Thermo Fisher Scientific (NYSE: TMO)Share Price and News

Overview of Thermo Fisher Scientific (NYSE:TMO)

Thermo Fisher Scientific operates as a leading global healthcare company. If you name something to do with healthcare, it is more likelier than not that Thermo Fisher does that.

This company (based on the outskirts of Boston, Massachusetts) makes, supplies and provides lab equipment, pharmaceutical drugs, consumables for medical devices and medical software just to name a few. But it is lab products and biopharmaceutical services that is its biggest revenue generator (making roughly half of its revenue).

The company's global footprint and diversified product offering position Thermo Fisher as a crucial player in advancing life sciences and healthcare worldwide. It has 125,000 employees, 7,500 of which are dedicated to R&D.

Thermo Fisher's Company History

Thermo Fisher's journey began with Thermo Electron Corporation in 1956, expanding through a series of strategic acquisitions and mergers. This was the company that introduced single-use bio-reactors and the first automated DNA analyser.

Nonetheless, Thermo Electron was a modest company up until the 2006 merger Fisher Scientific. Prior to that, it was only a US$2bn revenue per year company, but this deal created a powerhouse in scientific equipment and consumables, adopting the Thermo Fisher Scientific name.

Over the years, the company has continued to grow through acquisitions, including the significant purchase of Life Technologies, completed in early 2014 after being announced in 2013, which expanded its capabilities in genetic analysis.

More recently, Thermo Fisher acquired the clinical diagnostics firm PPD in 2021, bolstering its contract research services. These milestones reflect Thermo Fisher's continuous evolution from a laboratory supplier to a comprehensive provider of scientific and clinical solutions.

Future Outlook of Thermo Fisher Scientific (NYSE: TMO)

Thermo Fisher's future outlook appears promising. In the short-term it is underpinned by steady revenue growth and robust earnings forecasts. In the longer-run, the demand for healthcare is only going to increase and this company is at the forefront of that. Ongoing investments in automation and digital lab management systems position Thermo Fisher to capture emerging trends in laboratory efficiency.

Thermo Fisher’s potential market size has tripled in 10 years from $80bn to $240bn, all because of all the acquisitions it has made. You can trust this company to deliver given its track record. Over the last decade, it has grown revenue by 13% CAGR (Compound Annual Growth Rate), its profit by 15% CAGR and its free cash flow by 14% CAGR.

However, risks include potential supply chain disruptions and pricing pressures from healthcare budget constraints globally. Economic uncertainties and regulatory changes in key markets may also impact margins.

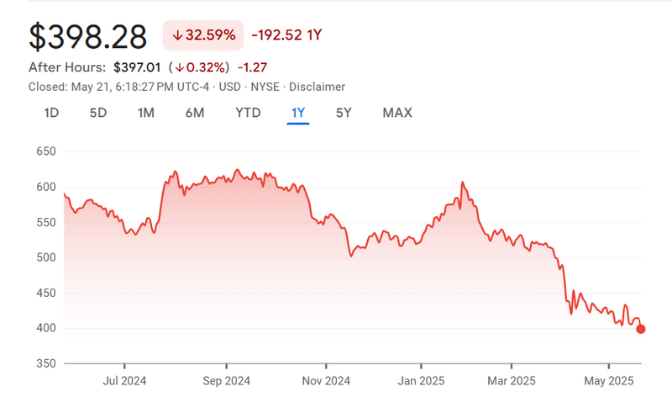

Trump's tariffs are proving a particular headache, causing shares to slide over 20% in the first 5 months of 2025. Thermo has estimated a $400m hit this year to its sales in China and it downgraded its forecast EPS for FY25 from $23.10-23.50 down to $21.76-22.84 ($8.31-8.73bn). But keep in mind this would be well ahead of FY24 in which its profit was $6.3bn.

Ultimately, Thermo Fisher's diversified business model and global scale offer resilience, making it well-placed to navigate sector challenges while capitalising on healthcare's shift towards precision diagnostics and therapies.

Is TMO a Good Stock to Buy?

For Australian investors, Thermo Fisher offers exposure to global life sciences innovation, balancing growth potential with a manageable risk profile. It has a big growth opportunity of it and a track record that can give investors confidence in it. The company estimates it has a $235bn market ahead of it which can grow 4-6% in the long-term.

However, considering Thermo Fisher should weigh its fundamentals against sector risks and also account for share price volatility. The company's shares can rise in response to regulatory news, shifts in biotech R&D spending or broader market movements. Trump's tariffs could cause trouble for the company, causing sales to decline in non-US markets and potentially requiring it to readjust supply chains and move manufacturing onshore.

Our Stock Analysis

Here are 5 US stocks for Australian investors other than the Magnificent Seven!

When thinking about US stocks for Australian investors, it is easy to just name the Magnificent Seven and be done…

Thermo Fisher (NYSE:TMO): A classic blue-chip health stock for the rest of the 2020s

Capped at over US$180bn, Thermo Fisher (NYSE:TMO) is a classic blue-chip healthcare stock. It has not escaped an impact from the…

Frequently Asked Questions

Thermo Fisher currently offers a dividend yield of approximately 0.3%, with a track record of regular dividend growth reflecting its strong cash flow and earnings stability.