What Are Penny Stocks?

Penny stocks are shares of small companies that usually trade for less than one dollar, or belong to businesses with a market value under $300 million. On the ASX, this includes approximately 2,000 smaller companies that are not included in the major indices. Even though the term "penny stocks" sounds dated, it’s still a handy way to describe early-stage or niche businesses, often in emerging industries like tech, mining, or specialised services.

What makes penny stocks appealing isn’t just their low price; it’s their potential. These companies are often in the early stages of growth, whether they’re exploring new resources, developing innovative products, or expanding their operations. This stage presents exciting opportunities, but also carries higher risks.

Top 6 Reasons Why You Should Invest in ASX Penny Stocks

ASX penny stocks offer a low-cost way to tap into high-growth opportunities. These small companies often operate in fast-moving sectors and can deliver strong returns if you choose wisely. For investors open to risk and research, they’re a compelling addition to any portfolio.

from a smaller base, even modest growth can lead to big percentage gains. A $10 million company doubling revenue is far easier than a $5 billion one doing the same. When their business model clicks, the returns can be dramatic, especially in fast-moving sectors.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

What to Look for When Buying Micro-cap Shares

Strong fundamentals separate promising penny stocks from speculative gambles. Focus on companies with improving revenue trajectories, not just one-off wins. Balance sheet strength matters enormously; companies with cash exceeding debt can fund operations without constant capital raises that dilute existing shareholders. Management quality often determines success more than the business concept itself, so track insider ownership and operational execution history.

Additionally, look for clear catalysts ahead. What specific milestones will move the stock over the next six to twelve months? Companies approaching production, signing major customers, or nearing regulatory approvals offer defined catalysts. Avoid businesses that require everything to go perfectly; the best opportunities have multiple pathways to success.

3 Best Penny Stocks ASX to Buy Now in 2025

Focus Minerals (ASX: FML)

Focus Minerals demonstrates what successful execution looks like in the penny stock space. The gold producer reported half-year sales of 77.73 million dollars and swung to profitability with net income of 221.4 million dollars, reversing last year's loss. The company operates debt-free, which ..

Alcidion Group (ASX: ALC)

Alcidion represents a different opportunity, a healthcare software business that recently achieved profitability. With a market cap of 141 million dollars, Alcidion develops and licenses healthcare software across Australia, New Zealand, and the United Kingdom. The company generated...

Wagners Holding (ASX: WGN)

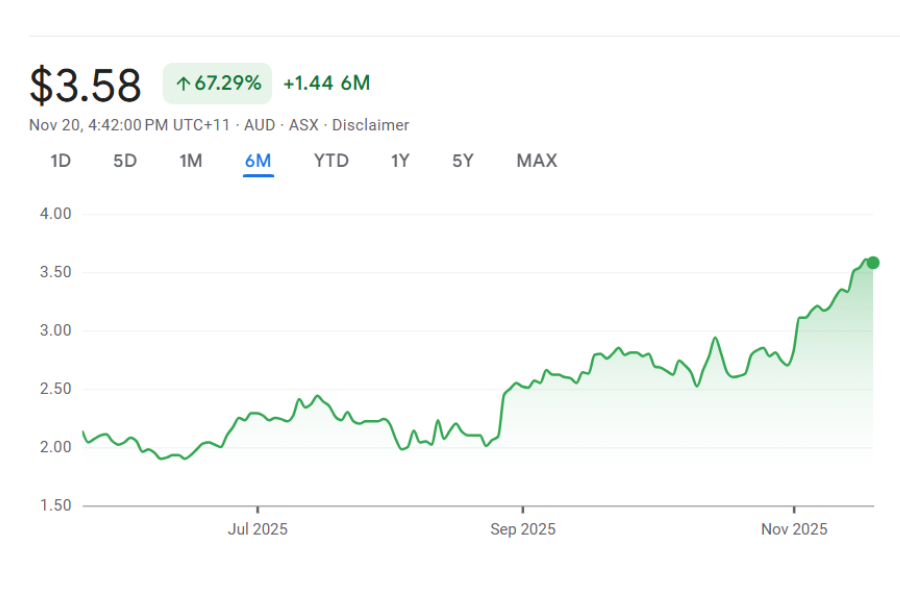

Wagner's Holding capitalises on construction demand in Southeast Queensland ahead of the 2032 Olympics. The company produces construction materials and has surged 120% year-to-date through November 2025 as investors recognise the infrastructure...

3 Best Penny Stocks ASX to Buy Now in 2025

How to Trade and Invest in Penny Stocks

Successful penny stock investing requires a different approach than blue-chip investing. Use limit orders rather than market orders to avoid paying inflated prices in low-liquidity stocks. Research catalysts and understand the timeline; buying six months before a major milestone provides better risk-reward than buying the day before. Position sizing matters enormously; even high-conviction penny stocks should represent smaller portions of your portfolio than stable large caps due to volatility and liquidity risks.

Diversification within the penny stock allocation helps manage individual company risk. Rather than concentrating in one or two positions, consider spreading capital across five to eight positions in different sectors. This approach means one failure won't devastate your small-cap portfolio while still allowing successful positions to meaningfully impact overall returns.

The Risk of Investing in Penny Stocks

Penny stocks offer tremendous upside potential, but they also come with considerable risk. Here’s a deeper look into some of the risks associated with ASX penny stocks:

Many penny stocks trade only a few hundred thousand dollars daily. This means large positions can be difficult to exit without moving the price significantly. If you need to sell quickly, you may face discounts of 10-15% simply to find enough buyers. This liquidity constraint means penny stocks should only be purchased with capital you can afford to have locked up for extended periods.

Are ASX Penny Shares a Good Investment?

Penny stocks serve a specific role in diversified portfolios; they offer growth potential that established companies can't match, but come with substantially higher risk. The current environment in November 2025 appears more favourable than recent years, with interest rate cuts by the RBA easing financial constraints on smaller firms and valuation gaps suggesting large caps may be overpriced relative to small caps. However, success requires selectivity. Not all penny stocks are created equal. Focus on companies with genuine business models, improving fundamentals, strong balance sheets, and clear paths to profitability. Avoid speculative plays without revenue or businesses burning through cash without visible progress toward self-sufficiency.

For growth-oriented investors willing to accept volatility and do thorough research, penny stocks can add meaningful returns to a broader portfolio. For conservative investors focused on income and capital preservation, the risks likely outweigh the potential rewards. Know which category you fall into before allocating capital.

FAQs on Investing in Penny Stocks

Typically, shares trading under one dollar or companies with market caps below 300 million dollars, though definitions vary.

Our Analysis on ASX Penny Stocks

ASX Company Spin: Here are 7 occasions when management tries to sell bad news as good news

In all our years, we have seen our fair share of ASX Company Spin. It is repeated because often investors…

Here are 7 ASX stocks that overinflated during the pandemic and crashed; and where they are now

If you want proof the COVID pandemic was a crazy time, just take a look at a list of ASX…

The 50% CGT discount on shares: Here’s how it works, and if it is under threat

The 50% CGT discount on shares is one of the key mechanisms that helps investors keep as much of their…

Stocks Down Under’s Top 10 Hottest ASX Stocks to Look At in 2026!

Today, on the first trading day of 2026, Stocks Down Under publishes its its 10 Hottest ASX Stocks to Look…

Our 5 ASX Predictions for 2026!

This article outlines 5 ASX Predictions for 2026 that Stocks Down Under puts its neck on the line to assert…

Here are 8 of the Top Performing ASX Stocks in 2025 (excluding resources)!

Yesterday, we recapped the Top Performing ASX Stocks in 2025 but the list was dominated by resources companies. Today, we…