TruScreen Ltd

(ASX: TRU)Share Price and News

About TruScreen

TruScreen is a New Zealand-based medical device company commercialising a cervical cancer screening technology.

The company’s TRU system (shown below) is designed to detect the presence of pre-cancerous and cancerous tissues in the cervix, by low level electrical and optic signals. It consists of a handheld device (HHD), intelligent cradle and a single-use-sensor (SUS). The device has an expected life of 5–7 years, but the SUS is used once per test per patient in order to avoid cross-infection.

TRU has wide application in Low and Middle-Income Countries (LMICs) where women typically lack access to cervical cancer screening. This real-time, single-visit and mobile screening technology does not require any high-cost lab infrastructure and can be conducted by a nurse or trained person based on local healthcare rules.

TRU system is presently certified for use throughout Europe and has approval for sale in China, Vietnam, Mexico, Russia, Saudi Arabia and Zimbabwe, with China being the company’s largest market.

TruScreen's History

The TRU system traces its origins to 1986 when leading professors at the University of Sydney conceived the idea. Polartechnics was an ASX-listed biotech company that bought the concept in 1987. After nearly 2 decades of R&D, the product was first known as Polar Probe, then Truscreen in 2005.

Commercialisation began over 2007-2009, but the drying up of funding during the GFC ultimately led to Polartechnics going bust and the assets were bought for just A$10,000 in December 2011. A new company was incorporated in 2013, named TruScreen.

Over time, the company has extended its reach into markets such as China, India, Southeast Asia, and Africa, where cervical cancer remains a leading cause of death. The second generation device was launched in 2016 with several performance and processing improvements.

TruScreen was listed on the ASX in February 2021, following its earlier listing on the NZX (New Zealand Stock Exchange). During the 2020s, Truscreen has grown both its revenues and devices installed, and consequently sales of disposable units. The device has also gained further validation, being published in several clinical papers, and through the passage of a major clinical trial in China.

Future Outlook of TruScreen (ASX: TRU)

TruScreen's future outlook remains strong, supported by several key factors that indicate substantial growth potential. The company is well-positioned for revenue growth as it expands into international markets, particularly in regions with a high prevalence of cervical cancer. The increasing demand for affordable screening solutions aligns perfectly with TruScreen's strategy to scale globally, positioning it to benefit from this rising market need.

Indeed, in April 2025, the company commenced a 5-year program in Vietnam that will screen at least 260,000 women. The company is on the cusp of completing product registration for Uzbekistan and will install into 14 women’s health clinics in Tashkent shortly thereafter. Further activities are planned for Indonesia following delayed product registration.

Despite the promising outlook, TruScreen faces certain risks, including competition from established diagnostic companies and regulatory challenges across different regions. Investors have arguably disregarded the company because it isn't going to the US first - as many other biotechs and medtechs do - but is instead targeting lower-to-middle income countries.

Economic factors, such as currency fluctuations and shifting healthcare policies, could also impact its global operations. Nevertheless, TruScreen’s continued product innovation and improvements in accuracy and ease of use will strengthen its competitive edge in the market.

Ongoing research and development will be vital for maintaining leadership and meeting the growing demand for accessible and accurate cervical cancer screening technology.

Is TruScreen a Good Stock to Buy?

TruScreen's expanding presence in the international market, coupled with the growing demand for early-stage cervical cancer screening technology, positions the company as an attractive stock for long-term investors.

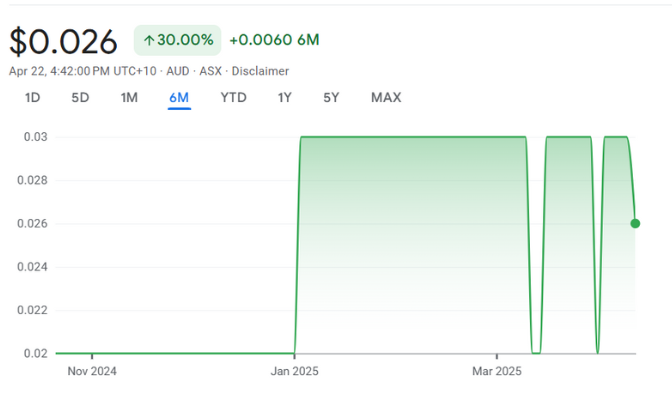

However, as with any growth stock, there are risks to consider. TruScreen's valuation reflects the promise of its breakthrough technology, but the company is still in a high-risk phase of market expansion, which could lead to volatility in its stock price.

At present, TruScreen does not pay a dividend, as the company is focused on reinvesting its earnings to fuel growth and product development.

The company's reliance on global expansion and the regulatory approval processes introduces risks, along with competition from larger, more established diagnostic companies, which could present challenges.

Despite these risks, TruScreen's continued global expansion, particularly in emerging markets, offers significant growth potential. The increasing demand for affordable and accessible cervical cancer screening solutions should drive long-term sales and partnerships.

While the stock is seen as speculative, its innovative technology and strong market potential in underserved regions make it a stock worth monitoring closely.

Our Stock Analysis

Truscreen (ASX:TRU): Taking a radical path to wide-spread commercialisation

Truscreen (ASX:TRU) is not taking the conventional path ASX medtech stocks take to market. Typically they seek approval in the…

Frequently Asked Questions

TruScreen Ltd does not currently pay a dividend, as the company is reinvesting its earnings to expand its operations and enhance product technology.