Understanding Nasdaq ETFs

Nasdaq ETFs are a type of exchange-traded fund that go after the performance of the Nasdaq indexes, which consider major technology firms such as Meta Platforms, Apple, and Microsoft. Unlike mutual investment funds, these funds are traded on an exchange, meaning that the investors can buy or sell shares during the trading day at market prices.

When a person buys Nasdaq ETF shares, the investor is provided with a diversified portfolio of the same stocks from the information technology sector. On the other hand, popular funds such as Invesco Nasdaq QQQ Trust seek to follow the performance of the Nasdaq Composite, hence making room for not only large capital Nasdaq but also smaller Nasdaq companies. Unlike major market sectors' based fund shares, certain ETFs follow equal-weighted index shares.

Additionally, inverse and leveraged Nasdaq ETFs provide more advanced strategies for investors. These Nasdaq ETFs are rebalanced quarterly and offer relatively low expense ratios, making them appealing for buy-and-hold investors. With diversified access and efficient management, Nasdaq ETFs enable investors to tap into the dynamic growth of the technology sector without the complexities of picking individual stocks.

Why Invest in Nasdaq ETFs?

To reap the rewards that come with the technology sector, investing in Nasdaq ETFs is a smart approach as they provide investors with a collection of a diversified portfolio of Nasdaq same stocks while maintaining low expense ratios. Top choices such as Invesco Nasdaq QQQ Trust indexes the Nasdaq Composite, hence allowing its investors to reach the likes of Meta Platforms Inc and Super Micro Computer Inc. These exchange-traded funds (ETFs) have implemented a full replication strategy consistent with the practice to ensure all shares of both large and smaller companies listed on the Nasdaq index are made available.

These Nasdaq ETFs are also rebalanced every week, which enables them to have more suitable exposure to the information technology sector. Moreover, Nasdaq ETFs tend to be cheaper than traditional investment funds as measured by the expense ratios, which makes them appropriate for long-term and short-term investors alike. Due to their strong potential for growth and ability to trade quickly, they are a big favorite among many retail investors. For more aggressive strategies, inverse ETFs or leveraged ETFs can also be found, with the most popular being Invesco Asda providing diversified exposure to the biggest market trends such as the Nasdaqs equity index.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

4 Best Nasdaq ETFs to Invest in

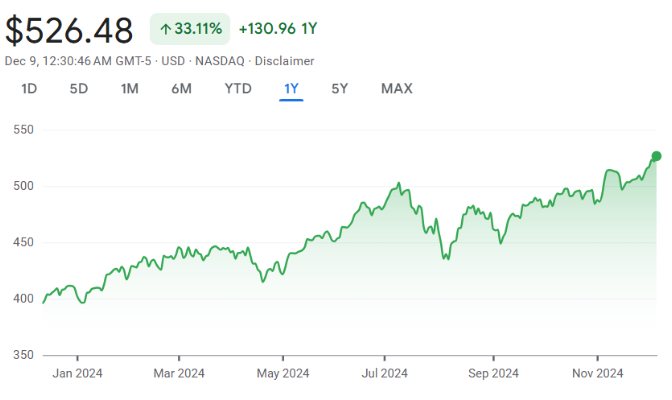

Invesco QQQ Trust (QQQ)

One of the most popular Nasdaq ETF, Invesco Nasdaq QQQ Trust tracks the Nasdaq-100 Index, which includes major tech stocks like Meta Platforms. It’s widely used by individual investors and institutional players for its strong performance and dividends. The expense ratio is 0.20%, making it a competitive choice for long-term investors looking for low expense ratios.

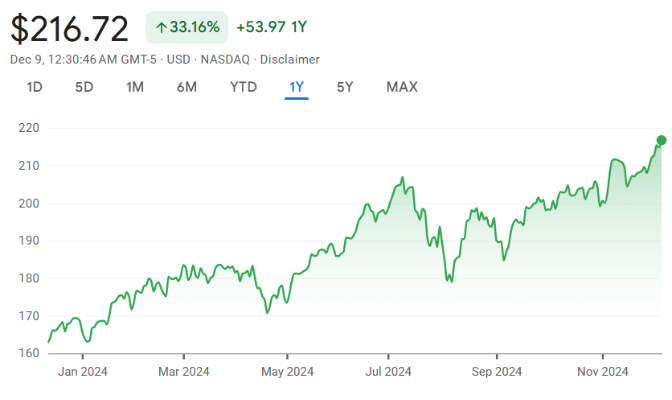

Invesco NASDAQ 100 ETF (QQQM)

Another Invesco Nasdaq ETF, QQQM mirrors QQQ's performance but with a lower expense ratio of 0.15%. This ETF focuses on the same top holdings as QQQ but is tailored to buy and hold investors who seek balanced exposure to the technology sector at a lower cost. It provides diversified access to Nasdaq composite companies.

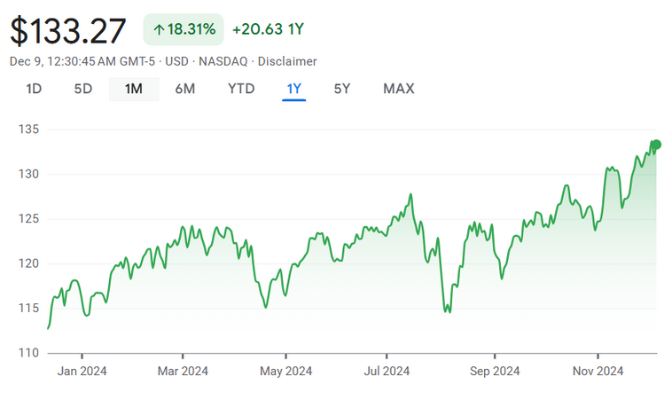

First Trust NASDAQ-100 Equal Weighted Index Fund (QQEW)

This ETF offers a unique approach by using an equal-weighted index strategy. Unlike other funds that focus on market capitalization, QQEW gives each stock in the Nasdaq-100 Index equal weight, providing more balanced exposure to technology companies of various sizes.

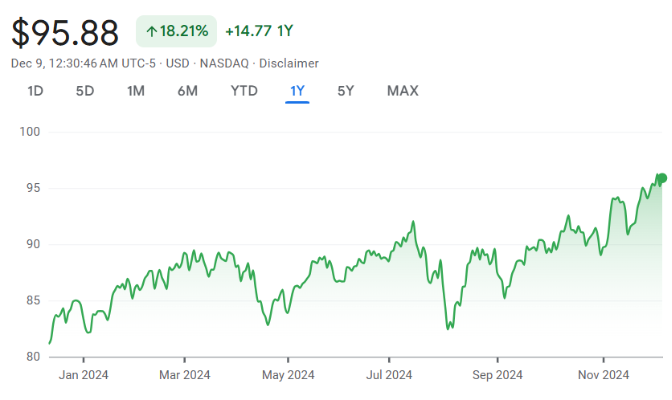

Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE)

This ETF also employs an equal-weighted index shares approach, offering balanced exposure across the Nasdaq index. This reduces concentration risk in companies and is rebalanced quarterly for consistent performance.

Invesco NASDAQ Next Gen 100 ETF (QQQJ)

The Invesco NASDAQ Next Gen 100 ETF (QQQJ) is designed to track the NASDAQ Next Generation 100 Index, which includes the 101st to 200th largest non-financial companies listed on the Nasdaq exchange.

5 Best Nasdaq ETFs to Invest in

How to Choose the Best-performing Nasdaq ETFs

Expense Ratio

Give Nasdaq ETFs with low expense ratios top priority. Better long-term returns come from lower costs. For long-term investors looking to reduce fees take into consideration options such as Invesco Nasdaq ETFs which provide competitive rates when compared to mutual funds and guarantee optimal performance.

Diversification

Select an exchange-traded fund offering diversified exposure to different Nasdaq indexes. Over time a more resilient diversified portfolio is ensured by balanced exposure which helps reduce risks when particular Nasdaq stocks or sectors such as the information technology sector underperform.

Rebalancing Strategy

To guarantee that the fund stays in line with the most recent Nasdaq indexes look for exchange-traded funds (ETFs) that undergo quarterly rebalancing. This realignment contributes to preserving a fair distribution of exposure across the Nasdaq composite's larger and smaller technology companies.

Top Holdings

Make sure the top holdings in each investment fund meet your investment objectives by looking at them.. Make sure that firms such as Meta Platforms and Super Micro Computer are included in the fund investment strategy for instance if you are interested in tech stocks.

Investment Goals

The ETF structure should align with your investment objectives. Traditional investment funds may be preferred by buy-and-hold investors while inverse and leveraged exchange-traded funds (ETFs) are a better option for short-term traders looking to profit from Nasdaq stock market fluctuations.

How to Invest in Nasdaq ETFs?

The first step involves selecting an online brokerage service that allows for the purchase of Nasdaq ETFs. Most brokers nowadays offer commission-free trading on a variety of financial instruments including ETFs like the Invesco QQQ Trust, hence reducing the overall cost of investing in such funds. Also, employ a system capable of tracking such data as market capitalization, fund performance, or other relevant indicators of those investments.

Is a Nasdaq ETF a Good Investment?

For potential investors looking for technology exposure without the risks of buying individual same stocks, investing in Nasdaq ETFs is a practical option. There are these exchange-traded funds, which also feature smaller Nasdaq participants, that have familiar technological firms such as Meta Platforms and Super Micro Computer. The Invesco QQQ Trust is one of the most popular used Nasdaq ETFs that seek to track the performance of the Nasdaq Composite index and provide broad exposure to the major IT companies. In a full replication approach, an investor's fund comes close to the investor's base index, thus exposing the investor's fund to almost all of the applicable markets. Because of their strong concentration on technology-oriented companies, Nasdaq ETFs can have higher volatility but this also gives long-term investors strong upside growth potential.

In addition, many of such funds provide opportunities for riskier investment policies such as leveraged and inverse ETFs. Nevertheless, another advantage that Nasdaq ETFs have is that they are inexpensive since they usually charge lower management fees than mutual funds. A few of the available Nasdaq exchange-traded funds (ETFs) integrate environmental, social, and governance (ESG) criteria into their design for investors who practice responsible investment. All out, an investor an individual investor looking to purchase a Nasdaq ETF enjoys its cost efficacy and availability of exposure to some of the world's most top-garde companies. These ETFs provide investors with long-term growth expectations coupled with quarterly index adjustments which suit long-term-oriented investors.

FAQs on Investing in Nasdaq ETFs

An ETF is a type of investment fund that trades on an exchange like a stock, offering diversified access to various assets such as stocks or bonds.

Our Analysis on Nasdaq ETFs

Artificial Intelligence: Smart Strategies for Investors

How Investors Can Ride the Next Wave of AI Growth NVIDIA (NSDQ: NVDA) has become the face of the artificial…

How to create a passive income from stocks in FY26? Here are 5 strategies

Most people invest in stocks for capital gains (in other words for selling the stock for more than they bought…

ASX ETFs (Exchange Traded Funds): Here’s why they’re a good option for investors to consider, and here are our Top 4!

There are a variety of options available for investors looking to invest in the stock market, with ASX ETFs (Exchange-Traded…

The dream of Bitcoin ETFs on the ASX will soon become a reality, but here’s what investors need to know

For a long time, the concept of bitcoin ETFs has been little more than a pipedream, until the SEC finally…

Gold in 2023: After a 19% jump in 6 months, is the good run set to continue?

Where to for Gold in 2023? After an average 2 years or so for gold prices, the past 6 months…

There are over 240 ETFs on the ASX and here’s what you need to know to profit from them

Exchange-traded funds (ETFs) are an increasingly popular investment option for investors looking to diversify their portfolios. ETFs are a type…