position. This is significantly below the industry average of 21.6x, suggesting that it may offer value to investors looking for a well-established company with significant growth potential. QBE also has a consistent history of paying dividends, supported by a solid track record of dividend growth.

Although the risk of the company being broken up has been removed with the defeat of Peter Dutton at the election, scrutiny on the company for higher premiums will remain with premiums up 16% in the last year. One risk facing QBE as a company is a potentially negative outcome of a current ASIC investigation that alleges it failed to deliver on pricing promises made to over half a million Australian customers over 5 years. Moreover, pressure on the company over its premiums will continue as will the risk of more extreme weather events which could lead to higher payouts.

But all things considered, even though the company is facing challenges in a competitive and heavily regulated environment, QBE's strong financial fundamentals and robust market position make it an appealing option for long-term investors. Looking ahead, QBE’s growth potential is tied to its ability to expand in emerging markets and capitalise on the ongoing digital transformation in the insurance industry.

Our Stock Analysis

Peter Dutton wants to break up insurers and investors are fearful, but should they be?

Some investors are worried that Peter Dutton wants to break up insurers. Not just because he is in with a…

Here are 4 unexpected ASX 200 stocks you should sell

Here are 4 ASX 200 stocks you should sell in FY25 One of the common criticisms of brokers and analysts…

Investing in ASX-listed insurance companies : Here’s what investors need to know and the top 5 companies

ASX-listed insurance companies may seem as if they are among the safest investments as far as listed equities go. After all,…

1HY23 reporting season is over: Here are 5 of the best results from ASX companies

With 1HY23 reporting season completed, Stocks Down Under looks at 5 of the best results. These companies may not have…

Frequently Asked Questions

QBE offers a competitive dividend yield, with a history of consistent growth in payouts. The current dividend yield is approximately 4.15%, which is considered competitive for income investors, supported by QBE’s strong cash flow and stable earnings.