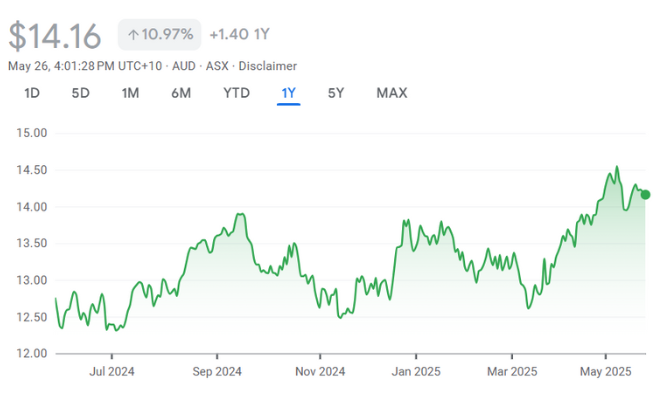

Transurban Group Ltd (ASX: TCL)Share Price and News

Introduction to Transurban (ASX:TCL)

Transurban is an owner and operator toll road networks that help millions of commuters and commercial vehicles navigate major urban corridors. The company’s portfolio spans Australia’s eastern states, primarily New South Wales, Victoria, and Queensland and extends internationally to key regions in the United States and Canada. But it is Sydney that is most important

Transurban's Company History

Transurban was established in 1996 as a pioneer in Australia’s privatisation of urban toll roads. Its early success was anchored in the operation of the CityLink toll road in Melbourne, which laid the groundwork for further expansion.

Over the next two decades, Transurban strategically acquired and developed key assets, including Sydney’s Hills M2 Motorway and several routes in Brisbane and Sydney. A significant milestone came in 2010 with the merger with Sydney Roads Group, which expanded the company’s Australian footprint and reinforced its position as the largest toll road operator in the country.

In 2014, Transurban expanded internationally by acquiring the 495 Express Lanes in Virginia, USA, marking the beginning of its North American presence. Since then, the company has added more assets, such as the 95 Express Lanes and the North Tarrant Express in Texas.

Transurban has pursued both organic growth through infrastructure development and strategic acquisitions, adjusting to changing transport demands and regulatory frameworks. This consistent strategy supports stable cash flow and capital growth, ensuring ongoing shareholder returns through dividends and asset appreciation.

Future Outlook of Transurban (ASX: TCL)

Looking ahead, Transurban’s prospects are shaped by several financial and operational factors. The company has long-term monopolies over many of its roads with toll rates indexed to inflation. This provides a natural hedge against rising operating costs and competition. It also preserves margins amid cost pressures in construction and labour.

Wider industry trends support Transurban’s outlook. Urban population growth and traffic congestion continue to drive demand for efficient transport infrastructure. Innovations in tolling technology and continued expansion into stable North American markets contribute to geographic diversification and revenue stability.

Nonetheless, investors should be aware of regulatory risks, such as potential limits on toll increases or new compliance costs imposed by governments. The NSW government has imposed a $60 per week toll limit on it. This may seem insignificant, but the government is doing something after years of doing nothing.

Is TCL a Good Stock to Buy?

Investors should weigh Transurban’s robust infrastructure portfolio, growth potential, and defensive characteristics against the inherent risks of the toll road sector. Current valuation levels reflect a balance of stable income and moderate growth, making TCL appealing to those seeking exposure to infrastructure with predictable cash flows.

Its dividend yield remains a major attraction, underpinned by toll revenue and operational cash flow. The company has demonstrated resilience across economic cycles, supported by long-term concession agreements and tolls indexed to inflation. However, regulatory uncertainty is a key risk. Government actions restricting toll increases or seeking to renegotiate concessions could impact future revenue.

Additionally, behavioural changes, such as increased remote working, may reduce traffic volumes in the medium term. Broker consensus is broadly positive, citing the company’s leadership, strong project pipeline, and visibility of earnings. Institutional investors often view TCL as a core infrastructure holding with a balanced risk-return profile.

Continued growth will depend on delivering projects efficiently and expanding in key overseas markets like North America. Overall, TCL suits investors seeking reliable dividends and exposure to infrastructure growth, while remaining mindful of traffic trends and regulatory developments.

Our Stock Analysis

3 ASX stocks to buy after Trump’s victory, and 3 ASX stocks to sell

Let’s take a look at 3 ASX stocks to buy after Trump’s victory, and 3 to sell. Last week we…

6 ASX Stocks to watch with an eager eye this FY24 reporting season

6 ASX Stocks to watch this FY24 reporting season Nick Scali (ASX:NCK) Nick Scali has doubled in the last…

Here are 5 ASX stocks with huge potential…if only they could get their act together

There are plenty of ASX stocks with huge potential, but very few end up realising it. For some, it is…

Here are 4 unexpected ASX 200 stocks you should sell

Here are 4 ASX 200 stocks you should sell in FY25 One of the common criticisms of brokers and analysts…

Transurban (ASX:TCL): Is it at risk of losing its valuable monopolies?

Transurban (ASX:TCL) is a unique stock on the ASX. No other stock has such long-term monopolies as Transurban does on…

Here are 4 ASX 200 growth stocks to look at in FY24

Growth opportunities are harder to find among large caps, but this article recaps 4 ASX 200 growth stocks with tantalising…

Frequently Asked Questions

Transurban’s dividend yield typically sits in the mid-to-high single digits, supported by strong toll revenues and a commitment to shareholder returns. The yield can vary depending on traffic volumes and capital investments.