Nick Sundich

Could Jumbo Interactive (ASX:JIN) deliver growth living up to its name?

Jumbo Interactive (ASX:JIN) is a lotteries retailer and a provider of a SaaS platform that helps government and charity lottery…

Here’s how government funding for biotechs is immensely helpful for companies and their investors

Government funding for biotechs boosts the entire sector and the players in it – including ASX-listed companies. Many investors in…

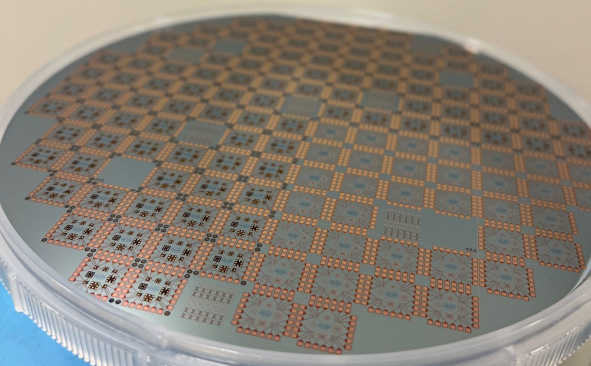

Archer Materials (ASX:AXE), the ASX’s only quantum computing stock, has made progress in the last 12 months

Archer Materials (ASX:AXE) has garnished significant investor attention as ASX’s only quantum computing stock. It has been a rollercoaster ride…

What are the best ASX Consumer Stocks for FY25? Here are our top 5 picks!

It is time to reveal our best ASX Consumer Stocks for FY25! We will be addressing both discretionary and staple…

Investing in NZX shares: Should Aussie investors say ‘sweet as’ to this >A$150bn market?

Have you ever considered investing in the NZX (New Zealand Exchange)? As the nearest overseas market to Australia (at least…

Here are 4 unexpected ASX 200 stocks you should sell

Here are 4 ASX 200 stocks you should sell in FY25 One of the common criticisms of brokers and analysts…

ESG Investing in Australia: Here are the 3 best options for intrigued investors

ESG investing in Australia is not just a fad, it is a fast growing trend that is here to stay.…

1 year since Redox (ASX:RDX) listed, it has gained nearly 20%. But what’s next for Australia’s largest chemicals importer?

It has been nearly a year since chemical importer Redox (ASX:RDX) listed on the ASX. It has raised $402m for…

What are the best ASX Health Stocks for FY25? Here are our top 4 picks!

As FY24 has come to an end, we thought we’d list our best ASX Health Stocks for FY25! Traditionally, healthcare…

The Virgin Australia IPO: It may go ahead, but here’s 4 reasons Blue Horseshoe doesn’t like it

The long awaited Virgin Australia IPO has been on and off ever since it was bought by Bain Capital. An…

Black Rock Mining (ASX:BKT): A mouth-watering graphite play in Tanzania with a US$1.4bn NPV project

Black Rock Mining (ASX:BKT) is developing the Mahenge Graphite Project in Tanzania. It is hoping to capitalise on the hot…

Here are 4 awesome ASX retail stocks to buy in FY25 … and 4 to sell

Here are 4 ASX retail stocks to buy in FY25! Universal Store (ASX:UNI) Universal Store is most poised to…

Should I buy McDonalds shares (NYSE:MCD)? Here are 3 reasons why we’re McLoving it!

McDonalds (NYSE:MCD) really doesn’t need an introduction. It is the world’s largest and most famous restaurant chain. It typically benefits…

What does your company’s auditor do and here’s why you should care

Each and every ASX-listed company will have auditor. But what do they do? Why is it almost always one of…

BrainChip (ASX:BRN): An exciting AI stock with an immense opportunity ahead

BrainChip is one of just a very few AI stocks on ASX BrainChip (ASX:BRN) is one of a few companies…

The Guzman y Gomez ASX IPO gained over 35% on its first trading day – but will the hot run last?

The Guzman y Gomez ASX IPO was a spectacular success. After months of rumours, and a few weeks marketing (and…

Share buybacks: Are they a good sign or a waste of money?

Share buybacks are a controversial topic amongst investors. Some say it is a waste of money, others will welcome it…

AFT Pharmaceuticals (ASX:AFP): A gem of a dual-listed healthcare company

AFT Pharmaceuticals (ASX:AFP) may not spring to mind as the best company to have come out of New Zealand. Many…

Can Tabcorp’s nеw boss improve the stock’s dwindling odds?

Tabcorp (ASX: TAH) has had a dog of a year, with its share price dropping roughly 40% in the last…

The dream of Bitcoin ETFs on the ASX will soon become a reality, but here’s what investors need to know

For a long time, the concept of bitcoin ETFs has been little more than a pipedream, until the SEC finally…

Highest yielding ASX dividend stocks: Here are 5 to take a look at!

The list of highest yielding ASX dividend stocks fluctuates substantially from year to year, and even from month to month.…

When will Canva list? Here’s why investors’ patience may pay off in the next 2 years

When will Canva list? This has been a hot question for several years now. The latest answer seems to be…

How to minimise the risks of biotech shares on the ASX? Here are 4 traits investors should look for

To minimise the risks of biotech shares is a major challenge for investors, but not one that is insurmountable. The…

Here’s what is the Price to Earnings Ratio (P/E Ratio) and 4 key ways investors can use it to their advantage!

What is the Price to Earnings Ratio or the P/E ratio? The P/E ratio is the most used multiple of…

Meme stocks: Are they still something investors should care about in 2024?

Meme stocks have become a popular topic in recent years, especially within the investing community. We thought we’d take a…

Here is why AGL Energy is buying Kaluza, spending $150m for a chunky 20% stake

‘AGL Energy is buying Kaluza’, read the headlines across the media earlier this week. It is not the first time…

Here’s why ASX manganese stocks could be about to break out, and our top 3 picks!

Investors in ASX manganese stocks, like all other battery metal stock investors, have been suffering from commodity prices being in…

ASX Baby Boomer Stocks: Here are 5 we think will be big winners as Boomers retire and 5 losers

Let’s take a look at ASX Baby Boomer Stocks. That is to say stocks that will benefit as Baby Boomers…

What’s a Bear Market? Here’s 7 ways to detect them and avoid big losses

It is easy to forget there is such a thing as a bear market during long-run stock booms, but the…

Indigo (NSE:INDIGO): Why India’s largest airline is a good opportunity to look at

20 years ago, Indigo (NSE:INDIGO), also known as InterGlobe Aviation, didn’t even exist. But now, it is the best example…

Profit Warnings: Here are 5 companies that issued them recently and red flags to look at for

A profit warning out of a company is never a good sign for investors. It is an official announcement made…

How can you tell when to sell a stock? Here are 5 ways to tell

How can you tell when to sell a stock? If you don’t sell a stock, you can make significant losses,…

Carbon neutral investing: Here’s what curious investors need to know and which stocks they might easily consider

As the world seeks to reduce carbon emissions, carbon neutral investing might be a strategy for investors to consider. But…

Modi Stocks: Here are the best stocks to buy after the Indian election in 2024

Let’s take a look at so-called Modi stocks; in other words, stocks to buy after the Indian election. India may…

Director Trades: Are they a good or bad sign? Here’s what investors should read into them

Director trades – either purchases or sales – are taken by investors as a sign of confidence (or a lack…

Oracle Corporation (NYSE:ORCL): Its 50% more valuable than Adobe and double IBM! Why the high price tag?

Oracle Corporation (NYSE:OCL) is one of the world’s largest software companies. Capped at $340.1bn, it is not one of the…

Here’s why founder-led companies can be good investments, or the odd man out!

Some companies on stock exchanges are founder-led companies. For several reasons, a company being founder-led can be a sign of…

James Hardie (ASX:JHX): Things have turned glum and there could be worse to come, but are fears overblown?

James Hardie (ASX:JHX) is one of the companies many would struggle to have sympathy for. It had a tortured history…

BHP wanted to buy Anglo American, but not even A$75bn could get the deal over the line

Nearly a month since it was made clear BHP wanted to buy Anglo American, it seems the deal is off.…

Orphan Drug Designation: What is it and why is it a big deal for biotech stocks?

While most small cap health stocks dream of commercialisation, healthcare companies at an early stage get excited about achieving Orphan…

Arcadium Lithium (ASX:LTM): Meet the newest and most exciting large cap lithium stock on the ASX, capped at US$5bn

Many investors have never heard of Arcadium Lithium (ASX:LTM) and we can’t really blame them. But hopefully, we can change…

When to sell a bad investment? Here’s 3 red flags that tell you it’s time to cut your losses

When should you sell a bad investment? On one hand, if you fail to get out of a bad investment, you…

Lithium operations: What is upstream and downstream, and which of the 2 is better to invest in?

When it comes to lithium operations, what is the difference between upstream and downstream? And does it really matter? Yes…

Web 3.0: What is it and is it a great investment opportunity?

In this article, we look at Web 3.0. What is it, which companies are involved in it and could companies in…

Why has Warren Buffett been so admired by investors for the last 50 years?

Everyone knows the name Warren Buffett as one of the most successful and well-known investors in history. But why is he…

IBM (NYSE:IBM) may no longer be a monopolist, but it is an emerging player in the lucrative AI, Cloud and Quantum spaces

‘No one got fired for buying an IBM‘. Yes, that was an actual saying, sometimes in those exact words, otherwise…

Should you invest in commodities in 2024? Here’s how to go about it

In this article, we look at why you may want to invest in commodities. To cut to the chase, we…

Recce Pharmaceuticals (ASX:RCE): Taking the fight against superbugs to the next level

Recce Pharmaceuticals (ASX:RCE, FSE:R9Q) is a Sydney-based company fighting the battle against superbugs, with a legitimate chance of succeeding if…

What is CAGR and why do listed companies like using it?

Although it is not as commonly used by ASX-listed companies, Compound annual growth rate (CAGR), is a growth metric you’ll…

You need to keep an eye on the ex-dividend date if you want a solid payout! Here’s why

If you’re wondering what is the last day can you buy/sell a stock and still get/keep a declared dividend –…

ResMed (ASX:RMD): Investors who bought the dip would be satisfied, but is there any growth left in this one?

ResMed (ASX:RMD) is one of the few ASX healthcare stocks that has successfully made it in the USA. In this…

How do analysts value stocks? Here are 3 key ways to judge what a stock is worth

In this article we answer the question ‘How do analysts value stocks?‘ By knowing how they do it, you can…

Corporate Advisors: What do they do for your stock and are they worth the dazzling fees?

Most small cap ASX stocks will have corporate advisors (one or multiple). At first glance, you may think of them as…

What is a dividend reinvestment plan and should you entertain participating in it?

In this article we look at what Dividend reinvestment plans are, why directors participate in them and whether or not…

When to invest in stocks? When you have these 3 things sorted

When to invest in stocks? Investing in stocks is a great way to grow your wealth and secure your financial…

Leo Lithium (ASX:LLL) once had a lucrative project, only to be forced out by the Mali government

Investors were excited about Leo Lithium (ASX:LLL) until sovereign risk issues became a reality. Some investors, and even ourselves for…

Who are the Best ASX CEOs? Here are our 5 favourite!

The question of who the best ASX CEOs are is a subject of much debate amongst retail investors. Much of this…

How to create a passive income from stocks in 2024? Here are 5 strategies

Most people invest in stocks for capital gains (in other words for selling the stock for more than they bought…

EBITDA can be a powerful metric if you use it wisely. Here’s 2 key things you need to know

ASX investors will frequently hear companies talk about EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation) as well as its…

What is short selling and can retail investors make a buck doing it?

Short sellers are one of the most mysterious, but most powerful actors in the markets. They have been known to…

Why is my stock going down even though it’s so good? Here’s 3 reasons why!

Why is my stock going down even though it’s so good? That’s a question many investors ask themselves. You could think…

Net Interest Margin: What is this important metric and which bank stocks have the highest?

Investors focused on the banking and financials sectors will commonly hear the term Net Interest Margin (NIM). In this article,…

Rule of 72: Here’s how investors can use it to their advantage

Here’s why The Rule of 72 might be useful to consider when investing in Stocks Investing in stocks can be…

Novo Nordisk (CPH: NOVO-B): It’s not all smooth sailing for the US$400bn company behind obesity drug Ozempic

Not many 100-year old healthcare stocks see a sudden 30% jump in sales in one year, but Novo Nordisk (CPH:…

Is there another Asian financial crisis brewing? How would stocks be impacted?

Is there another Asian financial crisis brewing? There is increasing concern there might be as many Asian countries’ currencies struggle…

Why can’t ASX small bank stocks beat the Big 4?

Be disappointed all you like at the performance of some of the Big 4, but ASX small bank stocks have…

Here are the 4 best ASX stocks for May 2024

Here are the 4 best ASX stocks for May 2024! Each month, we look at the best ASX stocks…

Cooking the Books: Here are 4 manipulative ways for your stocks to be manipulated

Have you heard of the term cooking the books? Cooking the books is a term used to describe the illegal act…

How are stock market indices like the ASX 200 determined?

Stock market indices like the ASX 200 and S&P 500 are used as barometers for the performance and overall health…

Pay attention to these 5 signs to buy a stock

What are the most important signs to buy a stock on the ASX or any other stock exchange? In this…

What are nominee shareholders? Have they got anything secret to hide from the rest of the market?

Let’s take a look at who nominee shareholders are. Have you ever seen a substantial shareholder notice lodged with your…

Here’s why the RBA is worried about the ASX. Should you be too?

The RBA is worried about the ASX. It all but confirmed that in its latest bulletin, released last week. The…

Buying Netflix shares from Australia? A golden growth opportunity

Buying Netflix shares from Australia may seem like a no brainer. It has recorded exponential growth since its famous pivot…

It is ASX quarterlies season! Here’s what investors need to know

It is ASX quarterlies season in the dying days of January, April, July and October, and we are just upon…

5 stocks that issued or upgraded their FY24 guidance in recent weeks!

We’re nearly at that time of year when companies upgrade or downgrade their FY24 guidance. It is called ‘confession season’.…

Tigers Realm Coal (ASX:TIG): Its making an awkward exit from Siberian coking coal, but what’s next?

Tigers Realm Coal (ASX:TIG) has been one of the few ASX stocks (if not the only ASX stock) with direct…

Is a soft landing still likely in Australia in 2024?

Is Australia still set for a soft landing? For some months now, it was thought the answer was a firm…

Hydrogen in Australia: Can we expect massive adoption in the next 10 years?

When will we see hydrogen in Australia? Not as a fad, not as an idea, but as a widespread energy…

Why is Gina Rinehart buying into Lynas? She’s accumulated a stake worth over $300m

The big question on many investors’ minds this week is why is Gina Rinehart buying into Lynas Rare Earths (ASX:LYC)?…

When will coal be phased out in Australia? And what will this mean for ASX coal and energy stocks?

When will coal be phased out in Australia? It is inevitable that coal’s days are numbered, although the Russia-Ukraine war…

Here are 5 reasons why Woolworths shares aren’t as great an investment as you might think

Woolworths shares may at first glance appear to be one of the most risk-free investments on the ASX. It has…

Australian merger and acquisition laws will be overhauled in 2026. Is this good or bad for ASX stocks?

Last week, the government introduced changes Australian merger and acquisition laws not seen in nearly 5 decades. The ACCC had…

GameStop (GME): How it became the greatest ever meme stock in 2021

The transformation of GameStop Corp. (GME) into a “meme stock” is a fascinating event. It underscores the power of collective…

Should I buy Air New Zealand shares given they’re still down over 65% from pre-COVID levels?

The question ‘Should I buy Air New Zealand shares?’ has been one many investors have asked, but any who thought…

Will Woolworths and Coles shares be hit by new supermarket regulation in 2024?

Woolworths and Coles shares are facing regulatory scrutiny like no other companies are right now. After months of allegations that…

Westgold is merging with Karora Resources and creating a A$2.2bn company: Is it a match made in heaven?

This morning, investors heard the news that Westgold is merging with Karora Resources, a TSX-listed gold miner. The deal will…

Can foreigners invest in ASX shares? Yes, but with a handful of caveats and considerations

Can foreigners invest in ASX shares? The simple answer is yes, although it isn’t as simple for them as it…

Dimerix (ASX:DXB): In Phase 3 for FSGS and so far, so very good!

There aren’t many ASX biotech stocks in Phase 3, and even fewer with successful interim data, but Dimerix (ASX:DXB) is…

WAAAX stocks in 2024: WAAAX on, WAAAX off!

Remember the days when WAAAX stocks were outperforming FAANG stocks, so we were told by journalists and analysts? The WAAAX…

Seek (ASX:SEK): One of the best ASX tech stocks, but strongly overvalued

Online employment marketplace Seek (ASX:SEK) may be formally categorised as ‘Media and Entertainment’ by the ASX, although it is difficult to…

Archer Materials (ASX:AXE): There’s more to the company than many investors think

Archer Materials (ASX:AXE) has long attracted intrigue as the only ASX company in quantum computing, although there is far more…

Here are the 3 best months to buy stocks

What are the best months to buy stocks? It is difficult to answer this question because there will always be…

Here’s why broker downgrades can cause such a big hit to stocks

There are plenty of ways a stock can be hit, but broker downgrades can be amongst the most contentious. …

Here are 4 tax deductions for stock investors to claim this tax time and maximise their refund!

There are plenty of tax deductions for stock investors to claim, they just need to be aware of them! Although…