Sherwin-Williams

(NYSE: SHW)Share Price and News

About Sherwin-Williams

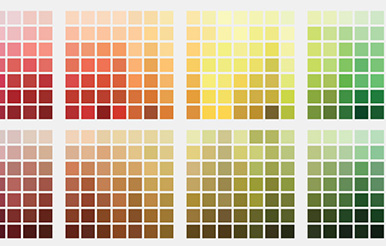

Sherwin-Williams is a global developer, manufacturer, and distributor of paints, coatings, and related products. Its extensive product line covers architectural, industrial, and automotive coatings, as well as marine and protective finishes. Sherwin-Williams also maintains a vast distribution network, including over 5,000 company-operated stores and facilities worldwide.

Known for its strong brand portfolio, including well-regarded names like Valspar, Dutch Boy, and HGTV Home, the company has a significant footprint in North America, with a growing presence in international markets, including Asia-Pacific and Europe.

Its commitment to quality and innovation has made it a preferred choice for both professional contractors and DIY enthusiasts.

Sherwin-Williams Company History

Sherwin-Williams was founded by Henry Sherwin and Edward Williams in 1866 in Cleveland, Ohio - and the company remains headquartered to this day. It only expanded outside Cleveland in 1888 but then expanded quickly, entering Canada in 1892 by merging with Walter H. Cottingham Co. and into London in 1903. 1909 saw the retirement of Henry Sherwin and Walter H. Cottingham took over as CEO. 1925 saw its initial public listing.

The company was an innovator in man ways, introducing the first synthetic aviation paints in the late 1920s, creating fast-drying and washable water-based paints for households as well as the Roller-Koater applicator in 1941.

In 2011, it introduced a brand of paint that was specially designed to promote better indoor air quality - Harmony Interior Acrylic Latex; in 2015 it introduced paint with bateria-killing capabilities; and in 2018 it introduced an app enabling people to 'try on' paint colours on their own walls.

Between 2016 and 2024, it was led by John G. Morikis, who worked his way up to the top job over a near 40-year career at the company. During Morikis’ tenure, he has expanded the company’s reach abroad. Sherwin Williams went from $11bn in sales in 2015 to $23bn in 2023 and the company has expanded its presence abroad through strategic acquisitions. He was succeeded by Heidi G. Petz in 2024. She had been with Sherwin-Williams since 2017, joining after it bought Valspar.

The company is a so-called Dividend Aristocrat as it has raised dividends each year for over 25 years - in this company's case, 46 to be exact. It closed 2024 with US$23.1bn in net sales (a record for the company), $4.49bn of EBITDA (up 6%). It made $10.55 EPS, which represents a profit of $11.2bn - a 4% increase. It has guided to $11.65-12.05 EPS for CY25.

Future Outlook of Sherwin-Williams (NYSE: SHW)

Sherwin-Williams' future appears promising, driven by steady demand for its high-performance coatings and robust global presence. As we noted above, it is expecting bottom line growth for CY25 - $11.65-12.05 EPS, up from $10.55 the year before (10-14% growth).

However, potential challenges include raw material cost volatility, supply chain disruptions, and economic uncertainties in key markets, which could impact its profitability. In particular, there uncertainty as to how tariffs will impact the company - they may result in price increases.

However, the longer-term looks positive. The typical square footage of a house (at least in America) continues to grow so more will be needed.

You name any generation and their life moves will need paint of some sort. Baby Boomers are downsizing and/or moving to assisted living facilities. Gen X and millennials are upsizing, or perhaps buying homes for the first time. And fresh paint is one of the best ways to add value to it. On top of that, the balance between Professional and DIY is returning to the pre-COVID norm where the former segment was more dominant.

It has very low turnover for a retail company because its staff are not your typical ‘check out chicks or guys’, they are essentially account managers for customers (particularly commercial customers that will keep coming back).

Is SHW a Good Stock to Buy?

Sherwin-Williams is often considered a strong investment due to its market leadership, robust financial performance, and consistent dividend payouts (being a Dividend Aristocrat having raised dividends for 46 straight years).

The stock is currently trading at a premium, reflecting investor confidence in its long-term growth potential. Analysts typically view it as a solid, defensive play in the materials sector, offering stability in diverse market conditions. Additionally, the company's focus on sustainability and premium product offerings gives it a competitive edge.

We do think investors should weigh its high valuation against broader market risks, including raw material price fluctuations and competitive pressures from other global coatings manufacturers.

Nonetheless, the company's long history depicts that it is a strong one - it has survived multiple crises. Theoretically, a paint company should only be growing with GDP - but this company has grown above and beyond.

Our Stock Analysis

Here are 5 US stocks for Australian investors other than the Magnificent Seven!

When thinking about US stocks for Australian investors, it is easy to just name the Magnificent Seven and be done…

Sherwin Williams (NYSE:SHW): Who said nothing good comes out of Cleveland?

Sherwin Williams (NYSE:SHW) is a near 160-year-old paint company from Cleveland, Ohio. This company is one we’ve been watching for…

Here are the 6 Best American stocks for Australian investors in 2025!

Here are the 6 Best American stocks for Australian investors in 2025! Eli Lilly (NYSE:ELY) If you thought Novo Nordisk’s…

Frequently Asked Questions

As of early 2025, Sherwin-Williams has a dividend yield of approximately 0.92%, low even for a US company. This reflects its preference for stock buybacks instead of dividends.