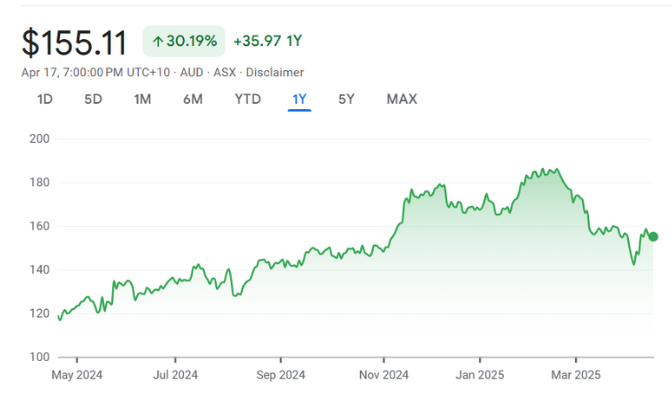

Xero Ltd (ASX: XRO)Share Price and News

About Xero Ltd

Xero Ltd is an Australian-based global software company, specialising in cloud-based accounting software for small to medium-sized businesses (SMEs). Established in 2006, the company has rapidly expanded internationally, with offices across New Zealand, the UK, the United States, and other regions. Xero's platform helps businesses streamline their accounting processes, offering services such as invoicing, payroll management, tax filing, and financial reporting. With a commitment to innovation and a focus on user experience, Xero has set itself apart from its competitors by offering seamless integrations with other business tools. The company takes pride in being a key enabler of SME growth, offering vital financial insights that help businesses make informed decisions.

Xero Company History

Founded in Wellington, New Zealand, Xero Ltd was established to develop a user-friendly accounting software solution for small businesses. The company's growth trajectory has been impressive, with milestones including its listing on the ASX in 2007. Over the years, Xero has expanded its product offerings, integrating features like bank feeds and automated reconciliations, which have proven highly beneficial to its users. Xero's expansion beyond Australasia into international markets, including the UK and North America, further solidified its position as a leader in cloud-based accounting. Key acquisitions, such as the purchase of Hubdoc in 2018, have enhanced its data entry capabilities, allowing the platform to better serve clients globally.

Future Outlook of Xero Ltd (ASX: XRO)

Xero Ltd's future outlook is closely tied to the growth of its cloud accounting services, as well as its ability to drive deeper market penetration in existing and new regions. As of the latest financial report, Xero has forecast continued growth in both revenue and user base. Key financial metrics such as revenue growth, recurring subscription revenue, and customer retention rates highlight the ongoing demand for its services.

The company is investing in expanding its AI and automation capabilities, aiming to offer even more streamlined financial management tools for small businesses. Sector trends also favour Xero, as the demand for digital financial services continues to rise, particularly in the wake of increased remote work and digital transformation in the SME sector.

However, the company faces competition from both traditional software providers and emerging fintech solutions. Risks include potential regulatory changes in key markets and any disruptions to its cloud infrastructure. Overall, Xero's strong market position, coupled with its continuous innovation, places it in a favourable position to maintain its growth trajectory.

Is XRO a Good Stock to Buy?

Xero Ltd remains an attractive stock for long-term investors, especially those looking for exposure to the growing fintech sector. The company's solid financial performance, with consistent revenue growth and expanding customer numbers, supports its growth narrative. Investors may be particularly drawn to Xero's strong recurring revenue model, which offers stability amid market volatility. Dividend yield is not currently a feature of Xero's stock, as the company reinvests earnings into growth initiatives.

However, its consistent revenue growth and strategic investments in AI and automation make it an interesting pick for growth-focused investors. Xero's market valuation remains high, but this reflects its potential for continued innovation and leadership in the cloud-based accounting space. Institutional investors and analysts have generally rated Xero positively, although its stock can experience volatility, particularly during earnings season.

The risk of competition from larger players and new entrants is notable, but Xero's established market share and ongoing product enhancements position it well for future expansion. For investors comfortable with growth stocks and seeking exposure to the digitalisation of SME accounting, Xero presents a compelling opportunity.

Our Stock Analysis

Why Are Tech and SaaS Stocks Selling Off Right Now?

Why Are Tech and SaaS Stocks Selling Off Right Now? You have probably felt the brute force of this sell-off…

Picks and shovels: Should you buy and hold these types of stocks? And which ASX stocks fit into this category?

You might have heard the saying that it is better to own companies selling ‘picks and shovels’ rather than companies…

There’s a new ACCC merger control regime! Here’s what investors need to know

With this new year comes a new ACCC merger control regime. Now that it is formally in place, investors who…

How to avoid getting caught in investor hype? Here are 5 ways to differentiate FOMO from long-term growth

Getting caught in investor hype is not the only trap investors can get caught into, but it is one of…

When will Canva list? Perhaps in the next 12-18 months, but here’s why it will give the ASX the cold shoulder

When will Canva list? This has been a hot question for several years now. Sometimes it has seen like it…

Want to find good software stocks? Here are 4 important traits you need to look for

Software stocks have provided amongst the highest returns of any ASX sector. There have been plenty of success stories in…

Frequently Asked Questions

Xero Ltd currently does not pay a dividend, as the company reinvests its profits into growth and expansion initiatives.